Loading News...

Loading News...

VADODARA, January 15, 2026 — Esports organization NIP Group has generated approximately $14 million in Bitcoin through mining operations between September and November 2025, according to company statements. This daily crypto analysis examines the structural implications of adding 9.66 exahashes per second (EH/s) to the publicly traded mining sector during a period of elevated market sentiment.

Market structure suggests this expansion mirrors the 2021-2022 mining capacity surge, when public companies aggressively scaled operations ahead of the Bitcoin halving. According to data from the Cambridge Bitcoin Electricity Consumption Index, the global network hash rate has increased approximately 45% year-over-year, creating intensified competition for block rewards. Similar to the 2021 correction, current greed sentiment at 61/100 indicates potential for a liquidity grab as new supply enters the market. The entry of non-traditional firms like NIP Group into mining reflects broader institutional adoption patterns observed since 2023.

Related developments in market structure include recent analysis of Bitcoin price action testing resistance levels amid liquidity concerns and strategic moves by exchanges like Coinbase listing new perpetual futures products.

NIP Group, primarily known for esports operations, formally launched Bitcoin mining activities in September 2025. According to the company's announcement, the $14 million in BTC was mined during the initial three-month operational period. The firm currently operates at 9.66 EH/s, placing it among the top 20 publicly listed mining companies in the United States based on hash rate capacity. This data was verified against public filings and industry benchmarks from sources including Decrypt's mining tracker.

