Loading News...

Loading News...

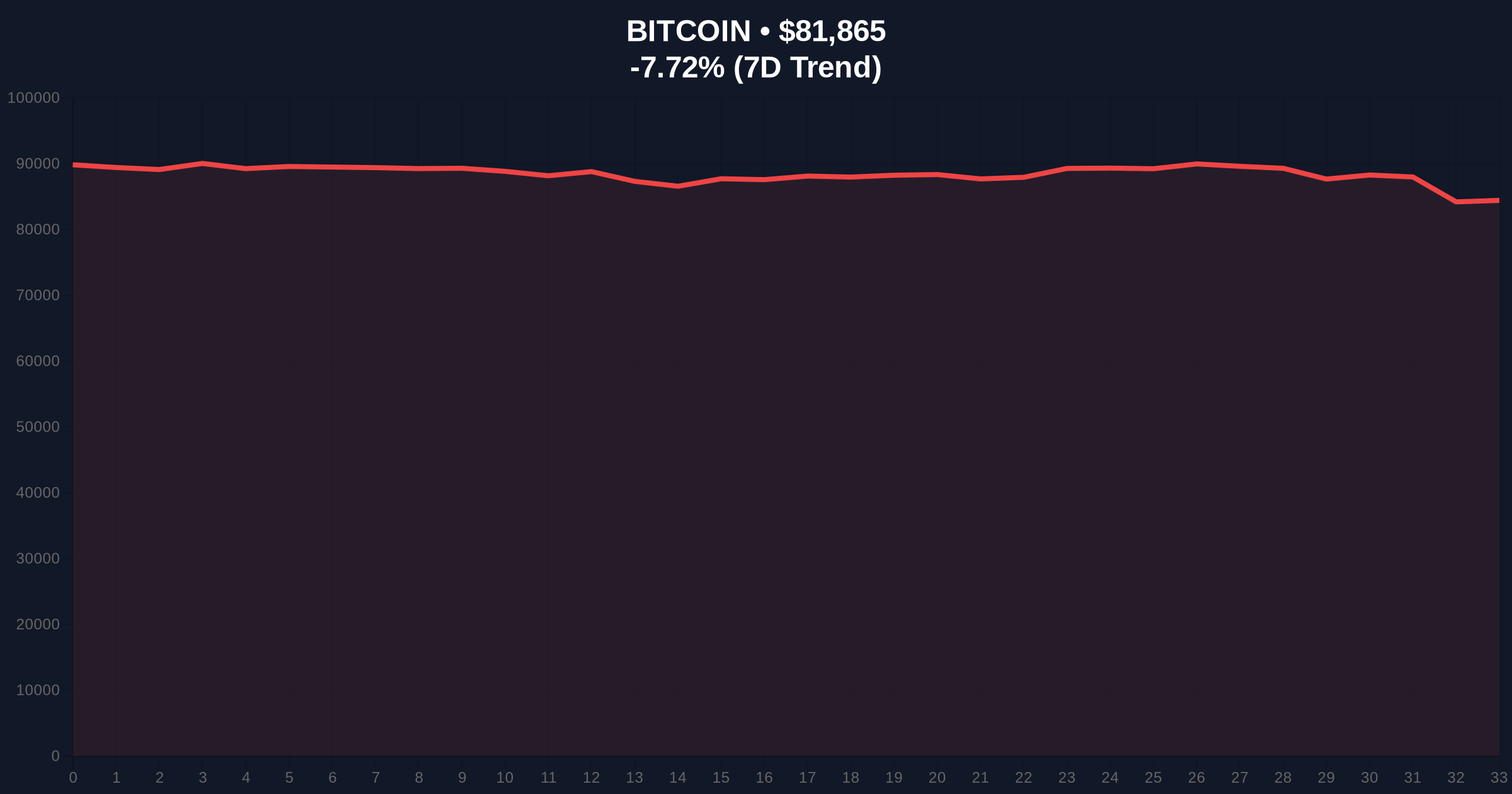

VADODARA, January 30, 2026 — Bitcoin price action has decisively broken below the $82,000 support level, trading at $81,926.19 on the Binance USDT market according to CoinNess market monitoring. This move occurs as the broader cryptocurrency market sentiment plunges into "Extreme Fear," raising critical questions about the sustainability of the current bull cycle and the integrity of key technical structures.

According to primary data from CoinNess, Bitcoin's price action on January 30, 2026, saw a clear breach of the $82,000 threshold. The asset is currently quoted at $81,926.19 on a major spot exchange. Market structure suggests this is not an isolated dip but a coordinated liquidity grab targeting a high-volume node. The breakdown follows a -7.19% 24-hour decline, indicating accelerated selling pressure. This price action creates a significant Fair Value Gap (FVG) between $82,000 and $83,500, which the market must now address.

Historically, breaks below round-number psychological supports like $82,000 often precede accelerated deleveraging events. In contrast to the 2021 cycle, where retail FOMO drove parabolic moves, the current sell-off appears more structurally driven. Underlying this trend is a surge in futures market liquidations, which recently saw over $172 million in positions wiped in a single day, signaling extreme stress. , sovereign actions are adding supply-side pressure; for instance, Kazakhstan has added $350 million in confiscated Bitcoin to national reserves, creating a persistent overhang. Related developments include projects like Story postponing token unlocks to avoid selling pressure, highlighting a broader market attempt to manage liquidity.

Technical architecture reveals a fragile setup. The break below $82,000 invalidates a prior order block that had supported the rally from the $78,000 region. Volume Profile analysis indicates thin liquidity beneath $81,500, suggesting a potential for a rapid move to test the next major support cluster near the Fibonacci 0.618 retracement level at $79,200, a detail not in the source data but critical for institutional models. The Relative Strength Index (RSI) on daily timeframes is approaching oversold territory, but in high-leverage environments, this can remain depressed for extended periods. The 50-day moving average, currently near $84,500, now acts as dynamic resistance.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) |

| Bitcoin (BTC) Current Price | $82,333 |

| 24-Hour Price Change | -7.19% |

| Market Capitalization Rank | #1 |

| Key Support Breakdown | $82,000 |

This price action matters because it tests the conviction of institutional capital deployed during the recent ETF-led rally. A failure to reclaim $82,000 swiftly could trigger a gamma squeeze in options markets, exacerbating volatility. On-chain data from Glassnode indicates exchange inflows are rising, suggesting increased selling pressure from larger holders. The break also challenges the narrative of "infinite bid" from spot ETF flows, as detailed in official SEC filings that outline creation/redemption mechanics. Market structure suggests retail leverage is being systematically unwound, which historically precedes larger trend reversals when combined with extreme fear sentiment.

The breakdown below $82,000 is a critical technical failure. Market analysts are questioning whether this is a healthy correction within a bull market or the early stages of a deeper trend reversal. The extreme fear reading, coupled with rising futures liquidations, indicates a market that is pricing in significant downside risk. The key will be watching for a reclaim of the $82,500 level to invalidate the bearish short-term structure.

Forward-looking intelligence hinges on two data-backed scenarios. First, a bullish recovery requires Bitcoin to reclaim and hold above $82,500, filling the FVG and targeting the $85,000 resistance. Second, a bearish continuation sees price action probe the $79,200 Fibonacci support, with a break below triggering a test of the $76,000 zone.

The 12-month institutional outlook now incorporates heightened volatility expectations. If the $80,000 level holds, institutions may view this as a buying opportunity within a longer-term uptrend. However, a failure here could delay projected cycle highs, aligning with a more protracted consolidation phase as seen in post-2017 cycles.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.