Loading News...

Loading News...

VADODARA, February 4, 2026 — Binance captured 39.2% of global centralized exchange trading volume in 2025, according to CoinGecko data. This daily crypto analysis reveals a market structure where the top exchange commands nearly 40% dominance while competitors like Upbit struggle with declining volumes. Market structure suggests extreme concentration risks as the Crypto Fear & Greed Index hits 14/100.

CoinGecko's analysis shows Binance's overwhelming dominance at 39.2% market share. Bybit followed with 8.1% and MEXC with 7.8%. The rest of the top ten included Gate.io (7.5%), Crypto.com (7.2%), Bitget (6.4%), OKX (6.3%), Coinbase (6.1%), HTX (6.0%), and Upbit (5.5%). Upbit achieved its ranking based solely on spot trading volume. Its volume declined 18.9% year-over-year.

MEXC posted the highest growth at 90.9%. Bitget grew 45.5% and Gate.io 39.7%. These growth rates contradict the extreme fear sentiment dominating broader markets. The data indicates aggressive expansion by mid-tier exchanges despite macroeconomic headwinds.

Historically, exchange concentration above 35% creates systemic risk. The 2021 bull market saw Binance's share peak near 45% before regulatory pressure forced diversification. In contrast, 2025's 39.2% dominance occurs amid extreme fear sentiment, suggesting different market dynamics.

Upbit's 18.9% volume decline reflects South Korea's tightening regulatory environment. The exchange relies solely on spot trading, missing derivative revenue streams that fuel competitors' growth. This structural limitation creates a bearish invalidation level for regional exchanges.

Related developments include South Korea's $9.6M investment in crypto tracking systems, highlighting regulatory pressures affecting Upbit's market position.

