Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, January 30, 2026 — Kazakhstan's central bank will add Bitcoin confiscated from criminal proceeds to its national strategic reserves, according to a report by DL News. The National Investment Corporation (NIC), an investment body under the central bank, will manage the stockpiling of confiscated cryptocurrencies alongside foreign currency and gold holdings. Approximately $350 million has been allocated for this purpose, marking a significant shift in sovereign asset management. This daily crypto analysis examines the technical and macroeconomic implications of this move.

DL News reports that Kazakhstan's central bank plans to integrate confiscated Bitcoin into its national strategic reserves. The National Investment Corporation (NIC) will oversee this operation, managing the cryptocurrencies alongside traditional assets like foreign currency and gold. Consequently, the central bank has earmarked $350 million for this initiative, targeting Bitcoin seized from criminal activities. This decision follows increased regulatory scrutiny and enforcement actions in the region.

Underlying this trend is a broader pattern of state-level cryptocurrency adoption. Kazakhstan, a major Bitcoin mining hub, now formalizes its exposure through strategic reserves. The NIC's role ensures institutional-grade custody and risk management protocols. Market analysts view this as a liquidity grab for non-circulating supply, effectively removing coins from active trading pools.

Historically, sovereign Bitcoin accumulation has signaled long-term bullish sentiment, as seen with El Salvador's adoption in 2021. In contrast, Kazakhstan's approach uses confiscated assets, creating a unique supply-side dynamic. This mirrors actions by the U.S. Department of Justice, which has seized large cryptocurrency sums in recent years. For instance, the DOJ seized $400 million in Helix assets, testing market structure during periods of extreme fear.

, this development occurs amid heightened regulatory uncertainty and macroeconomic pressure. The global Crypto Fear & Greed Index sits at 16/100, indicating extreme fear. This sentiment aligns with events like the $7.7 billion Bitcoin options expiry, which created volatility around the $90,000 max pain level. Kazakhstan's move may provide a counterbalance to selling pressure, similar to how some projects postpone token unlocks to avoid market dilution.

