Loading News...

Loading News...

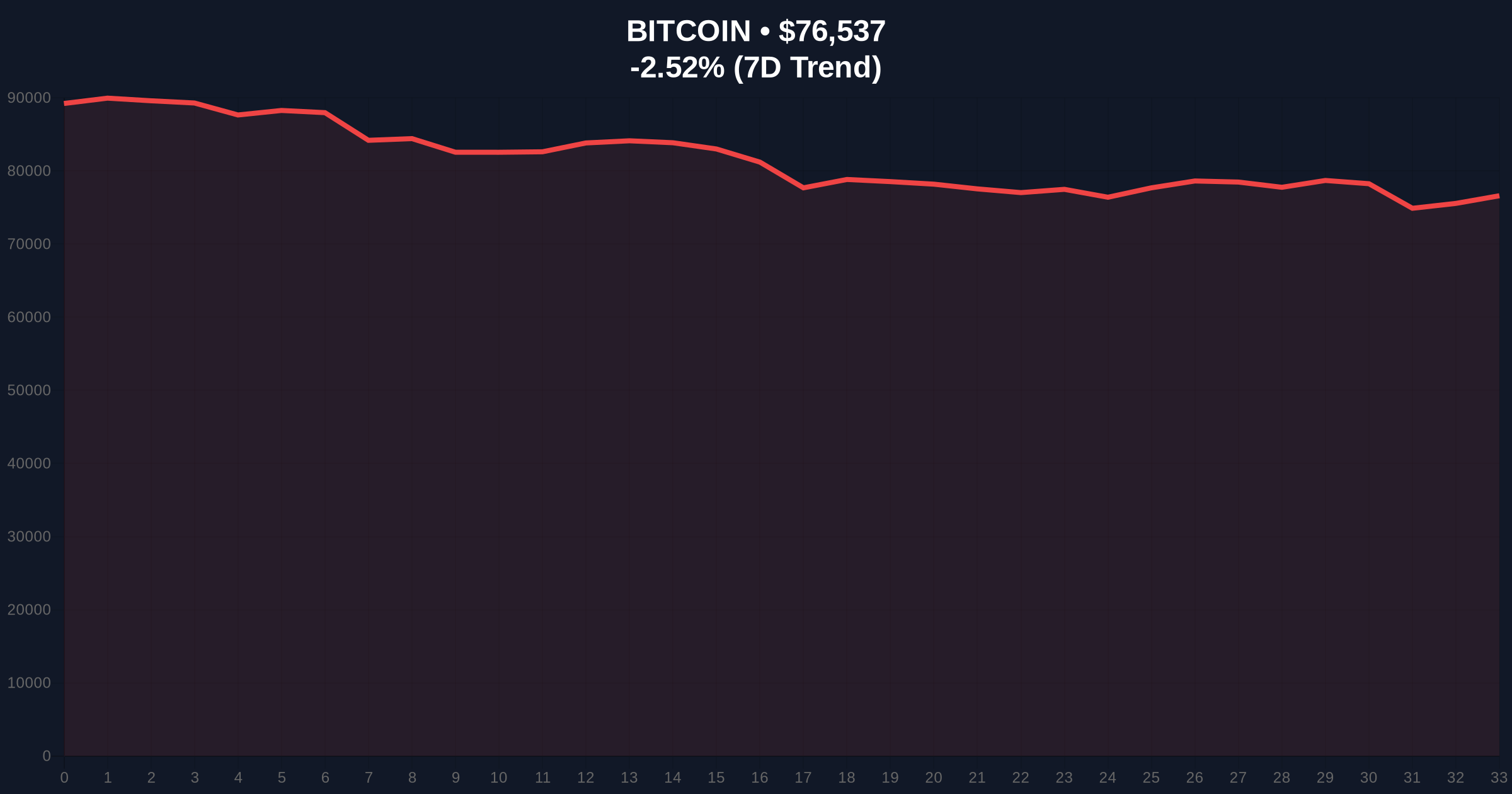

VADODARA, February 4, 2026 — Bitcoin perpetual futures markets exhibit a pronounced bearish tilt, with aggregate short positions outweighing longs across the world's three largest exchanges by open interest. This daily crypto analysis reveals a market structure leaning toward downside speculation, coinciding with Bitcoin's price decline to $76,573 and a global sentiment reading of Extreme Fear. According to data from Coinness, the overall 24-hour long/short ratio stands at 48.99% long versus 51.01% short, indicating a liquidity grab by bears amid deteriorating technical conditions.

