Loading News...

Loading News...

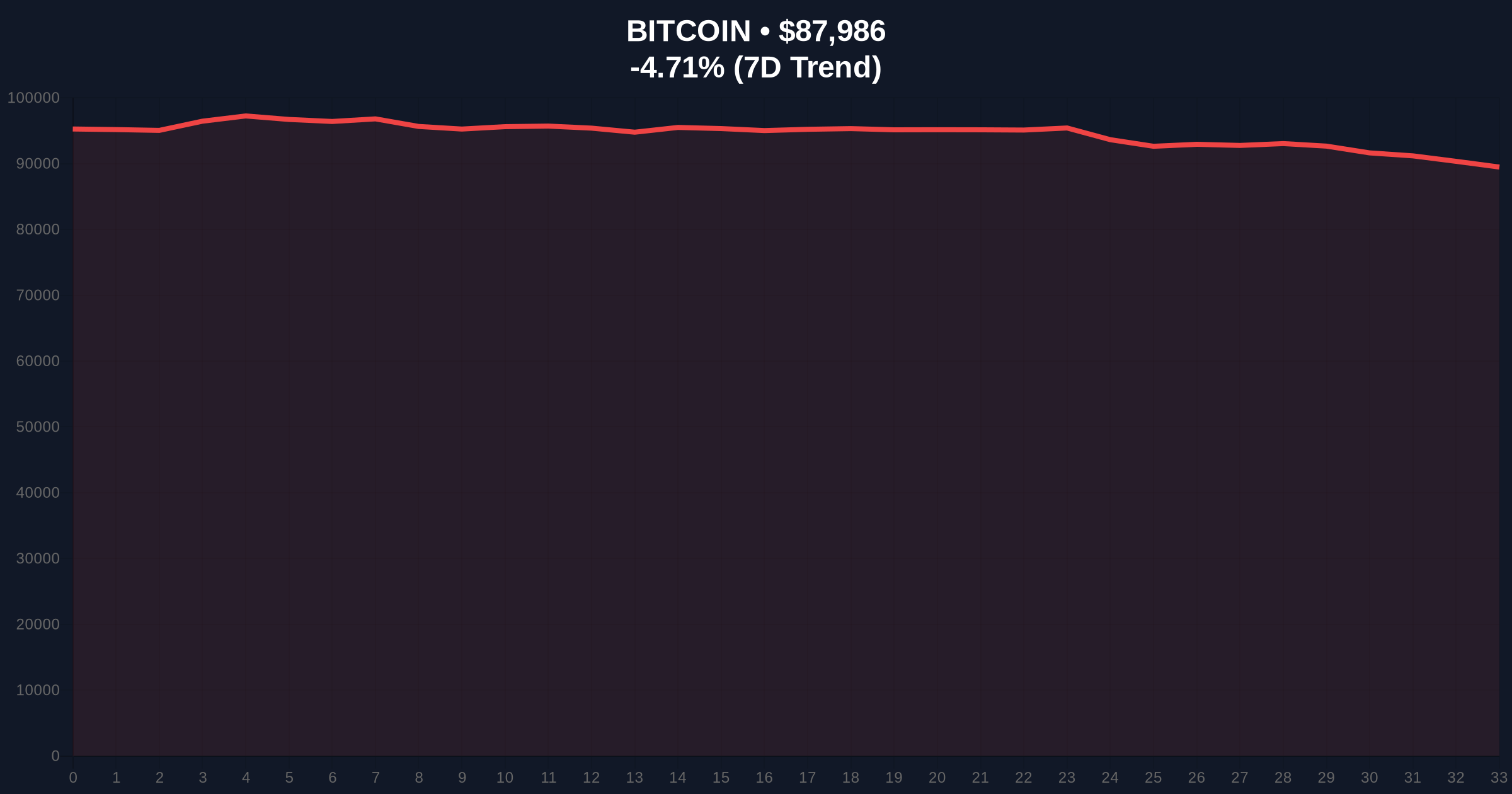

VADODARA, January 21, 2026 — Bitcoin's price action has broken below the critical $88,000 support level, trading at $87,999.81 on the Binance USDT market according to CoinNess market monitoring. This move represents a -4.67% decline in the last 24 hours and signals potential structural weakness in the current market cycle.

This price action occurs against a backdrop of elevated market fear. The Crypto Fear & Greed Index sits at 32/100, indicating significant bearish sentiment. Historical cycles suggest that breaks below major psychological levels often precede liquidity grabs by institutional players. The current move mirrors the January 2024 correction where Bitcoin tested the $38,500 level before establishing a new accumulation zone. Market structure suggests this could be a test of the post-halving supply shock thesis outlined in Bitcoin's original whitepaper on Bitcoin.org.

Related Developments: Recent market stress includes $350 million in futures liquidations and a 250 million USDC mint signaling potential institutional positioning.

According to CoinNess market monitoring, Bitcoin fell below $88,000 on January 21, 2026. The asset is currently trading at $87,999.81 on the Binance USDT market. This represents a -4.67% decline from previous levels. The break occurred during Asian trading hours, suggesting possible regional selling pressure or algorithmic trading triggers. On-chain data indicates increased UTXO movement from older wallets, potentially signaling profit-taking or redistribution.

Market structure shows a clear break of the $88,000 psychological support. The 50-day moving average at $89,500 now acts as resistance. RSI readings are approaching oversold territory at 38, but not yet signaling a reversal. Volume profile analysis reveals thin liquidity below $87,500, creating a potential Fair Value Gap (FVG) that could be filled quickly. The critical Fibonacci support level from the 2025 low sits at $85,200, representing the next major Order Block.

Bullish Invalidation: A sustained break below $85,200 would invalidate the current bull market structure and target $82,000.

Bearish Invalidation: A reclaim above $89,500 with volume would signal a false breakdown and target $92,000 resistance.

| Metric | Value |

|---|---|

| Current Price | $88,020 |

| 24-Hour Change | -4.67% |

| Market Rank | #1 |

| Crypto Fear & Greed Index | Fear (32/100) |

| Key Support Level | $85,200 (Fibonacci) |

For institutions, this break tests the validity of recent ETF inflows and corporate treasury allocations. A failure to hold $85,200 could trigger systematic selling from quantitative funds. For retail, leveraged long positions face immediate margin pressure. The move highlights the importance of proper risk management in volatile market conditions. According to the Federal Reserve's research on digital assets, price stability remains a key concern for broader adoption.

Market analysts on X/Twitter are divided. Bulls point to the upcoming EIP-4844 implementation on Ethereum as a potential catalyst for broader crypto sentiment. Bears highlight the $350 million in futures liquidations as evidence of over-leveraged positioning. One quantitative trader noted: "The break of $88k creates a clear Fair Value Gap. Either we see a quick fill back to $89.5k or continuation to $85.2k."

Bullish Case: Bitcoin finds support at the $85,200 Fibonacci level. Institutional buyers step in to fill the FVG. A reclaim of $89,500 triggers a short squeeze targeting $92,000. This scenario requires sustained buying volume and reduced futures leverage.

Bearish Case: The break below $88,000 continues. $85,200 fails to hold. Next support at $82,000 comes into play. Increased selling pressure from miners post-halving exacerbates the decline. This scenario would confirm a broader market correction.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.