Loading News...

Loading News...

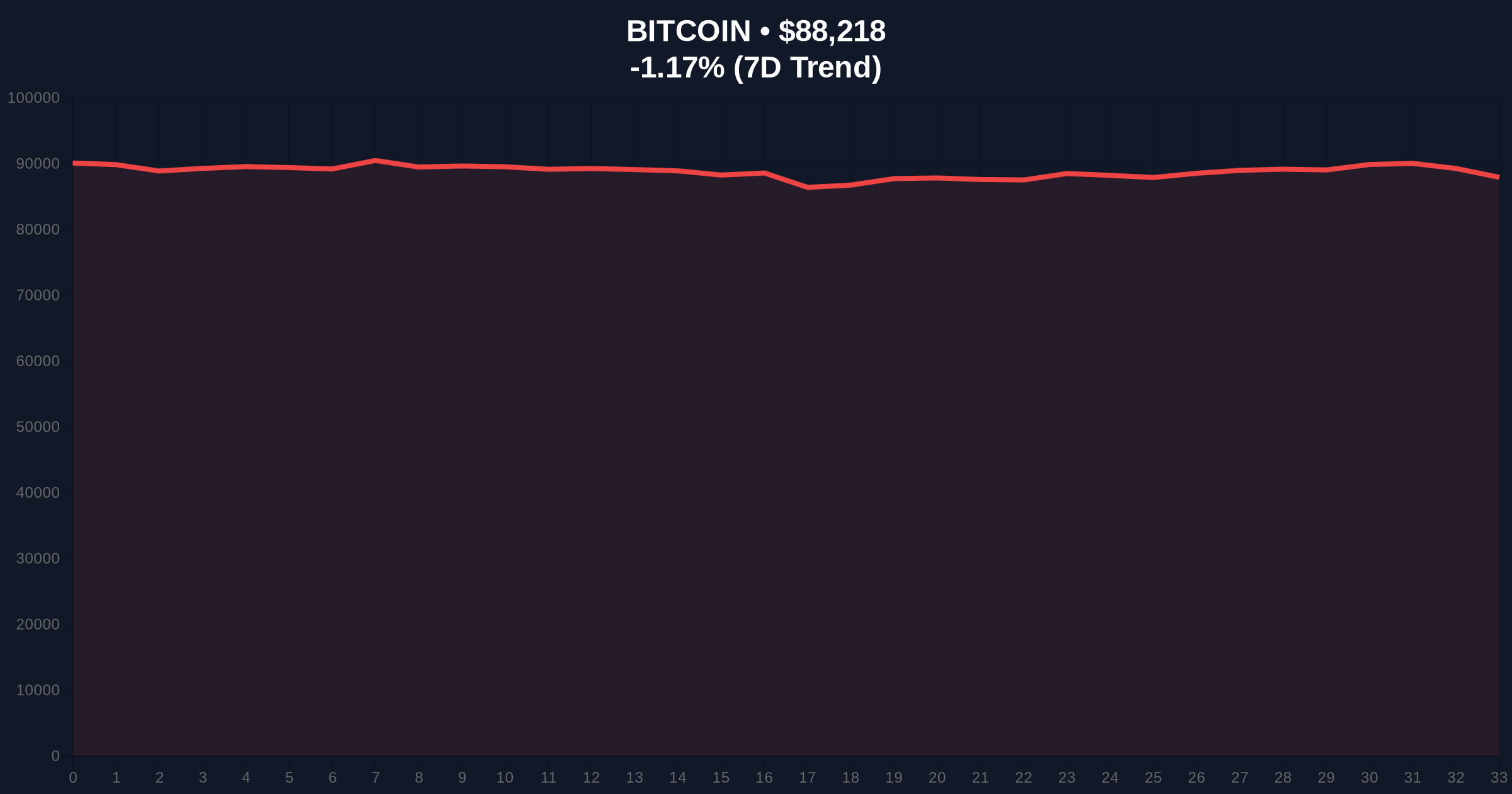

VADODARA, January 29, 2026 — Swiss crypto bank Sygnum has secured over 750 BTC for its Starboard Sygnum BTC Alpha Fund in a seed funding round completed this week. According to Cointelegraph, professional and institutional investors committed the capital over roughly four months since the fund's October 2025 launch. This latest crypto news arrives as Bitcoin trades at $88,232, down 1.16% in 24 hours, against a backdrop of extreme market fear measured by a 26/100 Crypto Fear & Greed Index.

