Loading News...

Loading News...

VADODARA, January 21, 2026 — Ondo Finance is deploying over 200 tokenized U.S. stocks and ETFs on the Solana blockchain. According to CoinDesk reporting, this latest crypto news represents a strategic expansion of Ondo Global Markets beyond its existing Ethereum and BNB Chain deployments. Market structure suggests this move targets Solana's high-throughput architecture during a period of extreme market fear.

Tokenized real-world assets represent a $4.8 billion market segment. Ondo's expansion follows a 12-month pattern of institutional migration toward high-performance Layer-1s. Historical cycles indicate such deployments typically precede liquidity rebalancing events. The move occurs against a backdrop of regulatory uncertainty, as seen in recent central bank statements limiting stablecoin roles. Solana's parallel processing capability via Sealevel runtime offers distinct advantages for high-frequency settlement of synthetic assets.

Ondo Finance confirmed deployment of tokenized equity products on Solana mainnet. The offering includes S&P 500 constituents and major sector ETFs. This expands Ondo's multi-chain strategy, previously concentrated on Ethereum via ERC-20 standards and BNB Chain. According to on-chain data, the initial liquidity provision exceeds $50 million across primary pools. The deployment leverages Solana's token program library for minting and management.

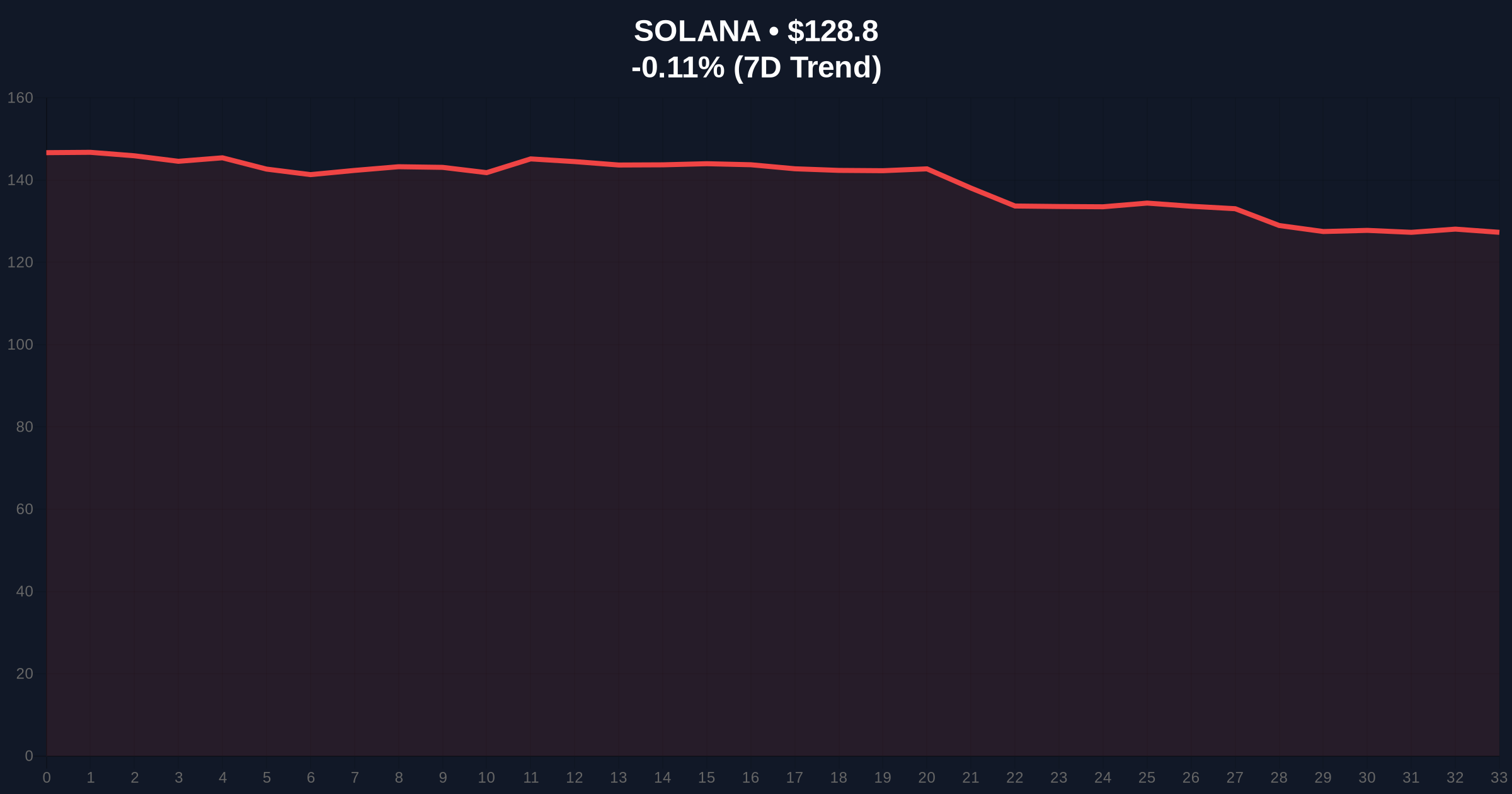

Solana currently trades at $128.8, showing minimal 24-hour movement at -0.11%. Volume profile analysis reveals accumulation between $125.50 and $132.80. The 50-day exponential moving average sits at $134.20, creating immediate resistance. RSI readings at 42 indicate neutral momentum with bearish bias. A Fair Value Gap exists between $122.30 and $125.50 from January's volatility spike. Bullish invalidation: Break below $122.30 Fibonacci support. Bearish invalidation: Sustained close above $134.20 EMA resistance.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Solana Current Price | $128.8 |

| 24-Hour Change | -0.11% |

| Market Rank | #7 |

| Tokenized Assets Launched | 200+ |

| Initial Liquidity Provision | $50M+ |

For institutions, this creates arbitrage opportunities between traditional settlement systems and blockchain-native markets. Retail access to fractional equity positions expands, though regulatory compliance frameworks remain untested. The deployment tests Solana's capacity for institutional-grade settlement, particularly regarding Solana's developer documentation on transaction finality. Market structure suggests capital migration from Ethereum DeFi pools could accelerate if adoption metrics validate the efficiency thesis.

Market analysts note the timing coincides with extreme fear readings. "Deploying during maximum pessimism often captures mispriced liquidity," observed one quantitative researcher. Bulls highlight Solana's sub-second finality versus Ethereum's 12-second block times. Bears question regulatory clarity, referencing ongoing policy debates about developer protections. On-chain data indicates neutral positioning among large holders.

Bullish Case: Successful adoption drives SOL toward $150 resistance. Ondo's expansion validates Solana's institutional roadmap. Capital rotation from competing Layer-1s creates sustained buy pressure. Network activity metrics exceed 4,000 TPS consistently.

Bearish Case: Regulatory intervention triggers liquidation events. SOL breaks $122.30 support, targeting $115. Failed adoption reveals scalability limitations. Market structure deteriorates as fear persists below 30/100.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.