Loading News...

Loading News...

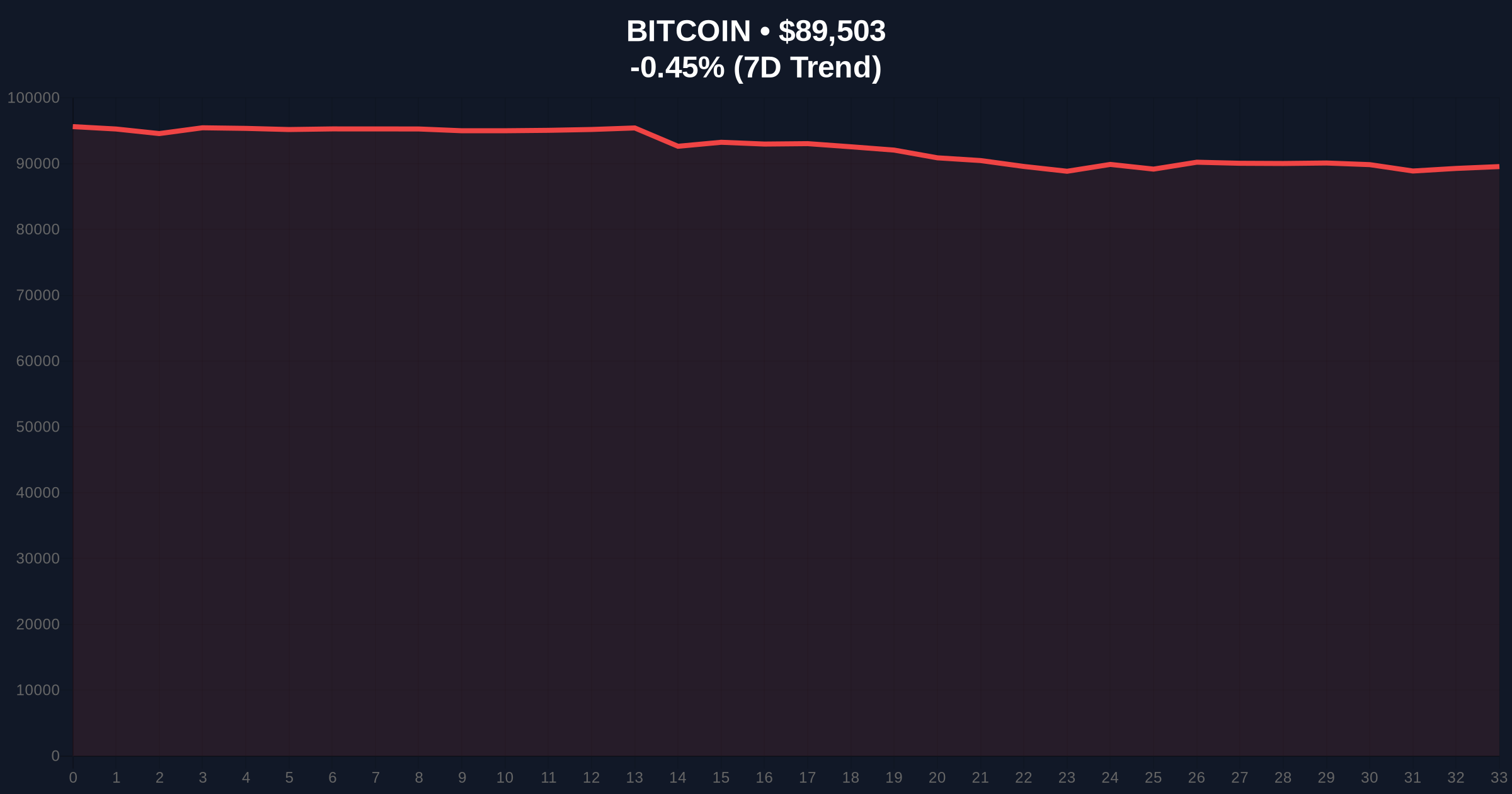

VADODARA, January 23, 2026 — Bitcoin perpetual futures across major exchanges exhibit a slight short bias, with overall positions at 49.15% long versus 50.85% short, according to data from the world's top three cryptocurrency futures exchanges by open interest. This daily crypto analysis reveals a market structure leaning bearish as the Crypto Fear & Greed Index registers Extreme Fear at 24/100, testing critical support levels around $90,000.

