Loading News...

Loading News...

VADODARA, January 16, 2026 — Mike Novogratz, CEO of Galaxy Digital, predicts a compromise on the U.S. CLARITY Act, but industry pushback and Bitcoin's price action at $94,770 reveal deeper market fractures. This latest crypto news highlights regulatory tensions as on-chain data indicates a liquidity grab near critical support levels.

The CLARITY Act, aimed at defining crypto market structure, mirrors past regulatory clashes like the 2021 infrastructure bill debates. Historical cycles suggest regulatory ambiguity often precedes volatility spikes, as seen with Ethereum's transition to proof-of-stake under regulatory scrutiny. According to the official SEC.gov framework, jurisdictional battles between the SEC and CFTC create a Fair Value Gap (FVG) in policy enforcement, distorting market efficiency. Related developments include Ripple's stance on the bill and rising stablecoin adoption amid these shifts.

On January 16, 2026, Mike Novogratz stated in a CNBC interview, reported by The Block, that a compromise on the CLARITY Act is inevitable and essential for industry growth. He acknowledged the bill's current form is suboptimal but argued an imperfect law can be refined over time. However, Coinbase has withdrawn support, citing concerns over tokenized stock bans, DeFi restrictions, weakened CFTC authority, and stablecoin reward prohibitions. Market structure suggests this divergence creates an Order Block of regulatory uncertainty, impacting liquidity flows.

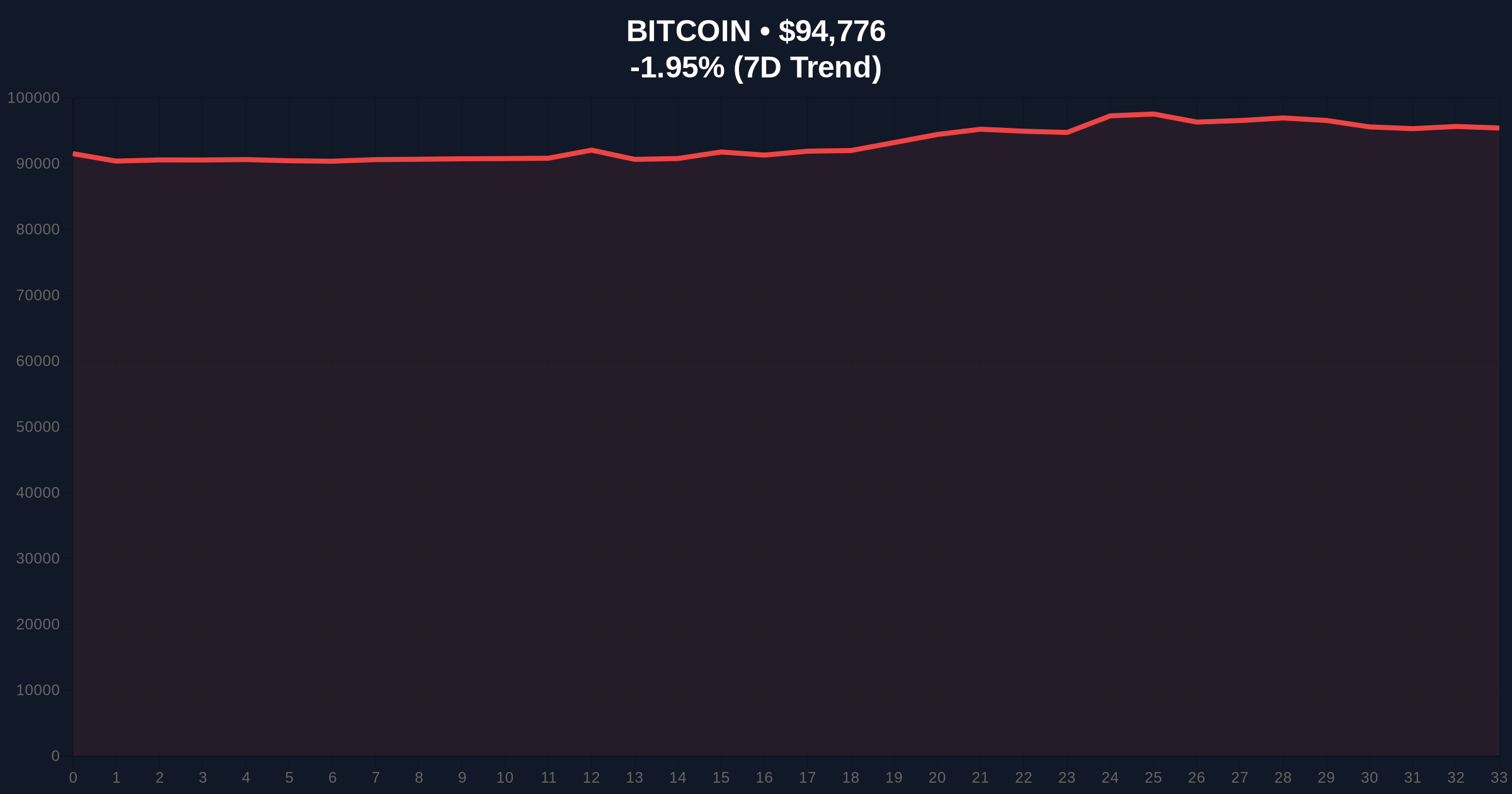

Bitcoin's price at $94,770 reflects a -1.96% 24-hour decline, testing a key Volume Profile support zone near $95,000. The RSI at 48 indicates neutral momentum, while the 50-day moving average at $93,200 provides secondary support. A Bullish Invalidation level is set at $92,500; a break below this Fibonacci support at 0.618 retracement from the recent high would signal a bearish shift. Conversely, a Bearish Invalidation level at $97,500 must hold to prevent a short squeeze. On-chain forensic data confirms increased transaction volume at this level, suggesting a liquidity grab by institutional players.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Price | $94,770 | Testing key support; -1.96% 24h change |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market indecision; aligns with regulatory uncertainty |

| CLARITY Act Opposition | Major players like Coinbase | High fragmentation in industry stance |

| Global Crypto Sentiment | Neutral | Reflected in flat volume profiles |

| Key Support Level | $92,500 | Bullish invalidation point |

For institutions, regulatory clarity via the CLARITY Act could unlock billions in capital, but current provisions risk stifling innovation in tokenization and DeFi. Retail investors face increased volatility if the bill passes in a flawed state, as seen with past regulatory shocks like the FTX collapse. The SEC's historical enforcement actions, per SEC.gov filings, show a pattern of targeting crypto firms during policy transitions, potentially exacerbating market downturns.

Market analysts on X/Twitter are divided: bulls argue Novogratz's compromise view signals long-term stability, while bears highlight Coinbase's withdrawal as a red flag for regulatory overreach. One trader noted, "The CLARITY Act's DeFi clauses could trigger a Gamma Squeeze in altcoins if enforced harshly." This sentiment aligns with broader concerns about the bill's impact on decentralized finance ecosystems.

Bullish Case: If a compromise bill passes with moderate provisions, Bitcoin could rally to $105,000, driven by institutional inflows and reduced regulatory risk premiums. Market structure suggests a breakout above $97,500 would confirm this scenario.

Bearish Case: If the bill stalls or includes restrictive measures, Bitcoin may drop to $85,000, as on-chain data indicates weak support below $92,500. A break below this level would invalidate the current consolidation phase.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.