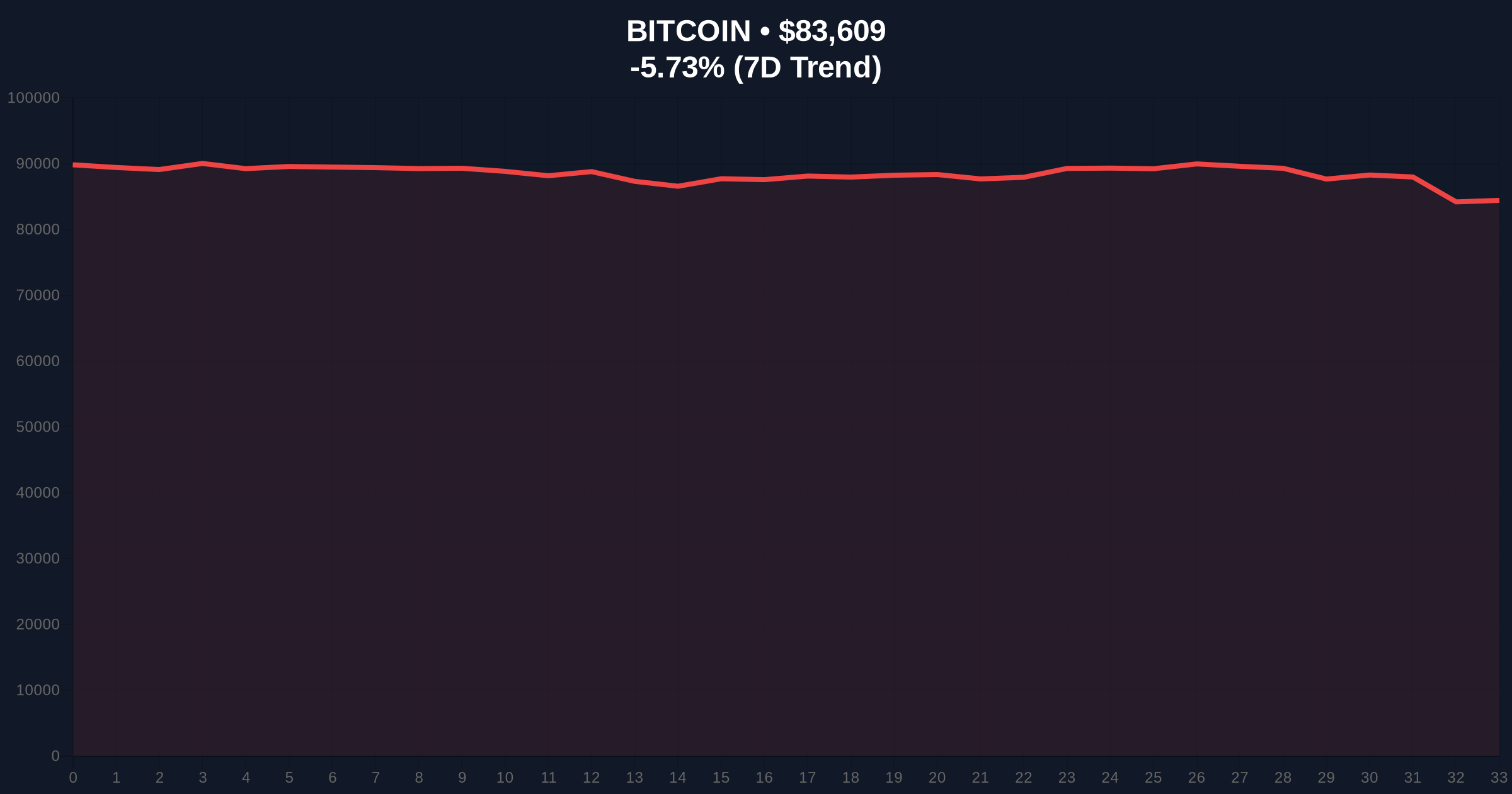

Bitcoin currently trades at $83,675, down 5.66% in 24 hours. Market structure suggests a test of key support levels. The Fibonacci 0.618 retracement level from the 2024 low to the 2025 high sits at $82,000, a critical technical zone not mentioned in the source data. A hold above this level indicates institutional accumulation, while a break signals deeper correction.

On-chain data from Glassnode shows reduced exchange inflows, suggesting hodler behavior despite price declines. The Relative Strength Index (RSI) on daily charts approaches oversold territory near 30. This creates a potential Fair Value Gap (FVG) if buying pressure resumes. Volume profile analysis reveals high liquidity clusters between $80,000 and $85,000, acting as a consolidation range.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $83,675 | Testing key Fibonacci support |

| 24-Hour Trend | -5.66% | Reflects extreme fear sentiment |

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Historically a contrarian buy signal |

| Kazakhstan Reserve Allocation | $350 million | Illiquid supply removal from market |

| Bitcoin Market Rank | #1 | Dominance holds amid altcoin weakness |

Kazakhstan's decision matters for three reasons. First, it legitimizes Bitcoin as a strategic reserve asset, following guidance from institutions like the International Monetary Fund on digital asset classification. Second, it removes $350 million in potential selling pressure from confiscated coins, tightening supply. Third, it sets a precedent for other nations to monetize seized cryptocurrencies, potentially creating a new source of sovereign demand.

Institutional liquidity cycles suggest such moves precede broader adoption phases. The NIC's management indicates professional custody solutions, reducing counterparty risk. Retail market structure may benefit from reduced volatility if more states adopt similar policies. This aligns with long-term trends toward digital asset integration in traditional finance.

"Kazakhstan's approach represents a pragmatic shift in reserve management. By allocating confiscated Bitcoin to strategic holdings, they effectively sterilize a portion of supply while gaining exposure to a non-correlated asset. This could pressure other central banks to evaluate similar strategies, especially as global monetary policy remains uncertain. The key risk lies in valuation volatility, but the long-term horizon mitigates this." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish scenario requires holding the $82,000 Fibonacci support, leading to a rally toward $90,000 resistance. The bearish scenario involves a break below this level, targeting the $78,000 order block from Q4 2025.

The 12-month institutional outlook remains cautiously optimistic. Kazakhstan's move may encourage other nations to formalize cryptocurrency holdings, increasing structural demand. However, macroeconomic factors like potential Federal Reserve policy shifts, as highlighted in reports on Fed chair odds impacting sentiment, could introduce volatility. Over a 5-year horizon, sovereign adoption could drive Bitcoin's role as a digital gold alternative.