Loading News...

Loading News...

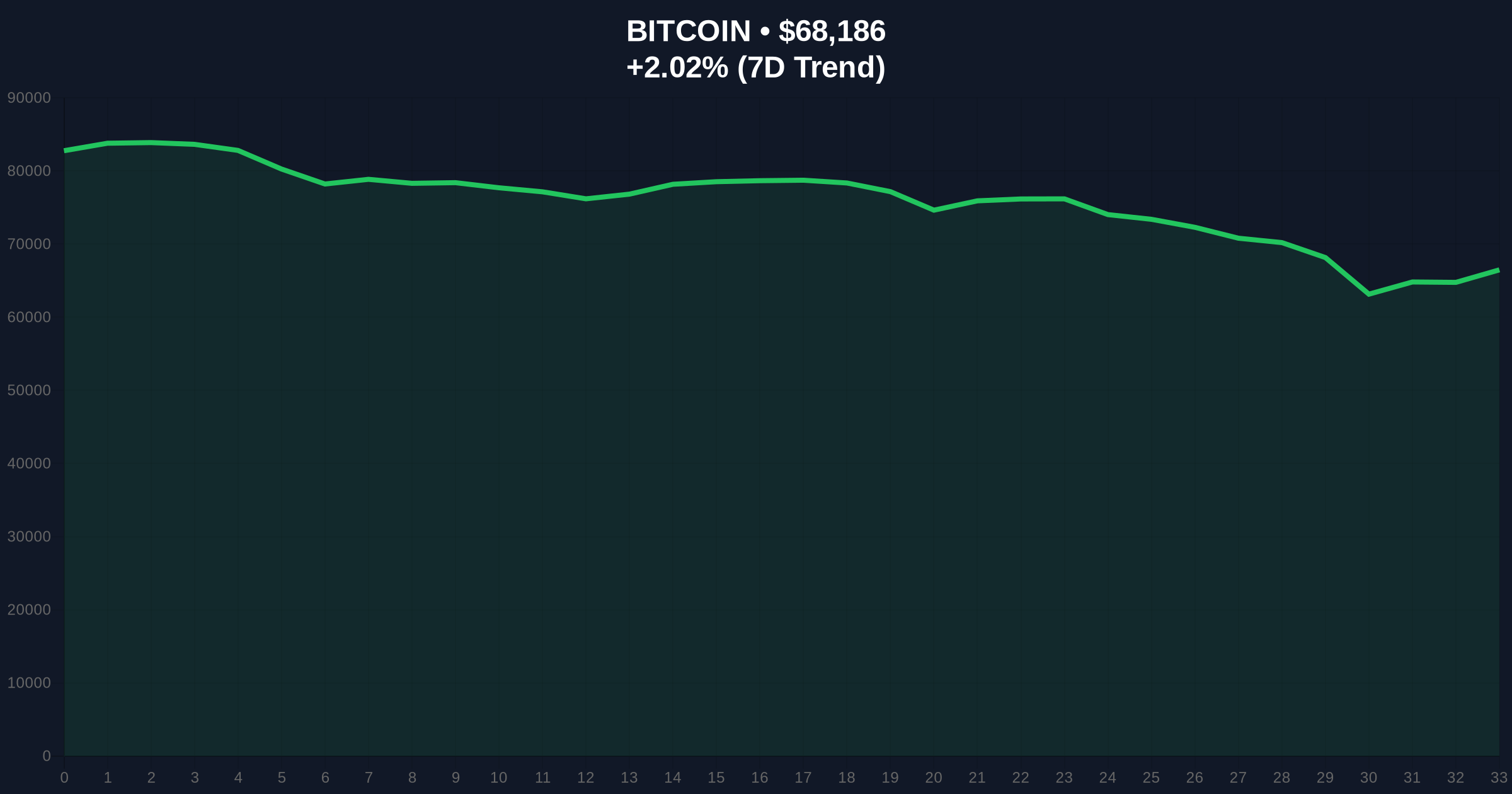

VADODARA, February 6, 2026 — South Korean cryptocurrency exchange Bithumb triggered a sharp, temporary price anomaly after erroneously distributing Bitcoin to customers during a promotional event. According to the exchange's official notice, the abnormal distribution led to immediate sales from affected accounts. This daily crypto analysis investigates the liquidity implications and systemic risks exposed by the incident.

