Loading News...

Loading News...

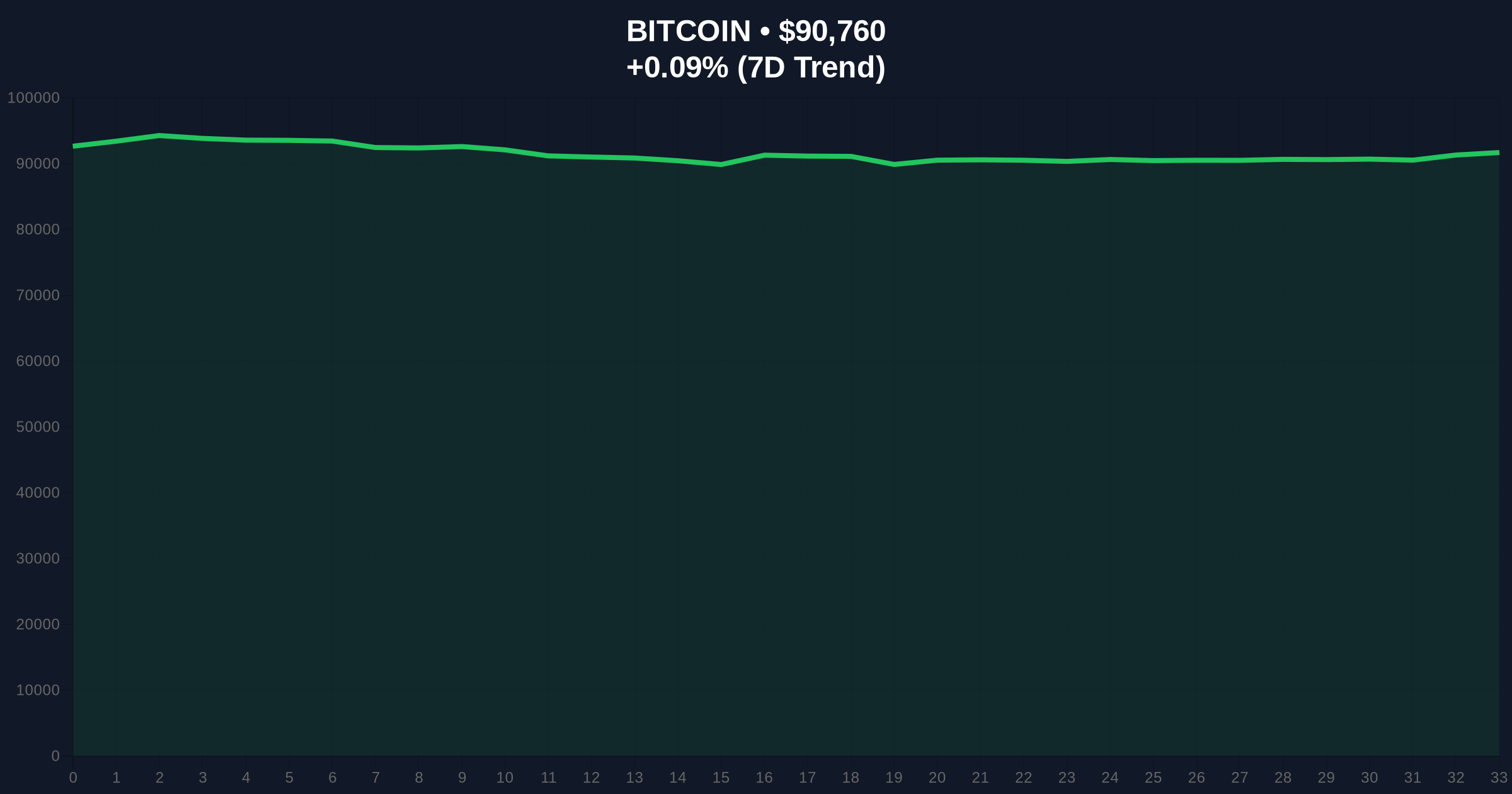

VADODARA, January 12, 2026 — Bitcoin enters a critical juncture with three converging factors threatening to disrupt its current equilibrium. According to Cointelegraph's analysis, the cryptocurrency faces an ongoing leverage squeeze, impending U.S. Consumer Price Index data, and significant whale position reductions. This daily crypto analysis examines whether these factors represent coordinated market manipulation or genuine structural weakness.

