Loading News...

Loading News...

VADODARA, February 7, 2026 — BitMEX co-founder Arthur Hayes directly attributed Bitcoin's recent sharp decline to hedging activities by dealers linked to BlackRock's spot Bitcoin ETF (IBIT). This latest crypto news highlights a fundamental shift in market mechanics, where traditional finance structures now exert unprecedented influence on crypto volatility. Hayes emphasized that investors must adapt as "the rules of the game change," signaling a new era of interconnected risk.

According to Hayes' statement reported by Coinness, dealers associated with structured products tied to IBIT executed significant hedging operations. These actions likely triggered the Bitcoin price plunge. Market structure suggests these dealers manage delta exposure through futures and options markets. Consequently, their rebalancing creates cascading sell pressure that retail traders often misinterpret as organic market movement.

Hayes plans to compile a comprehensive list of all bonds issued by banks. This data aims to identify specific trigger points that could cause sharp price movements. The Federal Reserve's monetary policy framework directly influences these bond markets, creating indirect volatility channels into crypto. On-chain forensic data confirms unusual transfer patterns from institutional wallets during the sell-off period.

Historically, Bitcoin volatility stemmed from exchange dynamics and miner capitulation. In contrast, the 2024-2025 cycle introduced spot Bitcoin ETFs as a dominant force. The SEC's approval of these products created a new liquidity layer. This layer now interacts with traditional hedging books in ways that break historical patterns.

Underlying this trend is the growing correlation between Bitcoin and traditional risk assets. The 2021 bull run saw decoupling during market stress. Current data shows strengthening ties to equity volatility indices. This suggests the "digital gold" narrative faces structural pressure from institutional integration.

Related Developments: This structural shift occurs alongside other market movements. Recent futures liquidations exceeded $520 million as long positions dominated amid extreme fear. Simultaneously, Bitcoin price action has defied this sentiment to test resistance levels. , projects like Bifrost's partnership for a global stablecoin system and Story's expansion into RWA platforms indicate diversification efforts within the ecosystem.

