Loading News...

Loading News...

VADODARA, January 29, 2026 — An early Bitcoin holder faces an unrealized loss exceeding $46 million on a massive long position. This daily crypto analysis reveals critical market structure risks. According to The Data Nerd, the holder's addresses (1011short, 0xb317d) control over $700 million in BTC, ETH, and SOL. Positions are underwater.

The Data Nerd identified the holder through on-chain forensic analysis. Addresses 1011short and 0xb317d hold three major assets. The portfolio includes 212,726 ETH with an average entry price of $3,149. It also contains 511,612 SOL entered at $130.1. The Bitcoin portion is 572 BTC acquired at $91,506.

Current market prices create the $46 million loss. Market structure suggests this represents a significant liquidity grab. The holder's average entry levels now act as resistance. This creates a Fair Value Gap (FVG) below each position.

Historically, large unrealized losses precede volatility spikes. The 2021 cycle saw similar whale liquidations trigger 30% corrections. In contrast, the 2017 bull run absorbed smaller positions without major disruption.

Underlying this trend is global crypto sentiment. The Crypto Fear & Greed Index sits at 26/100 (Fear). This mirrors Q2 2022 conditions before the LUNA collapse. Consequently, institutional players are adjusting risk models.

Related Developments:

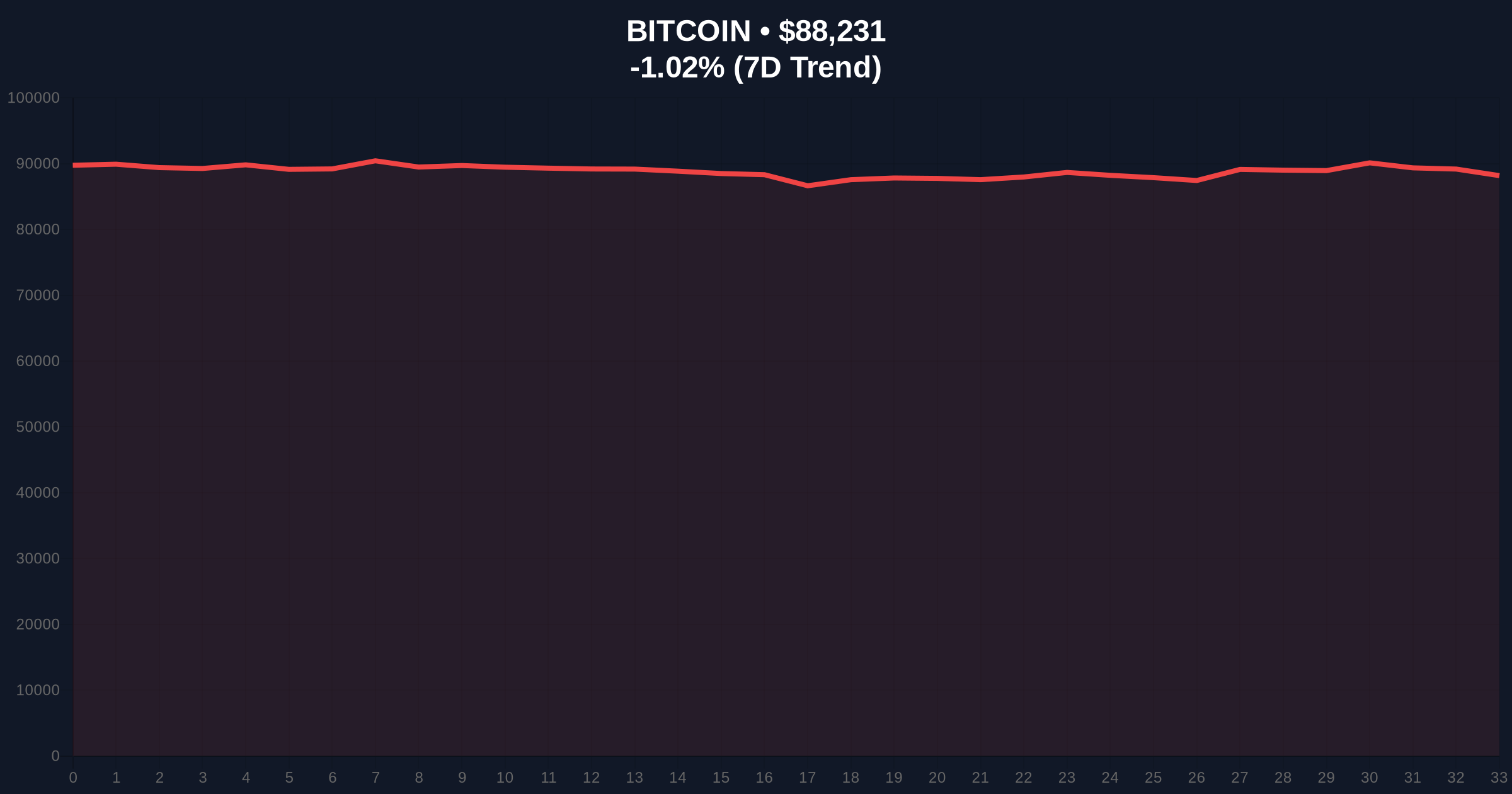

Bitcoin currently trades at $88,191. This is below the holder's $91,506 entry. The 24-hour trend shows a -1.06% decline. Market structure suggests a test of the Fibonacci 0.618 retracement at $82,000.

Ethereum's price action mirrors this. SOL faces additional pressure from its $130.1 entry. On-chain data indicates rising exchange inflows. This signals potential selling pressure. The Volume Profile shows weak support at current levels.

Technical analysis not in the source identifies a critical Order Block between $85,000 and $87,000. A break below invalidates the current structure. The Relative Strength Index (RSI) approaches oversold territory at 32.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 26/100 (Fear) |

| Bitcoin Current Price | $88,191 |

| 24-Hour Price Change | -1.06% |

| Holder's BTC Entry Price | $91,506 |

| Unrealized Loss | $46M+ |

This event matters for portfolio risk. A $46 million unrealized loss on a $700 million position represents a 6.6% drawdown. Market analysts watch for liquidation triggers. According to Ethereum.org's documentation on smart contract risks, large positions can create systemic pressure.

Institutional liquidity cycles are tightening. Retail market structure shows fear dominance. The Gamma Squeeze potential increases if prices drop further. This could accelerate selling.

Market structure suggests this holder misjudged volatility. The $91,506 Bitcoin entry now acts as a strong resistance zone. If broken, it could signal a trend reversal. However, the Fear & Greed Index at 26 indicates capitulation may be near. – CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge. Market structure suggests a retest of lower supports. Historical cycles indicate fear periods often precede rallies.

The 12-month institutional outlook remains cautious. Regulatory clarity from bodies like the SEC could shift sentiment. The 5-year horizon still favors accumulation during fear phases. However, short-term volatility will dominate.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.