Loading News...

Loading News...

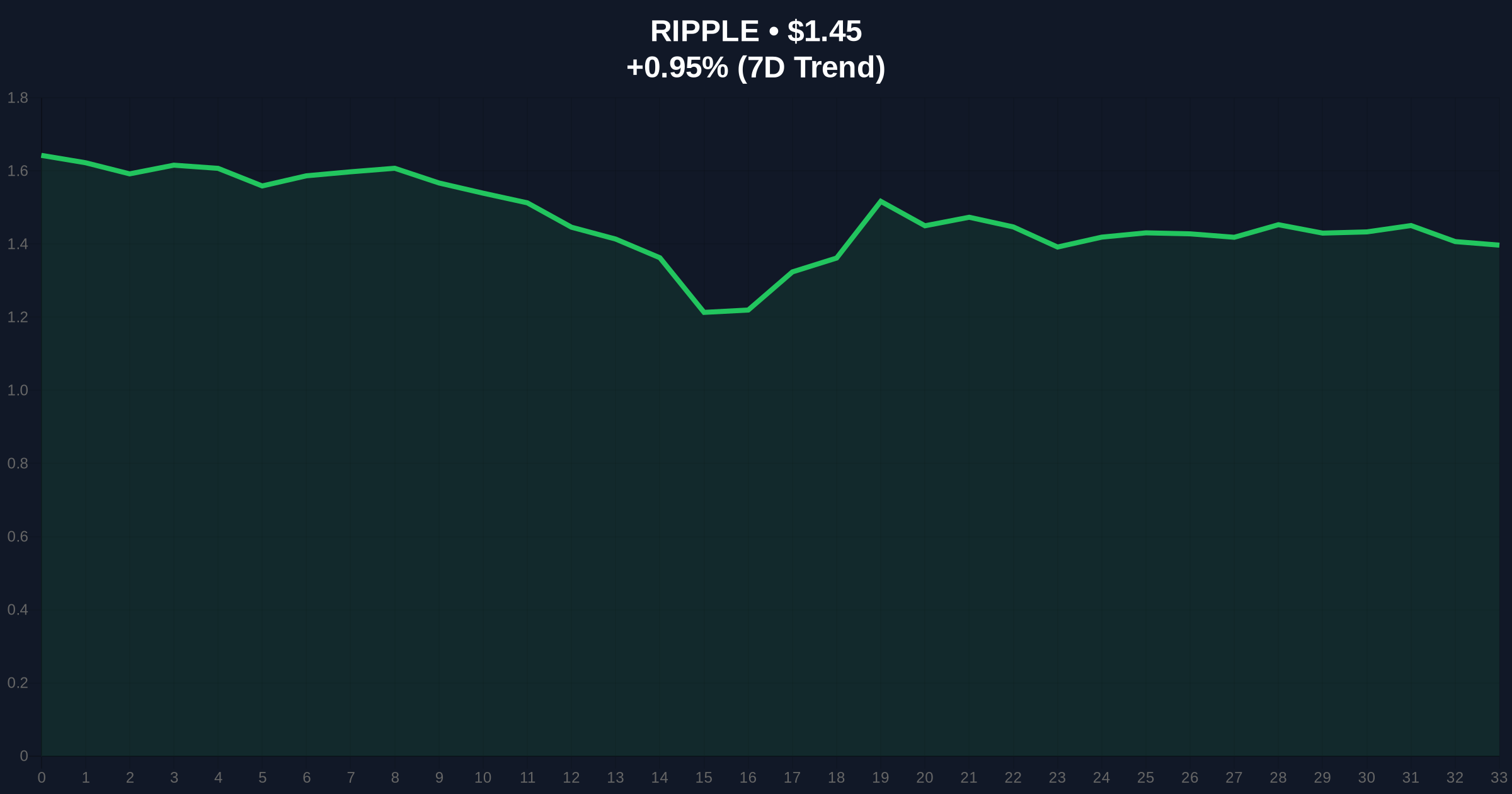

VADODARA, February 9, 2026 — XRP has entered a critical stop-loss phase. Its price now trades below the average cost basis for all holders. This triggers widespread selling pressure. According to on-chain data from Glassnode, the 7-day exponential moving average (EMA) of the Spent Output Profit Ratio (SOPR) has collapsed to 0.96. This latest crypto news signals realized losses now outpace profits. Market structure suggests a liquidity grab is underway.

