Loading News...

Loading News...

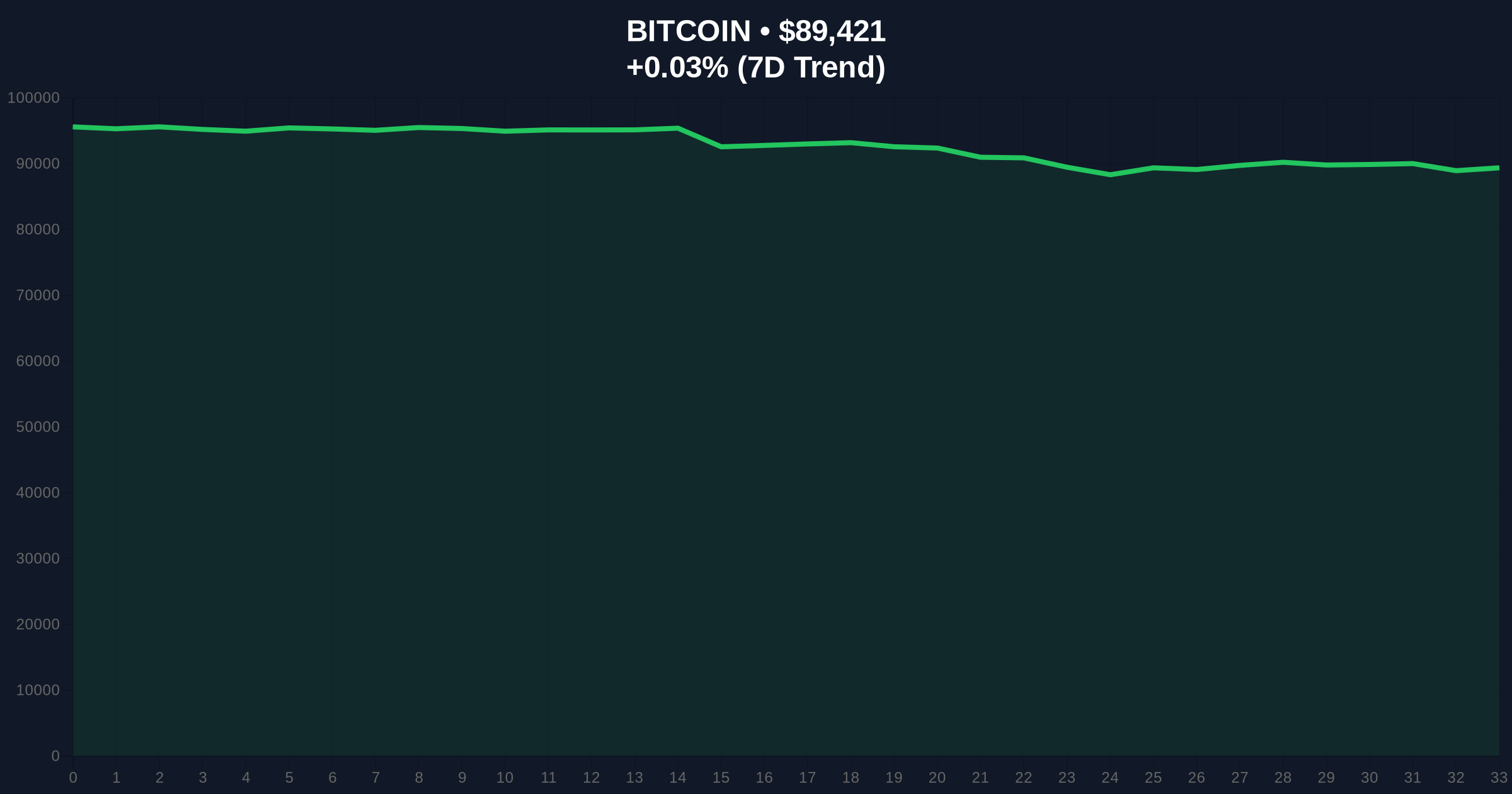

VADODARA, January 23, 2026 — According to data from crypto options exchange Deribit, Bitcoin options with a notional value of $1.9 billion are set to expire at 8:00 a.m. UTC today, presenting a significant liquidity event for the market. This daily crypto analysis examines the structural implications of this expiry, with a put/call ratio of 0.81 and a max pain price of $92,000, against a backdrop of extreme fear sentiment and current price action near $89,438. Market structure suggests this event could act as a catalyst for volatility, similar to historical options expiries that have precipitated sharp moves in both directions.