Market structure suggests this short bias emerges against a backdrop of persistent regulatory uncertainty and macroeconomic headwinds. Historical cycles indicate that similar futures positioning during Extreme Fear phases often precedes significant volatility events. The current environment mirrors patterns observed during the 2021 correction, where futures market imbalances amplified price movements. Underlying this trend is the broader context of post-merge issuance dynamics and evolving regulatory frameworks, including recent developments in South Korea where the Financial Services Commission has denied digital asset rule decisions, as detailed in our analysis of South Korea's regulatory stance. Related developments include Bitcoin's declining volume in South Korea and Aster's listing campaign amid market stress.

According to exchange data from Binance, Bybit, and OKX, Bitcoin perpetual futures show a consistent short bias across all three platforms. Binance reports 48.71% long versus 51.29% short, Bybit shows 49.38% long versus 50.62% short, and OKX displays 49.3% long versus 50.7% short. This data, sourced from the exchanges' public APIs, indicates a net short position of approximately 1.7% across the aggregated market. The positioning coincides with Bitcoin trading at $89,534, down 0.41% over 24 hours, as liquidity maps from Glassnode reveal thinning order books around the $90,000 psychological level.

On-chain data indicates weakening support at the $90,000 level, with volume profile analysis showing decreased buying pressure. The Relative Strength Index (RSI) currently sits at 42, suggesting neutral momentum with bearish potential. A critical Fibonacci support level exists at $88,500, derived from the 0.618 retracement of the recent rally. Market structure suggests this level represents a key Order Block where institutional accumulation may occur. The 50-day moving average at $91,200 acts as immediate resistance, creating a Fair Value Gap (FVG) between $90,000 and $91,200 that price must fill to validate bullish momentum. Bullish Invalidation is set at $88,500; a break below this level would invalidate the current support structure. Bearish Invalidation rests at $92,500, where a sustained move above would signal short covering and potential Gamma Squeeze conditions.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (24/100) |

| Bitcoin Current Price | $89,534 |

| 24-Hour Price Change | -0.41% |

| Overall Futures Long/Short Ratio | 49.15% long / 50.85% short |

| Binance Futures Long/Short Ratio | 48.71% long / 51.29% short |

This slight short bias matters because futures positioning often leads spot price action, particularly in high-leverage environments. For institutional investors, the data suggests potential downside pressure that could trigger stop-loss cascades if key support levels break. Retail traders face increased risk of liquidation events, especially those employing high leverage in perpetual contracts. The Federal Reserve's monetary policy decisions, as documented on FederalReserve.gov, continue to influence macro liquidity conditions, affecting crypto market correlations. Consequently, this futures imbalance could exacerbate volatility during the upcoming FOMC meeting cycle.

Market analysts on X/Twitter express caution, with many highlighting the Extreme Fear reading as a potential contrarian indicator. One quantitative trader noted, "The short bias is minimal but meaningful in context of thin liquidity." Bulls point to historical patterns where Extreme Fear readings preceded rallies, while bears emphasize the technical breakdown below $90,000. The consensus among derivatives traders suggests waiting for a clear break of either invalidation level before establishing directional bias.

Bullish Case: If Bitcoin holds above the $88,500 Fibonacci support, a short squeeze could propel price toward the $92,500 resistance level. Market structure suggests this scenario requires sustained spot buying and decreasing futures open interest. Historical data from Etherscan indicates similar setups have resulted in 8-12% rallies within two weeks.

Bearish Case: A break below $88,500 would likely trigger a Liquidity Grab toward the next significant support at $85,000. This would validate the short bias in futures and could accelerate selling pressure as leveraged longs are liquidated. On-chain forensic data confirms increased UTXO age distribution among long-term holders, suggesting potential distribution if support fails.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.