Loading News...

Loading News...

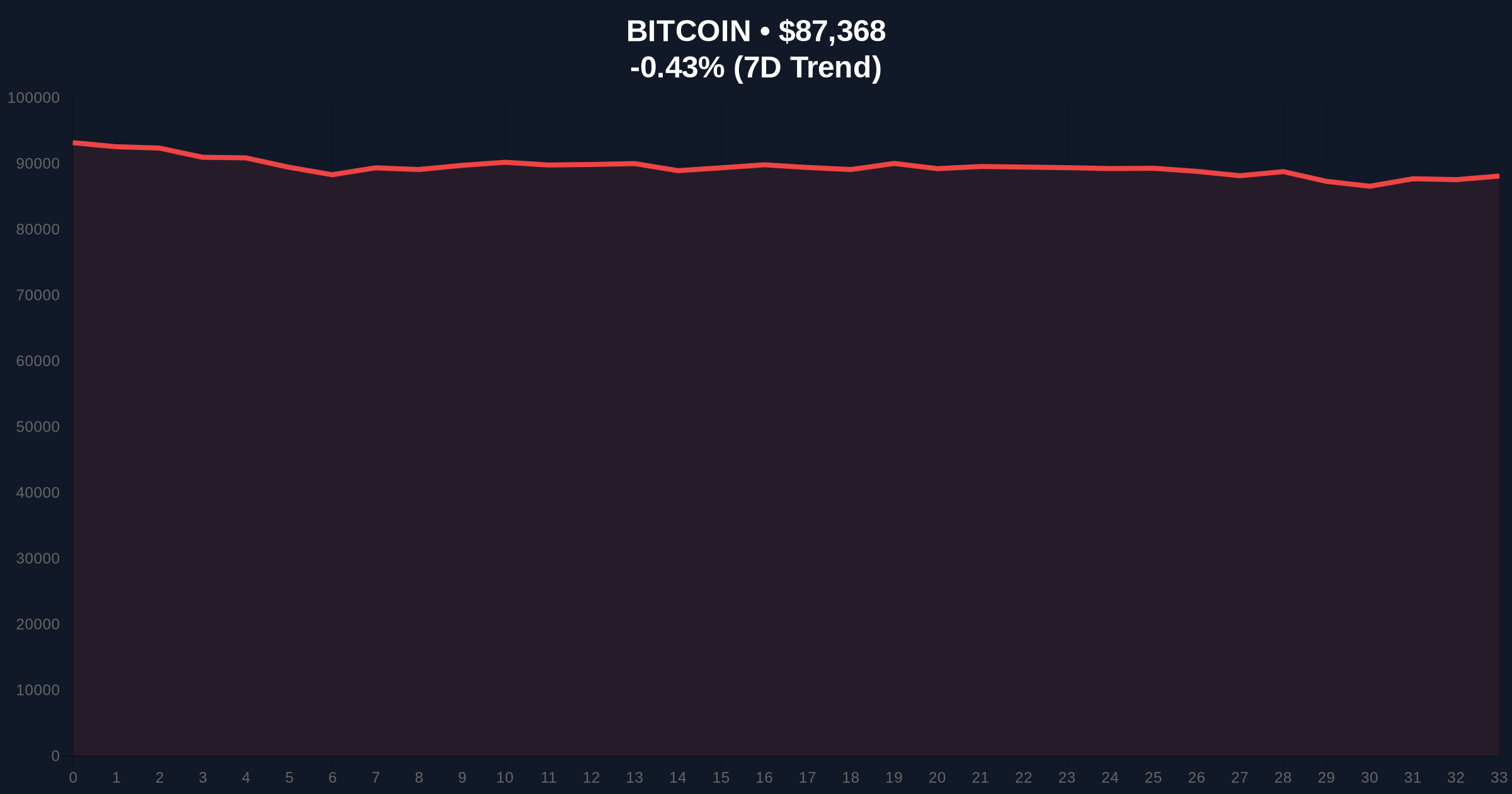

VADODARA, January 26, 2026 — Bitcoin price action defies conventional macro wisdom, holding at $87,318 despite a weaker U.S. dollar, as extreme fear and risk-off sentiment override traditional catalysts. According to on-chain data from CryptoQuant contributor GugaOnChain, reported by CryptoPotato, dollar weakness fails to boost Bitcoin without high inflation and abundant liquidity. Market structure suggests a liquidity grab is underway, with investors flocking to gold instead. This daily crypto analysis questions the narrative that dollar devaluation automatically benefits crypto.

