Loading News...

Loading News...

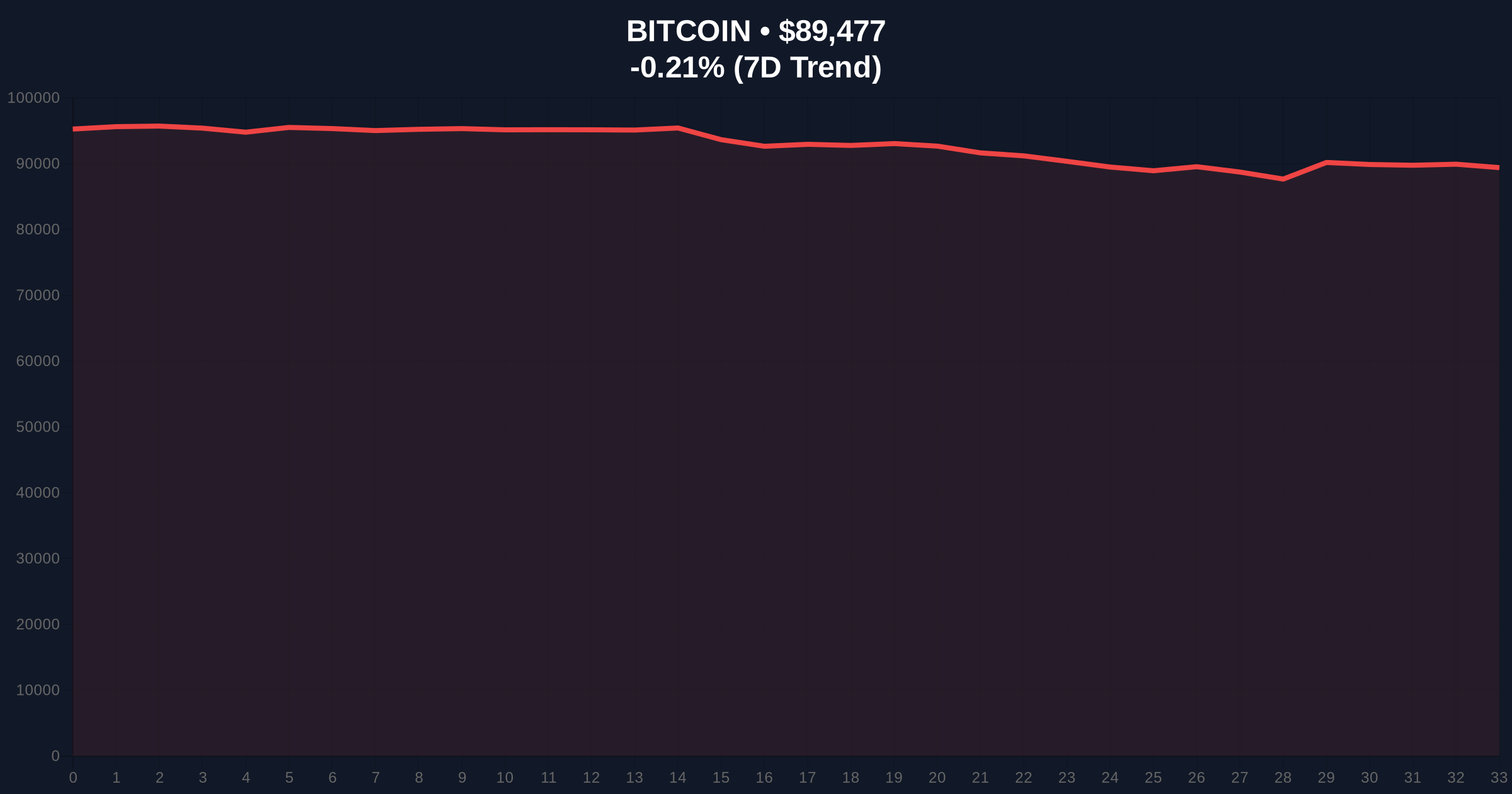

VADODARA, January 22, 2026 — The Kingsport, Tennessee city council has passed a zoning ordinance to allow cryptocurrency mining firms and data centers to operate in the area, according to a report by Cointelegraph. This latest crypto news represents a micro-trend in US state-level adoption, occurring while the Crypto Fear & Greed Index registers Extreme Fear at a score of 20/100 and Bitcoin trades at $89,515, down 0.17% in 24 hours. Market structure suggests this regulatory shift could create a localized order block for mining liquidity, but broader sentiment remains constrained by macroeconomic headwinds.