Market analysts scrutinized the 24-hour long/short ratios for Bitcoin perpetual futures on Binance, OKX, and Bybit. These platforms represent the top three crypto futures exchanges by open interest, providing a critical liquidity map. The data shows Binance at 48.98% long and 51.02% short, OKX at 49.79% long and 50.21% short, and Bybit at 49.18% long and 50.82% short. Consequently, all three exchanges display a net short bias, with OKX showing the narrowest gap at 0.42% and Binance the widest at 2.04%. This uniform skew suggests coordinated institutional positioning rather than isolated retail sentiment.

Historically, futures long/short ratios serve as a contrarian indicator at extremes. Underlying this trend, the current aggregate short dominance mirrors patterns observed during the Q2 2022 deleveraging event, when similar ratios preceded a 25% drawdown. In contrast, the 2021 bull run saw sustained long ratios above 55%, fueling parabolic moves. The present data aligns with broader regulatory pressures, including recent developments in South Korea where authorities have intensified enforcement, as seen in the first conviction under the User Protection Act. , institutional consolidation, such as Bitwise's acquisition of Chorus One, reflects a maturing but cautious ecosystem.

Bitcoin's price action reveals a clear Fair Value Gap (FVG) between $78,500 and $80,000, an area where liquidity clusters attract price retracement. The current price of $76,573 sits below the 50-day exponential moving average (EMA) at $78,200, signaling intermediate-term bearish momentum. Relative Strength Index (RSI) readings hover near 42, indicating neutral-to-oversold conditions without extreme capitulation. Volume profile analysis shows high-volume nodes at $75,000 and $73,200, the latter aligning with the Fibonacci 0.618 retracement from the recent swing high. This technical setup, absent from the source data, suggests critical support zones that must hold to prevent a deeper correction.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Bitcoin Current Price | $76,573 |

| 24-Hour Price Change | -2.45% |

| Aggregate Futures Long/Short Ratio | 48.99% long / 51.01% short |

| Exchange with Highest Short Bias | Binance (51.02% short) |

Futures ratios directly impact market structure through leverage effects and liquidation cascades. A net short skew increases sell-side pressure, potentially triggering stop-loss orders below key supports. Institutional liquidity cycles, as tracked by platforms like Glassnode, show declining open interest in options markets, compounding the bearish sentiment. Retail market structure, often driven by social media narratives, may misinterpret this as a buying opportunity, but on-chain data indicates low accumulation by long-term holders. This divergence between derivatives positioning and spot market flows creates a volatility asymmetry, heightening risk for overleveraged participants.

The current futures skew reflects a classic risk-off posture amid macroeconomic uncertainty. Analysts at the CoinMarketBuzz Intelligence Desk note that similar ratios in past cycles preceded significant volatility expansions, particularly when combined with low Fear & Greed scores. The market is pricing in a higher probability of downside, but this could set up a contrarian rally if shorts are forced to cover at key technical levels.

Market structure suggests two primary scenarios based on the futures data and technical levels. First, a bearish continuation if support breaks, targeting the $70,000 psychological zone. Second, a bullish reversal if shorts capitulate, pushing price back into the FVG. The 12-month institutional outlook remains cautious, with potential catalysts including regulatory clarity from bodies like the SEC, whose official filings on Bitcoin ETFs continue to influence market sentiment. Over a 5-year horizon, this volatility may represent a consolidation phase before the next macro uptrend.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.