Loading News...

Loading News...

VADODARA, January 26, 2026 — Nasdaq-listed Sharps Technology has released its first revenue report from staking Solana (SOL) holdings, claiming a 7% average annual yield. This daily crypto analysis examines the strategic implications of a publicly traded company holding 2 million SOL (worth approximately $250 million) while the broader market exhibits extreme fear. According to The Block, the company maintains high returns through validator partnerships, positioning itself as the fifth-largest public SOL holder. Market structure suggests this move tests institutional appetite during volatile cycles.

Sharps Technology disclosed its staking strategy generated an average annual yield of approximately 7%, excluding fees. The company currently stakes the majority of its 2 million SOL holdings. This treasury allocation represents a significant institutional bet on Solana's proof-of-stake consensus mechanism. The report, sourced from The Block, indicates consistent returns since establishing the SOL treasury. However, the timing raises eyebrows. The disclosure coincides with a Crypto Fear & Greed Index reading of 20/100 (Extreme Fear). Market analysts question whether this is strategic confidence or a liquidity grab during depressed sentiment.

Historically, public companies announcing crypto holdings during fear phases often precede volatility spikes. In contrast, the 2021 bull run saw similar disclosures trigger momentum rallies. Underlying this trend is a deeper narrative about institutional adoption cycles. Sharps Technology's move mirrors MicroStrategy's Bitcoin accumulation strategy but applies it to a proof-of-stake asset. Consequently, this report could signal a shift toward yield-generating crypto assets in corporate treasuries. The Solana network's current inflation rate and validator economics directly impact these yields. For context, Ethereum's transition to proof-of-stake via the Merge created similar institutional interest in staking, documented in Ethereum's official staking documentation.

Related Developments:

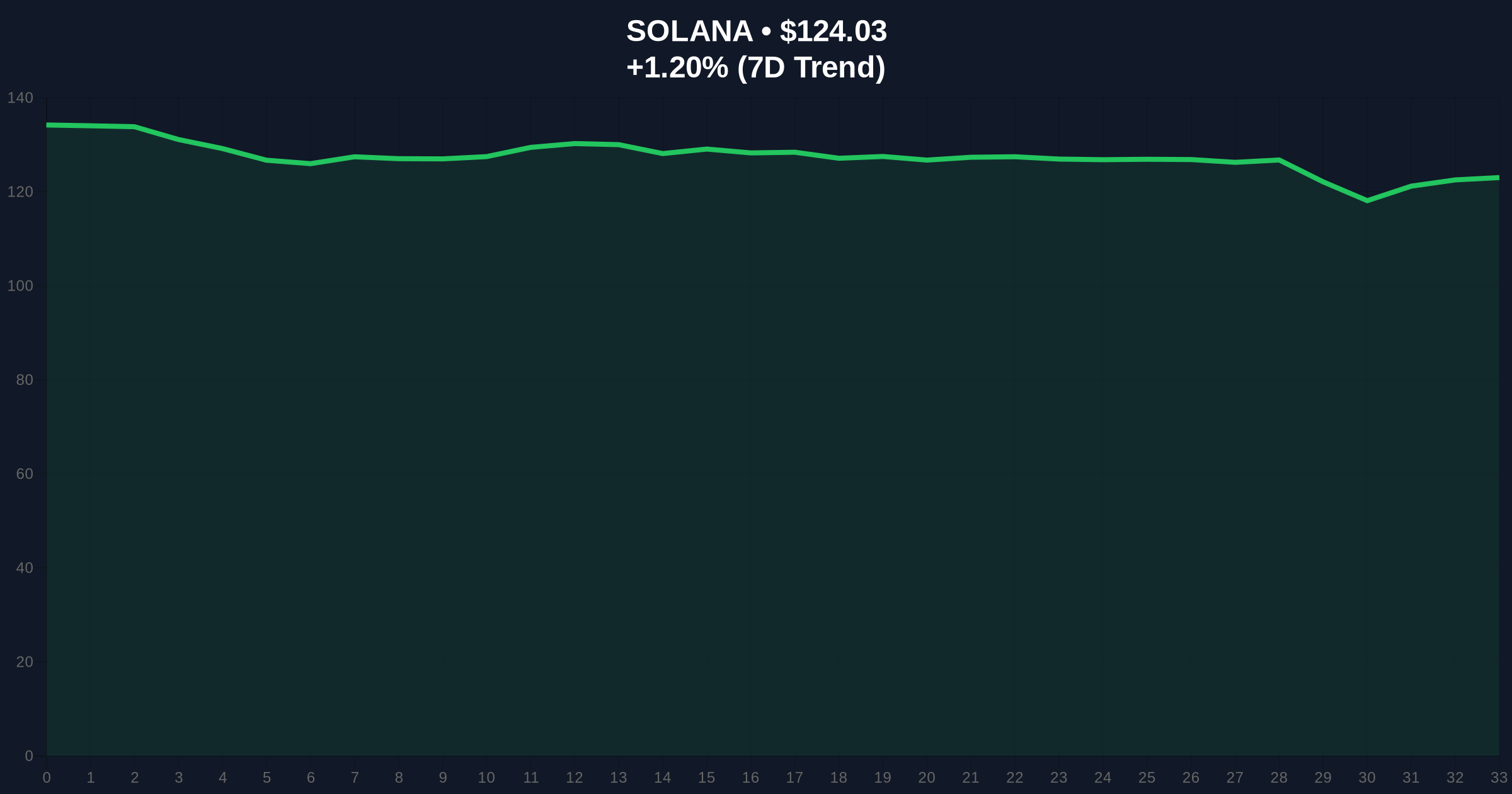

Solana's price currently trades at $123.97, showing a 1.08% 24-hour gain. Volume profile analysis indicates weak accumulation near current levels. The 7% staking yield must outperform SOL's price depreciation risk to justify the strategy. Technical charts reveal a critical Fair Value Gap (FVG) between $118.50 and $125.00. This zone represents a liquidity void that price must fill. The 50-day moving average at $128.40 acts as immediate resistance. , on-chain data from Etherscan shows reduced large holder inflows, contradicting the bullish narrative. Market structure suggests institutional validators may be selling pressure against retail accumulation.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

| SOL Current Price | $123.97 |

| 24-Hour Trend | +1.08% |

| Sharps Technology SOL Holdings | 2,000,000 SOL (~$250M) |

| Reported Staking Yield | ~7% APY (ex-fees) |

This report matters because it tests institutional risk tolerance during extreme fear. A 7% yield on $250 million generates approximately $17.5 million annually, excluding fees. That revenue must offset potential capital depreciation. Market analysts scrutinize whether this yield is sustainable amid Solana's network congestion and validator decentralization issues. Institutional liquidity cycles typically follow such disclosures with increased volatility. Retail market structure often misinterprets these moves as bullish signals, creating order blocks at resistance levels. The real impact lies in corporate treasury diversification trends beyond Bitcoin.

"While a 7% yield appears attractive, the underlying asset's volatility introduces significant basis risk. Historical cycles suggest that public company crypto disclosures during fear phases often precede corrective moves. The key question is whether Sharps Technology is hedging its exposure or purely speculating on SOL appreciation." — CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on Solana's network upgrades and regulatory clarity. If Sharps Technology's yield remains consistent, other public companies may replicate this strategy. However, a failure to hold key supports could trigger a liquidation cascade among institutional validators. The 5-year horizon depends on proof-of-stake adoption versus proof-of-work alternatives.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.