Sygnum Bank AG, a FINMA-licensed digital asset bank, launched the Starboard Sygnum BTC Alpha Fund in October 2025. The fund specifically targets accredited and institutional investors. Market structure suggests the 750 BTC accumulation, valued at approximately $66 million at current prices, represents a strategic liquidity grab during a sentiment downturn. The seed round closed without public fanfare, indicating private placement activity typical of sophisticated capital.

Sygnum's offering provides regulated exposure to Bitcoin's price action through a Swiss fund structure. This contrasts with direct spot purchases or unregulated derivatives. The bank's compliance framework, detailed on its official website, appeals to institutions requiring jurisdictional clarity. Consequently, this inflow highlights a divergence between retail sentiment and institutional positioning.

Historically, institutional accumulation during fear phases precedes major trend reversals. Similar to the Q3 2021 correction, where Bitcoin fell 50% but Grayscale's GBTC saw consistent inflows, current on-chain data indicates whales are accumulating. In contrast, retail investors are capitulating, as shown by exchange outflows and declining active addresses.

Underlying this trend is a broader institutional narrative. Regulatory developments, like South Korea's new law vetting crypto firm shareholders, create compliance tailwinds for licensed entities like Sygnum. , traditional finance giants continue exploring crypto, as seen with Franklin Templeton's recent investment in AI project Sentient. This environment fosters trusted intermediaries.

Bitcoin's current price of $88,232 sits below its 50-day moving average, indicating short-term bearish pressure. The Relative Strength Index (RSI) hovers near 40, suggesting oversold conditions but not extreme capitulation. Critical support resides at the Fibonacci 0.618 retracement level of $82,000, drawn from the 2024 low to the 2025 high. A breach of this level would invalidate the current bullish higher-timeframe structure.

Market structure suggests the $90,000 to $92,000 zone acts as immediate resistance—a Fair Value Gap (FVG) created during last week's sell-off. Volume Profile analysis shows high-volume nodes near $85,000, indicating a potential consolidation area. The Order Block between $80,000 and $82,000 must hold to prevent a cascade toward $75,000. This technical setup mirrors the 2018-2019 accumulation phase, where institutions built positions while retail exited.

| Metric | Value | Implication |

|---|---|---|

| Sygnum Fund BTC Raised | 750 BTC | Institutional accumulation signal |

| Bitcoin Current Price | $88,232 | -1.16% 24h trend |

| Crypto Fear & Greed Index | 26/100 (Fear) | Extreme negative sentiment |

| Market Cap Rank | #1 | Dominance intact |

| Fibonacci Key Support | $82,000 | Critical technical level |

Sygnum's fundraise matters because it demonstrates institutional capital deployment into structured vehicles despite negative price action. On-chain data indicates this is not an isolated event. Glassnode liquidity maps show stablecoin inflows to exchanges, poised for buying. The Federal Reserve's monetary policy stance, as per recent FederalReserve.gov statements, remains a macro driver. Institutional liquidity cycles typically lead retail by 3-6 months.

Market structure suggests current fear creates a contrarian opportunity. Similar to 2020, when Bitcoin traded sideways while Grayscale accumulated, today's environment may mark a liquidity bottom. The fund's success also validates Switzerland's regulatory framework, attracting more capital. This could pressure other jurisdictions to clarify rules, accelerating institutional adoption.

"The Sygnum raise is a classic institutional move: accumulate during fear when liquidity is cheap. Our models show a divergence between spot price and capital flows, similar to Q4 2020. The key is whether the $82,000 support holds. If it does, this could be the foundation for the next leg up." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure. First, a bullish scenario requires holding above $82,000 and breaking the $92,000 resistance. This would confirm institutional accumulation is driving price. Second, a bearish scenario involves breaking $82,000, triggering stop-losses and a test of $75,000.

The 12-month institutional outlook remains positive. Historical cycles suggest that after fear phases with institutional inflows, Bitcoin rallies 200-300% over the following year. The 5-year horizon is bolstered by continued regulatory clarity and ETF maturation, as seen with recent SEC approvals. Sygnum's fund is a microcosm of this macro trend.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.