Market structure suggests Bitcoin has been consolidating within a $88,500 to $93,200 range for the past two weeks, creating multiple Fair Value Gaps (FVGs) that remain unfilled. Historical cycles indicate that periods of high leverage concentration typically precede violent liquidity grabs, similar to the May 2021 flush that liquidated $8.7 billion in positions. The current environment mirrors pre-correction setups where derivative metrics become disconnected from spot price action. Related developments this week include Bitcoin testing key support levels amid market fear and institutional figures questioning asset valuation fundamentals.

Cointelegraph has identified three specific pressure points for Bitcoin this week. First, the ongoing leverage squeeze across major exchanges has created what market analysts describe as a potential gamma squeeze scenario, where options market makers are forced to hedge positions aggressively. Second, the U.S. Bureau of Labor Statistics will release December's Consumer Price Index data, with consensus estimates pointing to a 3.2% year-over-year increase according to FederalReserve.gov economic projections. Third, on-chain data from Bitfinex indicates large-scale investors are reducing long positions, with aggregate open interest declining by approximately 18% over the past seven days.

The current price of $90,741 sits within a critical order block between $90,200 and $91,400. Volume profile analysis shows weak participation at current levels, suggesting this consolidation represents distribution rather than accumulation. The 20-day exponential moving average at $91,850 acts as immediate resistance, while the 50-day simple moving average at $89,200 provides tentative support. Relative Strength Index (RSI) readings at 48 indicate neutral momentum, but the compression suggests imminent expansion. Market structure suggests a break below the weekly Fibonacci 0.382 retracement level at $88,500 would invalidate the bullish thesis and target the $85,000 FVG. Conversely, sustained trading above $92,800 would confirm bullish continuation toward the $95,000 liquidity pool.

| Metric | Value | Significance |

|---|---|---|

| Crypto Fear & Greed Index | 27/100 (Fear) | Extreme fear typically precedes reversals |

| Bitcoin Current Price | $90,741 | Testing critical order block |

| 24-Hour Price Change | +0.07% | Minimal movement suggests compression |

| Market Rank | #1 | Dominance at 52.3% per CoinMarketCap |

| Bitfinex Whale Position Reduction | ~18% (7-day) | Institutional distribution signal |

For institutional portfolios, the leverage squeeze represents systemic risk as cascading liquidations could trigger cross-margin calls across correlated assets. Retail traders face asymmetric risk from the impending CPI data release, where a hotter-than-expected print could catalyze a risk-off environment across all risk assets. The whale position reduction contradicts the official narrative of continued institutional accumulation, suggesting smart money may be taking profits ahead of potential volatility. According to Ethereum.org documentation on blockchain analytics, large holder outflows typically precede corrective phases by 3-7 trading sessions.

Market analysts on X/Twitter express skepticism about the timing of these converging factors. One quantitative trader noted, "The simultaneous leverage build-up and whale exits suggest coordinated positioning rather than organic market movement." Another analyst questioned, "Why would institutions reduce exposure just before potentially bullish CPI data unless they possess superior information?" This sentiment aligns with broader market fear indicators and suggests the official narrative of "healthy consolidation" may be misleading.

Bullish Case: If CPI data comes in below expectations (<3.0%) and the leverage squeeze resolves without cascading liquidations, Bitcoin could reclaim the $92,800 resistance and target the $95,000 liquidity zone. Bullish invalidation occurs below $88,500.

Bearish Case: If CPI exceeds expectations (>3.4%) and whale outflows accelerate, the leverage squeeze could trigger a liquidation cascade toward the $85,000 Fair Value Gap. Bearish invalidation requires sustained trading above $92,800 with expanding volume.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.