Glassnode's analysis reveals a precise metric shift. The SOPR 7-day EMA declined from 1.16 in July 2025 to 0.96 currently. A SOPR value below 1.0 confirms net realized losses across the network. Holders are selling positions at a loss. This creates a self-reinforcing feedback loop. Selling begets more selling. The average cost basis acts as a critical psychological level. Breaching it triggers automated stop-loss orders.

This pattern mirrors the early 2022 bear market. Glassnode identified a similar SOPR dip below 1.0 from September 2021 to May 2022. That event preceded a prolonged market correction. Historical cycles suggest these metrics are leading indicators. They often forecast broader price deterioration.

The current environment echoes past capitulation events. In early 2022, a SOPR break below 1.0 coincided with a 60% drawdown in XRP's price. The current setup shows alarming parallels. Underlying this trend is a shift in UTXO age bands. Older coins are now moving at a loss.

, the broader market exhibits Extreme Fear. The Crypto Fear & Greed Index sits at 14/100. This sentiment amplifies the stop-loss cascade. Retail investors panic-sell into weak liquidity. Consequently, order books thin out. This increases volatility.

Related Developments: This extreme fear environment is impacting multiple assets. For instance, analysis shows a bearish pattern threatening Solana's price stability. Meanwhile, Bitcoin tests key resistance amid the same macro fear.

XRP currently trades at $1.44. The critical support zone lies between $1.40 and $1.35. This area represents a major Fair Value Gap (FVG) from Q4 2025. A break below $1.35 would invalidate the current bullish structure. The Relative Strength Index (RSI) on the daily chart hovers near 42. This indicates weakening momentum.

Resistance is firm at $1.55. This level aligns with the 50-day simple moving average. Volume profile analysis shows high volume nodes around $1.50. This confirms strong selling interest. The market must reclaim this zone to stabilize. On-chain forensic data confirms increased exchange inflows. This typically precedes further selling pressure.

| Metric | Value | Significance |

|---|---|---|

| XRP Current Price | $1.44 | Below average cost basis |

| SOPR (7-day EMA) | 0.96 | Signals net realized losses |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Amplifies selling pressure |

| 24-Hour Price Change | -0.92% | Negative momentum |

| Market Rank | #4 | High correlation risk |

This event matters for portfolio risk management. XRP's market rank of #4 creates systemic risk. A breakdown here could spill over into other major altcoins. Institutional liquidity cycles are tightening. The Federal Reserve's latest minutes, available on FederalReserve.gov, suggest a hawkish stance remains. This pressures risk assets.

Retail market structure is fragile. The stop-loss phase indicates weak hands are exiting. This can create a vacuum for stronger buyers. However, timing is critical. Historical data from the 2022 cycle shows these phases can last for months.

"The SOPR metric is a cold, hard ledger of pain. A sustained print below 1.0 tells us the market is in a distribution phase. Sellers are capitulating. This often marks a mid-to-late stage in a downtrend, but it can also precede a final washout low. The key is watching for a reversal in this ratio coupled with a decrease in exchange inflows." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. The path depends on the $1.35 support level.

The 12-month institutional outlook remains cautious. Regulatory clarity for XRP, as outlined in historical legal documents from SEC.gov, provides a long-term floor. However, short-term technicals dominate. If the SOPR remains depressed, a retest of the 2025 lows is probable within the next quarter. This aligns with a broader 5-year horizon where regulatory assets may decouple from pure speculative plays.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.