Loading News...

Loading News...

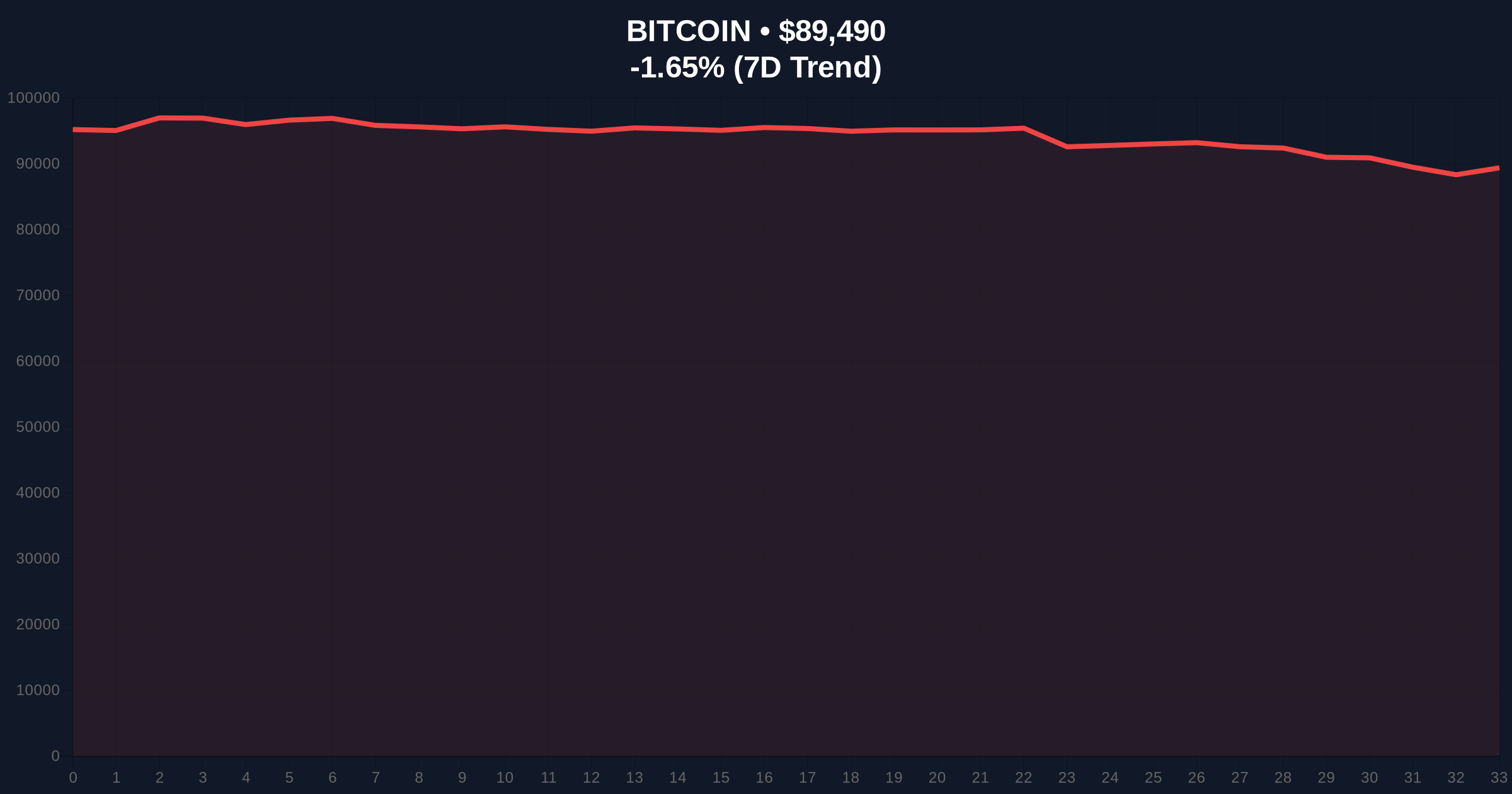

VADODARA, January 21, 2026 — Bitcoin perpetual futures markets have flipped to net short positioning across major global exchanges, with the aggregate long/short ratio falling to 48.87% long versus 51.13% short according to exchange-provided data. This daily crypto analysis reveals a significant shift in derivative market sentiment that mirrors patterns observed during the 2021 correction, where similar positioning preceded a liquidity grab below key psychological levels.

