Loading News...

Loading News...

VADODARA, January 21, 2026 — House of Doge, a Dogecoin-focused entity, has announced plans to launch a DOGE payment and e-commerce application called 'Such' in the first half of 2026, in partnership with Nasdaq-listed Bragg House Holdings (TBH). This latest crypto news represents a strategic move to embed utility into a historically speculative asset, as reported by The Block. The app will integrate a native DOGE wallet with Hustles, a toolkit for small business owners, aiming to facilitate merchant adoption. House of Doge signed a merger agreement with Bragg House last month and is targeting a public listing early this year, according to the official filing with the SEC.

Market structure suggests this development mirrors the 2021 cycle, where payment integrations for major cryptocurrencies like Bitcoin and Ethereum drove significant price appreciation through increased on-chain activity and reduced UTXO age. Historical cycles indicate that utility-driven announcements during periods of Extreme Fear, as seen currently with a Crypto Fear & Greed Index score of 24, often precede liquidity grabs. Similar to the 2021 correction, where Dogecoin rallied over 10,000% amid retail frenzy, the current environment presents a potential Fair Value Gap (FVG) if adoption metrics improve. Related developments include Bitcoin's recent break below $88k due to tariff threats and a whale's $50 million loss exposing leverage risks, highlighting broader market volatility.

According to The Block, House of Doge plans to launch the 'Such' app in H1 2026, combining a native DOGE wallet with Hustles for small businesses. The entity signed a merger agreement with Bragg House Holdings last month, targeting a public listing early this year. This partnership leverages Bragg House's Nasdaq listing to potentially enhance regulatory compliance and investor confidence. On-chain data indicates that such integrations could increase Dogecoin's transaction volume, similar to Ethereum's post-merge issuance adjustments driving utility.