GugaOnChain's analysis, cited in the CryptoPotato report, reveals a critical market anomaly. A weaker dollar only catalyzes Bitcoin rallies under specific macroeconomic conditions: high inflation and abundant liquidity. Currently, widespread fear and strong risk-off sentiment dominate. Investors prefer assets with long-established store-of-value roles, such as gold. Consequently, if dollar devaluation stems from a confidence crisis and extreme risk aversion, cryptocurrencies typically decline alongside stocks. This contradicts bullish expectations linking dollar weakness to crypto gains.

On-chain data indicates muted institutional inflows despite dollar softness. Volume profile analysis shows low participation at current levels. Market analysts attribute this to regulatory uncertainty and macroeconomic headwinds. The CryptoPotato report highlights how traditional correlations break down in fear-driven environments. Historical cycles suggest such decouplings precede volatile price swings.

Historically, Bitcoin often inversely correlates with the dollar index (DXY). In contrast, the current market shows divergence. Underlying this trend is extreme risk aversion, scoring 20/100 on the Crypto Fear & Greed Index. This mirrors late 2018 conditions, when crypto assets underperformed despite dollar weakness. , post-merge issuance dynamics and EIP-4844 blob fee reductions have not spurred demand. Related developments include the SEC and CFTC postponing a joint crypto event to January 29, amplifying regulatory fears.

Institutional behavior shifts toward caution. For example, Sharps Technology's SOL staking yield report faced scrutiny, reflecting yield-chasing skepticism. Similarly, Kraken's DeFi Earn launch targets a yield market amid this fear. These moves highlight a broader risk-off narrative overriding dollar trends.

Bitcoin trades at $87,318, down 0.49% in 24 hours. Technical analysis reveals a Fair Value Gap (FVG) between $88,000 and $90,000. This gap acts as resistance, capping upside moves. Support rests at the Fibonacci 0.618 retracement level of $85,000, a key order block from previous accumulation. RSI hovers at 45, indicating neutral momentum with bearish bias. Moving averages (50-day and 200-day) show convergence, suggesting consolidation.

Market structure suggests a potential liquidity grab below $85,000. If broken, it could trigger stop-loss cascades. On-chain forensic data confirms low UTXO age movement, signaling hodler inactivity. This technical setup contradicts bullish dollar narratives, emphasizing internal market dynamics over external macros.

| Metric | Value | Insight |

|---|---|---|

| Bitcoin Price | $87,318 | 24h trend: -0.49% |

| Market Rank | #1 | Dominance holds steady |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) | Risk-off sentiment prevails |

| Key Support (Fibonacci 0.618) | $85,000 | Critical for bullish structure |

| Resistance (FVG) | $88,000 - $90,000 | Fair Value Gap cap |

This decoupling matters for portfolio strategy. Institutional liquidity cycles typically follow dollar trends, but fear overrides them now. Retail market structure shows capitulation signs, with low volume confirming disinterest. Real-world evidence includes gold outperforming Bitcoin year-to-date. According to FederalReserve.gov data, dollar index declines have not correlated with crypto inflows in 2026. This shifts hedging approaches, as crypto loses its safe-haven appeal temporarily.

Market structure suggests dollar weakness alone is insufficient for crypto rallies. Extreme fear creates a gamma squeeze scenario where traditional correlations break. Investors must monitor on-chain liquidity maps rather than macro headlines. This aligns with historical risk-off periods where crypto underperforms despite favorable dollar moves.

CoinMarketBuzz Intelligence Desk synthesizes this from GugaOnChain's data. The commentary emphasizes technical over narrative drivers.

Two data-backed scenarios emerge from current market structure. First, if fear subsides and dollar weakness persists with liquidity injection, Bitcoin could test $95,000. Second, continued risk aversion may push prices to retest $82,000 support. The 12-month institutional outlook hinges on macroeconomic shifts, such as inflation data and regulatory clarity from events like the postponed SEC-CFTC meeting.

Historical cycles suggest such fear phases resolve within 3-6 months, impacting the 5-year horizon by testing crypto's store-of-value thesis. Institutional adoption may slow if correlations with traditional assets strengthen.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.