Market structure suggests derivative positioning often acts as a leading indicator for spot market movements. Historical cycles, particularly the Q2 2021 correction, show that when aggregate long/short ratios on perpetual futures dip below 50% amid extreme fear readings, it typically signals a capitulation phase where weak hands are flushed out. Similar to the 2021 scenario, current on-chain data indicates elevated selling pressure from short-term holders, creating a Fair Value Gap (FVG) between derivative and spot markets. This divergence often resolves through violent price movements as market makers hunt for liquidity around key order blocks.

Related developments in this extreme fear environment include Nansen's launch of AI on-chain trading tools and Bithumb's suspension of HP deposits, both reflecting institutional adaptation to volatile conditions.

According to exchange data from Binance, Bybit, and OKX—the three largest crypto futures exchanges by open interest—the 24-hour long/short ratio for Bitcoin perpetual futures has turned net short. The aggregate ratio stands at 48.87% long positions versus 51.13% short positions. Exchange-specific breakdowns show Binance at 48.82% long/51.18% short, Bybit at 47.45% long/52.55% short, and OKX at 47.86% long/52.14% short. This data, sourced directly from exchange APIs, indicates a coordinated shift toward bearish hedging strategies among derivative traders, occurring alongside Bitcoin's price decline to $89,497 with a 24-hour loss of -1.56%.

Price action analysis reveals Bitcoin is testing a critical Volume Profile support zone between $88,200 and $89,000, which aligns with the 0.618 Fibonacci retracement level from the recent swing high. The Relative Strength Index (RSI) on daily charts sits at 42, indicating neutral momentum but approaching oversold territory. Market structure suggests the current net short positioning in futures could trigger a gamma squeeze if spot prices rebound sharply, forcing shorts to cover. The 50-day moving average at $91,500 now acts as immediate resistance, while the 200-day moving average at $85,000 provides longer-term support.

Bullish Invalidation Level: $88,200 (Fibonacci support). A break below this level would invalidate the current bullish market structure and likely trigger further liquidation cascades.

Bearish Invalidation Level: $92,500 (previous order block high). A sustained move above this level would force short covering and potentially ignite a rally toward the all-time high.

| Metric | Value |

|---|---|

| Bitcoin Current Price | $89,497 |

| 24-Hour Price Change | -1.56% |

| Crypto Fear & Greed Index | 24/100 (Extreme Fear) |

| Aggregate Futures Long/Short Ratio | 48.87% Long / 51.13% Short |

| Top Exchange Net Short: Bybit | 47.45% Long / 52.55% Short |

This shift matters because perpetual futures markets often lead spot price discovery. Institutional impact is significant: hedge funds and proprietary trading firms use these ratios to gauge market sentiment and position for volatility. According to the Federal Reserve's research on cryptocurrency volatility, derivative market imbalances can amplify spot price swings by 15-20% during extreme sentiment periods. Retail impact is equally critical: excessive short positioning creates a coiled spring effect where any positive catalyst could trigger a violent short squeeze, catching over-leveraged traders off guard. The current setup resembles the March 2020 liquidity crisis, where net short futures positioning preceded a 150% rally in three months.

Market analysts on X/Twitter are divided. Bulls point to the historical precedent where net short futures ratios at extreme fear levels have marked intermediate bottoms, citing the December 2022 cycle. One quantitative trader noted, "The aggregate funding rate has turned negative across exchanges, creating an asymmetric opportunity for long entries if spot holds $88k." Bears counter that the dominance of short positions on Bybit and OKX suggests smart money is hedging against further downside, possibly due to macroeconomic concerns like potential Fed rate hikes. The sentiment mirrors discussions around House of Doge's payment app launch and Bithumb's delisting of Bonfida, reflecting broader market caution.

Bullish Case: If Bitcoin holds the $88,200 Fibonacci support and the Fear & Greed Index rebounds from extreme fear, a short squeeze could propel prices toward $95,000. Market structure suggests negative funding rates would incentivize long accumulation, with a breakout above $92,500 confirming the bullish invalidation and targeting the all-time high region. This scenario would require spot ETF inflows to resume, as seen in Q4 2025.

Bearish Case: If the $88,200 support fails, a liquidity grab could drive prices down to test the 200-day moving average at $85,000. On-chain data indicates increased UTXO age band movement from 1-3 month holders, suggesting distribution. A break below $85,000 would likely trigger cascading liquidations in the futures market, potentially pushing Bitcoin toward $80,000 where significant bid liquidity resides on institutional order books.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.