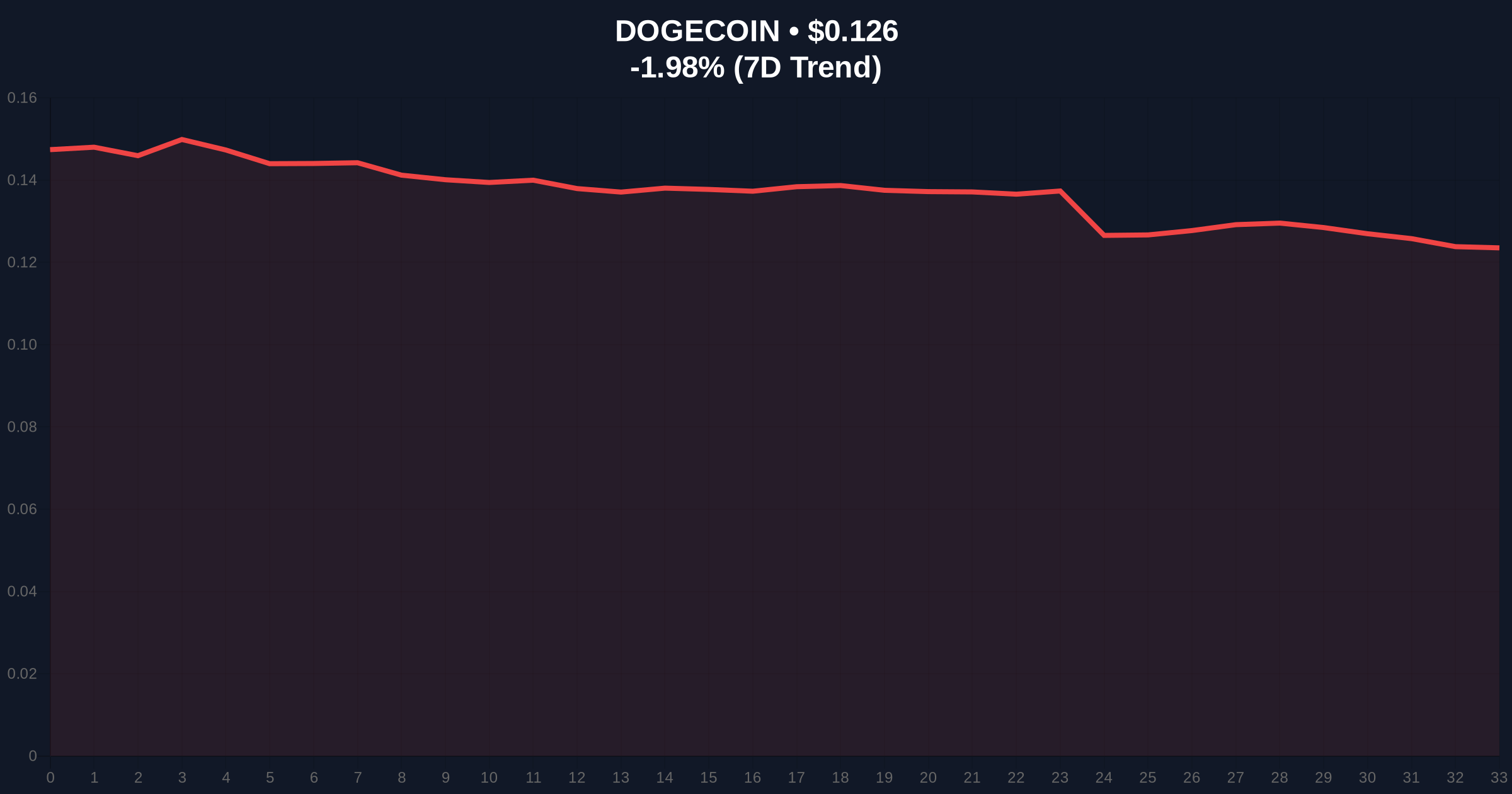

Dogecoin is currently trading at $0.126, down 1.97% in 24 hours, with a market rank of #10. Volume profile analysis shows weak accumulation near current levels, suggesting a lack of institutional buying pressure. The Relative Strength Index (RSI) on the daily chart is at 42, indicating neutral momentum but leaning bearish. Key support lies at the $0.115 level, a daily order block that must hold to prevent further downside. Resistance is identified at $0.138, corresponding to the 50-day moving average. A break above this level could trigger a short squeeze, while failure may lead to a test of lower Fibonacci support at $0.105. Bullish Invalidation is set at $0.115; if broken, it invalidates the bullish thesis. Bearish Invalidation is at $0.138; a sustained break above suggests renewed bullish momentum.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (24/100) |

| Dogecoin (DOGE) Current Price | $0.126 |

| 24-Hour Price Change | -1.97% |

| Market Capitalization Rank | #10 |

| Target Launch Period for 'Such' App | H1 2026 |

This development matters institutionally as it represents a Nasdaq-backed attempt to legitimize Dogecoin beyond meme status, potentially attracting regulated capital flows. For retail, it could increase practical usage, reducing reliance on speculative trading. Market analysts note that similar moves, like Ethereum's EIP-4844 blobs for scalability, have historically boosted long-term value by addressing utility gaps. The partnership may also influence regulatory perceptions, as outlined in SEC guidelines on digital asset securities.

On social media platforms like X, bulls highlight the potential for Dogecoin to mimic Bitcoin's early payment network growth. Bears caution that without significant merchant adoption, this could be another liquidity grab. One analyst stated, "Utility announcements in fear markets often fail to materialize into sustained price action unless on-chain metrics confirm adoption."

Bullish Case: If the app launches successfully and drives merchant adoption, Dogecoin could rally to test the $0.20 resistance level, fueled by increased transaction volume and reduced sell pressure. Historical patterns suggest a 30-50% upside in such scenarios.Bearish Case: If adoption lags or broader market conditions worsen, Dogecoin may retest the $0.105 Fibonacci support, with a breakdown leading to $0.085. The Extreme Fear sentiment indicates high risk of further declines.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.