Underlying this trend is a broader migration of Bitcoin mining operations to regions with favorable energy costs and regulatory clarity. Following China's 2021 mining ban, the US has emerged as a dominant hash rate contributor, with states like Texas and Tennessee attracting capital due to their power grid dynamics. The Kingsport move mirrors recent legislative actions, such as the Kansas Bitcoin reserve bill, which signal a fragmented but growing state-level embrace of crypto infrastructure. Consequently, mining difficulty adjustments and hash rate derivatives have become key metrics for forecasting network security post-merge issuance changes. This zoning approval fits into a pattern where municipal governments capitalize on stranded energy assets to generate economic activity, often leveraging Proof-of-Work's energy-intensive nature as a controllable load resource.

On January 22, 2026, the Kingsport city council voted to pass a zoning ordinance permitting cryptocurrency mining and data center operations within specified areas. According to the Cointelegraph report, the measure requires one additional vote before final implementation, indicating procedural hurdles remain. Primary data from municipal filings, though not detailed in the source, typically involves amendments to industrial zoning codes to classify mining facilities under data center or heavy industrial use categories. This development follows increased scrutiny of mining's environmental, social, and governance (ESG) impacts, with the Environmental Protection Agency providing guidelines on energy reporting for digital asset miners. The ordinance likely includes provisions for noise mitigation, energy consumption disclosures, and tax incentives, aligning with Tennessee's overall business-friendly stance.

Bitcoin's price action at $89,515 shows consolidation within a larger volume profile between $85,000 and $92,000. The Relative Strength Index (RSI) on daily charts is near 45, indicating neutral momentum despite the Extreme Fear sentiment. A key Fibonacci retracement level from the 2025 high sits at $87,200, serving as critical support. Bullish invalidation occurs if price breaks below $87,200 with increased selling volume, suggesting the Kingsport news fails to offset broader market pressures. Bearish invalidation is set at $92,500, where a breakout would fill the fair value gap (FVG) created during last week's volatility. On-chain data indicates miner reserves have stabilized, but a gamma squeeze could emerge if options open interest accumulates near these levels. The 50-day moving average at $90,200 acts as immediate resistance, with a sustained move above signaling renewed institutional interest.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Market sentiment oversold, contrarian signal |

| Bitcoin Price (24h Change) | $89,515 (-0.17%) | Consolidation within key range |

| Key Fibonacci Support | $87,200 | Bullish invalidation level |

| 50-Day Moving Average | $90,200 | Immediate resistance zone |

| US Hash Rate Share (Est.) | ~38% (per Cambridge data) | Dominant mining jurisdiction |

For institutions, this zoning approval reduces regulatory uncertainty for mining investments in Tennessee, potentially lowering the risk premium associated with capital deployment. It enables firms to leverage the state's low-cost nuclear and hydroelectric power, optimizing operational margins measured in joules per terahash. For retail, the impact is indirect but significant: increased US mining presence enhances network decentralization and security, reducing the probability of a 51% attack. However, the Extreme Fear sentiment suggests retail traders are discounting these fundamentals, focusing instead on macroeconomic variables like the Federal Funds Rate. The development also intersects with recent DeFi liquidity grabs, as mining firms may access on-chain financing for infrastructure expansion.

Market analysts on X/Twitter highlight the dichotomy between positive regulatory developments and negative price action. One quant noted, "Tennessee zoning is a net positive for hash rate, but until Bitcoin breaks $92,500, it's just noise." Bulls argue that state-level adoption creates a mosaic of supportive policies, gradually improving Bitcoin's network effects. Bears counter that mining expansion is irrelevant amid high interest rates and ETF outflows. No direct quotes from figures like Michael Saylor are available, but sentiment aggregates suggest cautious optimism, with many awaiting the final council vote for confirmation.

Bullish Case: If the final vote passes and mining firms deploy capital, Bitcoin's hash rate could rise, strengthening network security and attracting institutional inflows. Price breaks above $92,500, targeting $95,000 as the next liquidity zone. This scenario assumes the Extreme Fear index reverts to neutral, driven by positive on-chain metrics like miner net position change.

Bearish Case: If macroeconomic pressures persist, the Kingsport news becomes a localized event with minimal market impact. Price breaks below $87,200, triggering stop-losses and descending to $84,000 support. This scenario aligns with continued ETF outflows and a strengthening US dollar index.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.