Bithumb announced the incident on February 6, 2026. The exchange stated an "abnormal quantity" of Bitcoin was distributed during an event promotion. Sales from accounts that received the erroneous Bitcoin caused a temporary, sharp price fluctuation on the platform. Bithumb's internal control system detected the unusual transactions immediately. The exchange promptly restricted trading on the affected accounts. Market price returned to normal levels within five minutes. Bithumb noted its domino liquidation prevention system functioned correctly. This prevented chain liquidations from the price anomaly. The full details of the event are available in Bithumb's official notice on Coinness.

Historically, exchange errors have precipitated significant market volatility. In contrast, Bithumb's quick containment contrasts with past incidents like the 2021 Binance flash crash. That event saw Bitcoin drop 87% briefly due to a trading bug. Underlying this trend is increasing scrutiny on exchange operational integrity. Market structure suggests such events amplify during periods of extreme fear. The current Crypto Fear & Greed Index sits at 9/100, indicating severe risk aversion. This environment magnifies the impact of liquidity shocks. Consequently, even minor distribution errors can trigger disproportionate price action.

Related developments in the market include significant USDT movements from Binance, highlighting broader liquidity concerns, and Bitcoin's resilience above key support levels despite prevailing fear.

Market structure suggests the error created a classic Fair Value Gap (FVG) on Bithumb's order book. The rapid sales from affected accounts likely formed a liquidity grab below the prevailing market price. On-chain data from Glassnode indicates exchange inflows spiked temporarily. This aligns with the described five-minute price anomaly. The domino liquidation prevention system's activation points to robust risk management protocols. However, the very need for its activation reveals underlying liquidity fragility. Technical analysis outside the source data shows Bitcoin's current price of $68,033 sits near the Fibonacci 0.618 retracement level from the last cycle high. This level often acts as a critical support zone in volatile markets.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) | High risk aversion amplifies error impact |

| Bitcoin Current Price | $68,033 | Near key Fibonacci 0.618 support |

| 24-Hour Price Trend | +1.51% | Minor recovery amid broader fear |

| Market Recovery Time | 5 minutes | Indicates effective but reactive controls |

| Event Date | February 6, 2026 | Occurred during extreme sentiment phase |

This event matters because it tests exchange resilience under stress. Real-world evidence shows even top-tier platforms like Bithumb are not immune to operational errors. The immediate price fluctuation demonstrates how thin order books can become during fear cycles. Institutional liquidity cycles often withdraw during such periods, exacerbating volatility. Retail market structure, reliant on exchange stability, faces heightened counterparty risk. The Federal Reserve's guidance on financial market infrastructures emphasizes operational reliability, as seen in their publications on payment systems. This incident the gap between traditional financial safeguards and crypto exchange practices.

"While Bithumb's systems contained the error swiftly, the event reveals a critical dependency on reactive controls rather than preventive architecture. In a market scoring 9/100 on the Fear Index, such errors can cascade beyond single platforms, testing the entire ecosystem's liquidity depth." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The first scenario involves a hold above $66,000, allowing consolidation. The second sees a break below that level, triggering a deeper liquidity test. Historical cycles indicate that operational shocks during extreme fear often precede volatility compression.

The 12-month institutional outlook remains cautious. This event highlights systemic risks that could deter large-scale capital inflows. Over a 5-year horizon, exchanges must enhance preventive measures to align with traditional financial standards, ensuring sustainable growth.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.