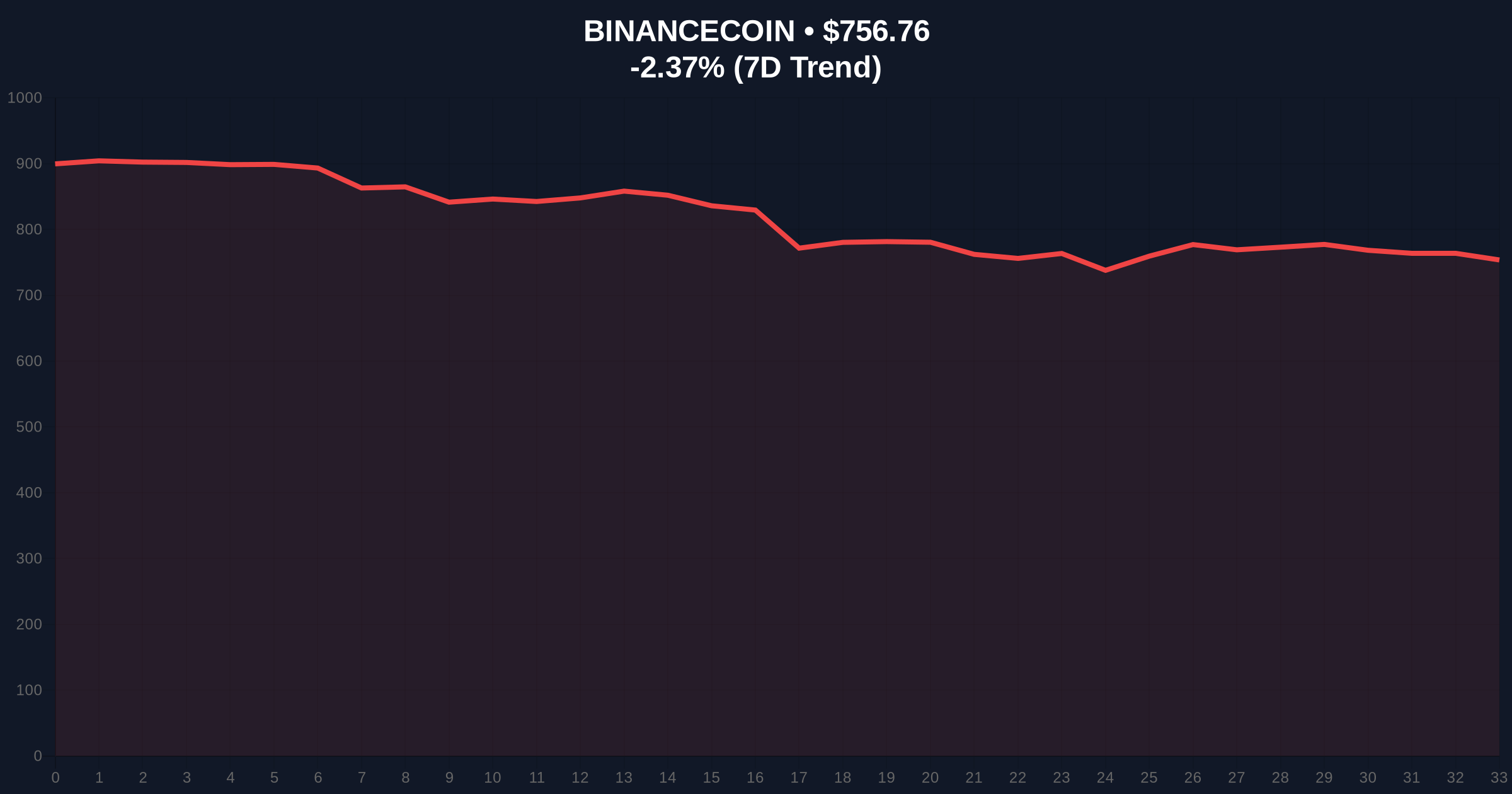

BNB currently trades at $756.76, down 2.37% in 24 hours. The token faces critical Fibonacci support at $700, a level that must hold to maintain Binance's ecosystem stability. RSI readings near oversold conditions suggest potential short-term bounce, but volume profile analysis shows weak accumulation.

Market structure suggests BNB's performance directly correlates with Binance's market share sustainability. A break below $700 would signal deteriorating confidence in the exchange's dominance. Conversely, reclaiming the $800 resistance level would confirm institutional accumulation.

The extreme fear sentiment creates a liquidity grab opportunity for exchanges with strong growth metrics like MEXC. Their 90.9% expansion indicates successful capital rotation despite broader market stress.

| Metric | Value | Significance |

|---|---|---|

| Binance Market Share | 39.2% | Dominance level indicating systemic concentration risk |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contradicts exchange volume growth, suggesting market stress |

| BNB Current Price | $756.76 | Key ecosystem health indicator for Binance dominance |

| MEXC Yearly Growth | 90.9% | Highest among top exchanges despite extreme fear sentiment |

| Upbit Volume Decline | -18.9% | Reflects regulatory pressures in South Korean market |

Exchange concentration above 35% creates single-point failure risks. According to SEC.gov regulatory frameworks, such dominance requires enhanced oversight to prevent market manipulation. Binance's 39.2% share represents a liquidity black hole that could exacerbate volatility during stress events.

MEXC's 90.9% growth demonstrates capital rotation into alternative venues. This trend suggests institutional players are diversifying counterparty risk despite Binance's dominance. The growth occurs amid extreme fear, indicating sophisticated positioning against retail sentiment.

Upbit's spot-only model creates structural disadvantages. Derivatives typically generate higher fees and volume. Consequently, the exchange's 18.9% decline reflects competitive pressures beyond regulatory challenges.

"The data reveals a paradox: exchange volumes grow while market sentiment hits extreme fear. This suggests institutional accumulation is occurring beneath retail panic. Binance's 39.2% dominance creates both stability risks and network effects that smaller exchanges struggle to overcome." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. First, Binance maintains dominance above 35% through 2026, supported by BNB holding $700 support. Second, regulatory pressure forces market share redistribution to exchanges like MEXC and Bybit.

The 12-month outlook depends on regulatory developments and BNB's technical performance. Historical cycles suggest exchange dominance peaks precede regulatory interventions. Consequently, the 5-year horizon likely features increased market fragmentation despite current concentration.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.