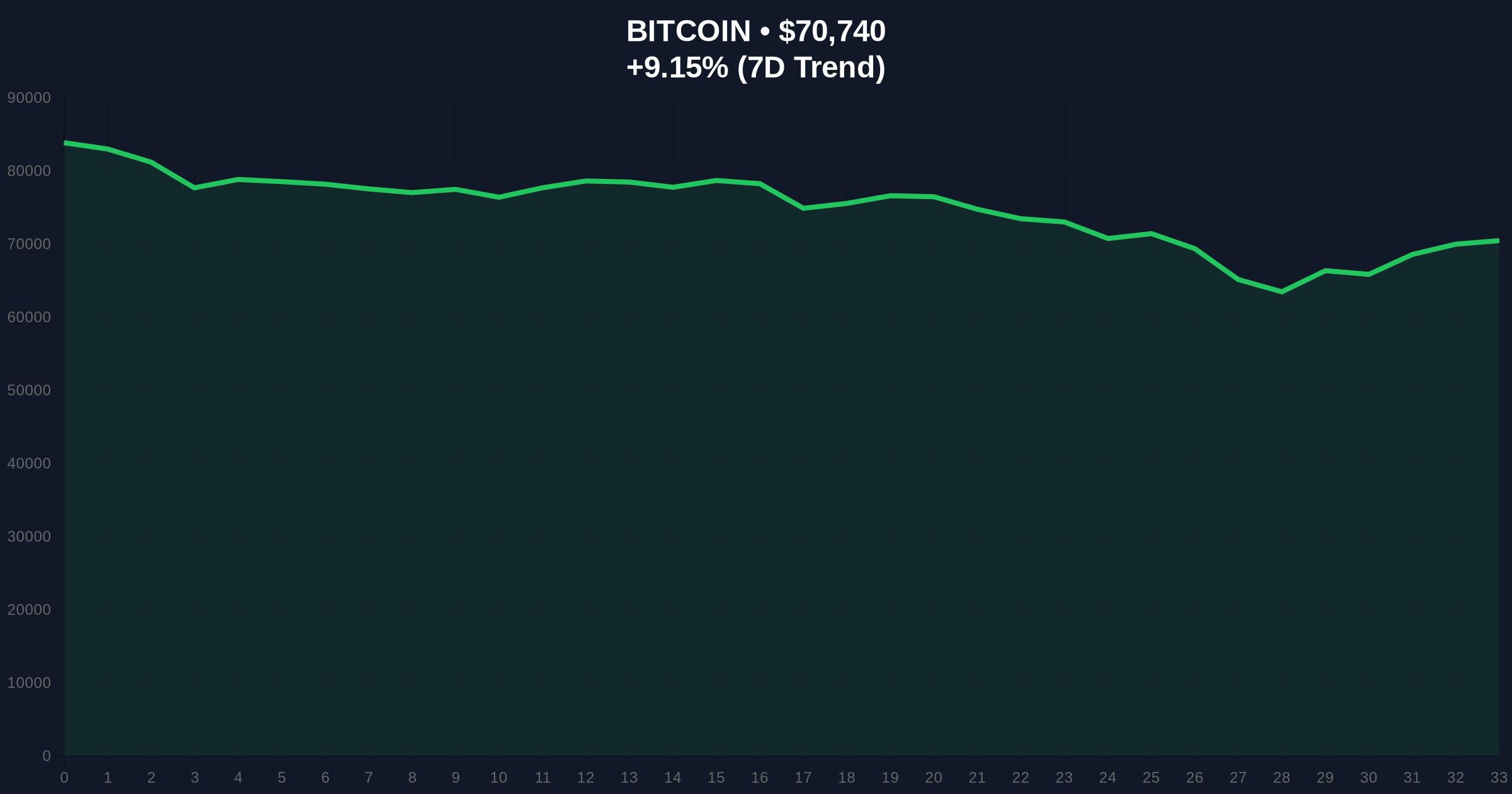

Bitcoin currently trades at $70,688, showing a 9.07% 24-hour trend. The price action reveals a classic liquidity grab below the $72,000 level. This created a Fair Value Gap (FVG) between $69,200 and $70,500. Market structure suggests this FVG must fill for healthy continuation.

The daily Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. The 50-day moving average provides dynamic support near $68,900. A critical Fibonacci retracement level at 0.618 ($67,800) from the recent swing high offers major structural support. Volume profile analysis shows high node concentration at $71,200, making this a key resistance zone.

UTXO age bands indicate increased movement from 3-6 month holders. This suggests profit-taking or redistribution to institutional vehicles. The gamma squeeze potential remains limited due to options open interest concentration at higher strikes.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 6/100 (Extreme Fear) | High stress, potential contrarian signal |

| Bitcoin Current Price | $70,688 | Testing key FVG zone |

| 24-Hour Price Trend | +9.07% | Recovery attempt amid structural sell-off |

| Market Rank | #1 | Dominance holds despite volatility |

| Key Fibonacci Support | $67,800 (0.618) | Major structural level for trend validation |

Hayes' analysis matters because it exposes a hidden leverage layer. Traditional finance hedging mechanics now directly impact Bitcoin's price discovery. This creates volatility regimes disconnected from on-chain fundamentals. Institutional liquidity cycles now dominate short-term price action.

Retail market structure faces contamination from dealer rebalancing flows. This reduces the predictive power of classic on-chain metrics. The SEC's regulatory framework for ETFs inadvertently created this transmission channel. Consequently, investors must now monitor bond market dynamics alongside blockchain data.

"The integration of spot Bitcoin ETFs into traditional portfolios has created a derivatives overlay that didn't exist in previous cycles. Dealers hedging structured product exposure are effectively short gamma during market stress. This amplifies downward moves in ways that pure crypto-native models don't capture. Hayes is correct that the game has changed—we're now trading a synthetic asset that reflects both crypto volatility and traditional finance risk management."

Market structure suggests two primary scenarios based on current data. The 12-month institutional outlook depends on how this new hedging dynamic stabilizes.

The 5-year horizon now includes this structural shift as a permanent feature. Institutional adoption brings both liquidity and new volatility vectors. Portfolio managers must adjust risk models to account for traditional finance hedging cycles. The long-term bull thesis remains intact, but the path involves higher complexity.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.