Historical cycles indicate that large options expiries often serve as liquidity grabs, where market makers adjust their delta-hedging positions, leading to increased volatility. According to Deribit's data, today's expiry mirrors patterns seen in late 2021, when similar-sized expiries coincided with market tops and subsequent corrections. The put/call ratio of 0.81 suggests a slight bullish bias among options holders, as more call options (bets on price increases) are open relative to puts. However, the max pain price of $92,000—the level at which most options expire worthless—creates a gravitational pull that can influence spot prices. This dynamic is compounded by the current extreme fear sentiment, which, per the Crypto Fear & Greed Index, sits at 24/100, often a contrarian indicator for potential bounces. Related developments include US Bitcoin mining expansion amid similar fear sentiment and stablecoin market stagnation under regulatory pressure, both adding to macro uncertainty.

On January 23, 2026, at 8:00 a.m. UTC, Bitcoin options worth $1.9 billion in notional value expired on Deribit, as reported by the exchange's official data. These contracts feature a put/call ratio of 0.81, indicating 81 puts for every 100 calls, and a max pain price of $92,000. Concurrently, Ethereum options worth $347 million expired with a put/call ratio of 0.84 and a max pain price of $3,200. This event represents one of the largest single-day expiries in recent months, with market makers likely engaged in delta-hedging activities that can amplify price swings. According to on-chain data, open interest in Bitcoin options has been building over the past week, suggesting heightened speculative positioning ahead of this expiry.

Current Bitcoin price action shows the asset trading at $89,438, down 0.04% in the last 24 hours, and below the max pain level of $92,000. Market structure suggests a Fair Value Gap (FVG) exists between $90,500 and $91,800, which may act as a magnet for price movement post-expiry. The Relative Strength Index (RSI) on the daily chart is near 45, indicating neutral momentum, while the 50-day moving average at $91,200 provides dynamic resistance. Volume profile analysis reveals significant liquidity clusters around $87,200 and $94,500, key levels for support and resistance. Bullish invalidation is set at $87,200; a break below this level would signal a deeper correction toward the Fibonacci 0.618 retracement at $85,000. Bearish invalidation is at $94,500; a sustained move above this would negate the current downtrend and target the all-time high near $100,000. This technical setup is reminiscent of the EIP-4844 upgrade period, where similar volatility patterns emerged due to derivatives market activity.

| Metric | Value | Source |

|---|---|---|

| Bitcoin Options Notional Value | $1.9B | Deribit |

| Put/Call Ratio (BTC) | 0.81 | Deribit |

| Max Pain Price (BTC) | $92,000 | Deribit |

| Current Bitcoin Price | $89,438 | Live Market Data |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) | Live Market Data |

| Ethereum Options Notional Value | $347M | Deribit |

This expiry matters because it represents a critical liquidity event that can dictate short-term price direction. For institutions, the max pain price of $92,000 serves as a focal point for gamma squeeze potential, where rapid price moves force market makers to buy or sell spot Bitcoin to hedge their options positions. According to the Federal Reserve's research on market microstructure, such events can lead to increased volatility and liquidity crunches. For retail traders, the extreme fear sentiment suggests oversold conditions, but a failure to hold support could trigger stop-loss cascades. The interplay between options expiry and spot market dynamics is a key driver of crypto volatility, as seen in past cycles like the 2021 correction.

Market analysts on X/Twitter are divided. Bulls point to the put/call ratio below 1.0 as a sign of underlying bullish positioning, with one analyst noting, "The max pain at $92k is a clear target for a bounce." Bears highlight the extreme fear reading and price below max pain, suggesting further downside. Sentiment on platforms like CryptoQuant indicates net outflows from exchanges, hinting at accumulation, but this is countered by high funding rates in perpetual swaps, signaling leveraged long positions at risk.

Bullish Case: If Bitcoin holds above the $87,200 support and reclaims the max pain level of $92,000, a gamma squeeze could propel prices toward $94,500 and beyond. Historical patterns show that expiries with low put/call ratios often precede rallies, especially when fear sentiment is extreme. Market structure suggests a move to fill the FVG up to $91,800 is probable.

Bearish Case: If Bitcoin breaks below $87,200, the bearish invalidation level, it could trigger a liquidation cascade toward $85,000 or lower. The extreme fear sentiment may persist, leading to continued selling pressure. Options-related hedging could exacerbate the downturn, similar to the March 2023 banking crisis sell-off.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.