Loading News...

Loading News...

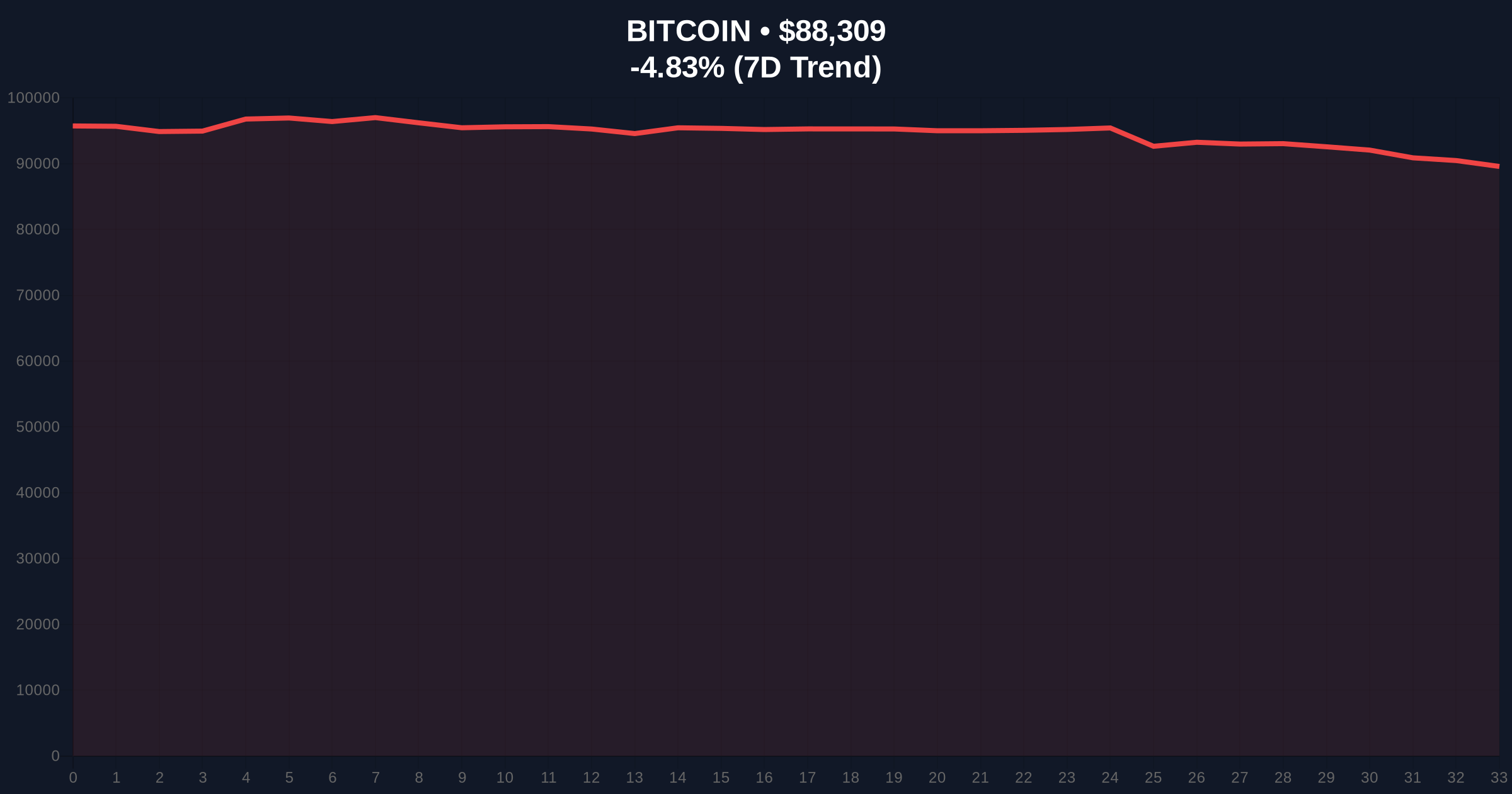

VADODARA, January 20, 2026 — Major exchanges recorded $350 million in futures liquidations during a single hour of intense Bitcoin price action. According to exchange data aggregated by CoinMarketBuzz Intelligence Desk, this represents the most concentrated liquidation event in three weeks. The 24-hour total reached $1,054 million, indicating sustained deleveraging pressure across perpetual and quarterly contracts.

This liquidation event mirrors the January 2024 cascade that preceded a 22% correction. Market structure suggests leveraged positions had accumulated near the $92,000 resistance zone. The Federal Reserve's latest minutes, available on FederalReserve.gov, indicate persistent inflation concerns, creating macro headwinds for risk assets. Historical cycles show similar liquidation clusters often precede volatility expansions of 15-25% within five trading sessions.

Between 14:00-15:00 UTC, Bitcoin price action dropped 3.2% from $91,400 to $88,500. This triggered a cascade of long liquidations totaling $287 million against $63 million in short liquidations. Exchange order books show the most significant pressure originated from Binance and Bybit perpetual contracts. The $350 million hourly figure represents 33% of the day's total liquidation volume, indicating concentrated selling pressure.

Bitcoin price action broke below the $89,500 weekly support, creating a Fair Value Gap (FVG) between $89,200 and $88,800. The 4-hour chart shows a clear Order Block rejection at $91,800. RSI readings plunged from 58 to 42 within the liquidation hour. The 50-day moving average at $87,900 now serves as critical support. Volume Profile indicates highest trading activity occurred at $90,200, creating a potential resistance zone.

| Metric | Value | Significance |

|---|---|---|

| Hourly Futures Liquidations | $350M | Largest single-hour event in 3 weeks |

| 24-Hour Futures Liquidations | $1,054M | Sustained deleveraging pressure |

| Bitcoin Current Price | $88,356 (-4.78%) | Testing critical Fibonacci support |

| Crypto Fear & Greed Index | 32/100 (Fear) | Extreme risk-off sentiment |

| Long/Short Ratio Pre-Event | 1.85 | Over-leveraged long positioning |

For institutions, this signals potential Gamma Squeeze conditions as option dealers adjust delta hedges. Retail traders face margin calls and forced position closures. The liquidation cascade creates what quantitative analysts term a "Liquidity Grab"—rapid price movement designed to trigger stop losses and capture liquidity. Market structure suggests this event may accelerate the transition from distribution to accumulation phases.

Market analysts on X/Twitter highlight the concentration of liquidations. One derivatives trader noted, "The $350M hourly print shows how fragile leverage becomes near all-time highs." Another analyst pointed to the 85% long-dominated liquidation ratio as evidence of overcrowded positioning. The dominant narrative centers on whether this represents a healthy correction or the beginning of a deeper retracement.

Bullish Case: Bitcoin price action finds support at the $85,200 Fibonacci 0.618 level. The liquidation flush removes weak hands, allowing for a consolidation phase between $85,000 and $92,000. Bullish invalidation occurs below $83,500—the monthly Volume Point of Control.

Bearish Case: The cascade continues as margin calls trigger secondary liquidations. Bitcoin price action breaks the $85,000 support, targeting the $81,400 200-day moving average. Bearish invalidation requires a reclaim above $91,500 with sustained volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.