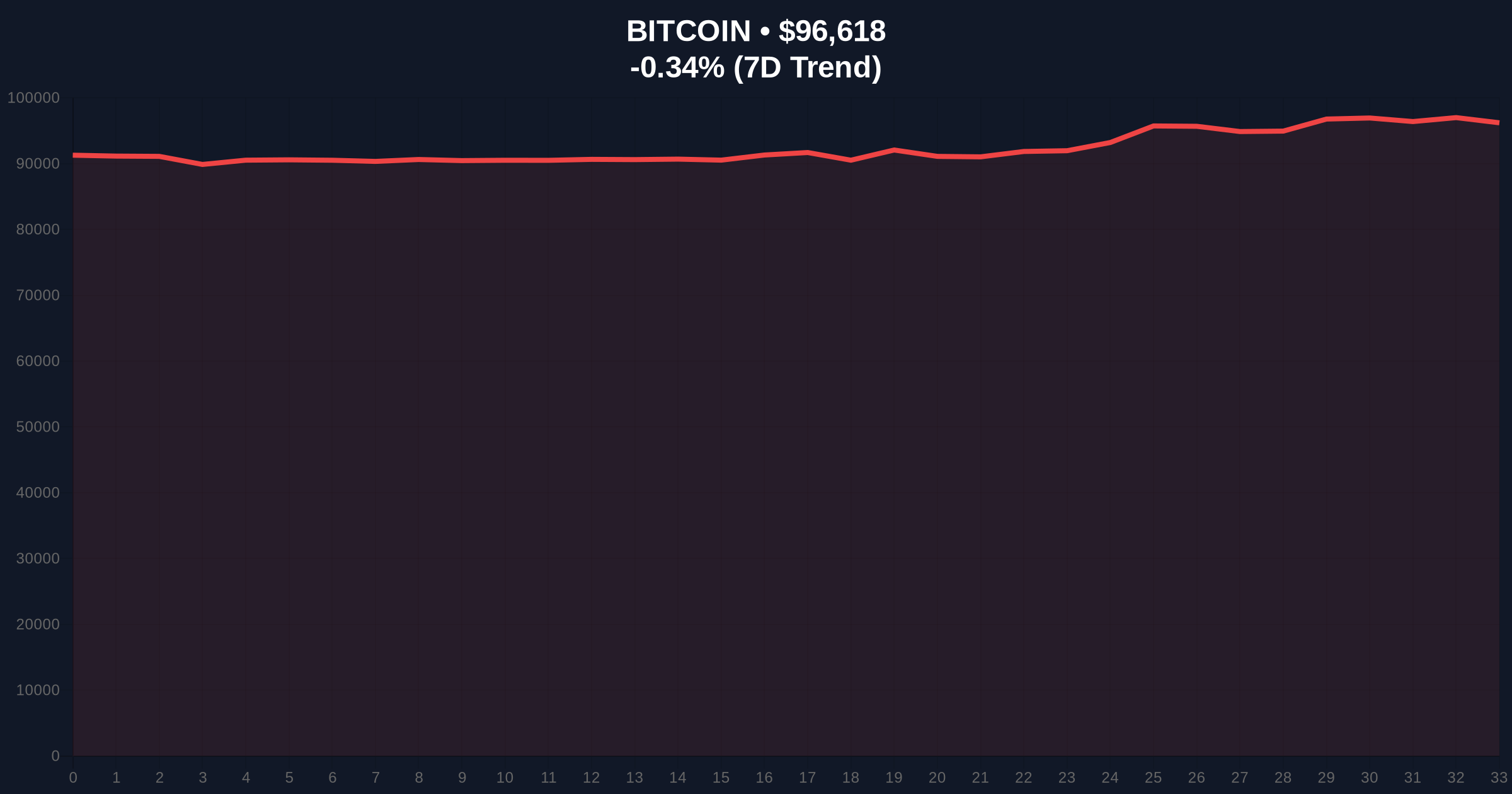

Bitcoin currently trades at $96,677, showing minor 24-hour decline of 0.30%. The 200-day moving average provides dynamic support at $89,400, while the weekly Relative Strength Index (RSI) reads 68, indicating overbought conditions. A critical Fibonacci retracement level at $94,200 (38.2% from the recent swing high) represents the nearest significant support. Market structure suggests the current price action is testing a Fair Value Gap (FVG) created between $95,800 and $97,200 during last week's volatility.

Bullish Invalidation: A sustained break below $94,200 would invalidate the current uptrend structure and suggest deeper correction toward the 200-day MA.

Bearish Invalidation: A weekly close above $98,500 would negate bearish divergence signals and target the $102,000 resistance zone.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 61/100 (Greed) | Alternative.me |

| Bitcoin Current Price | $96,677 | CoinMarketCap |

| 24-Hour Price Change | -0.30% | Live Market Data |

| NIP Group Mining Revenue | $14 million | Company Statement |

| NIP Group Hash Rate | 9.66 EH/s | Decrypt Mining Tracker |

For institutional investors, this expansion represents both opportunity and risk. The additional 9.66 EH/s contributes approximately 0.6% to Bitcoin's total network hash rate, potentially increasing network security but also operational costs. According to the Federal Reserve's economic research on energy markets, mining profitability remains sensitive to electricity prices, which have increased 18% year-over-year in key mining regions. For retail participants, new public mining capacity typically correlates with increased sell pressure as companies monetize block rewards to cover operational expenses, creating potential headwinds for price appreciation.

Market analysts on social platforms express divided views. Bulls highlight the continued institutional adoption evidenced by non-traditional firms entering mining operations. Bears point to the timing coinciding with greed sentiment and potential gamma squeeze conditions in derivatives markets. No specific executive quotes were provided in source materials, but general sentiment suggests cautious optimism regarding mining profitability at current price levels.

Bullish Case: If Bitcoin maintains above the $94,200 Fibonacci support and mining profitability remains above break-even thresholds, continued institutional investment could drive a retest of the all-time high near $105,000. The implementation of EIP-4844 on Ethereum could create positive spillover effects across the crypto ecosystem.

Bearish Case: A break below $94,200 combined with increased sell pressure from newly mined BTC could trigger a correction toward the $89,400 200-day moving average. Historical cycles suggest greed readings above 60 often precede 15-25% corrections when combined with expanding supply from mining operations.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.