Loading News...

Loading News...

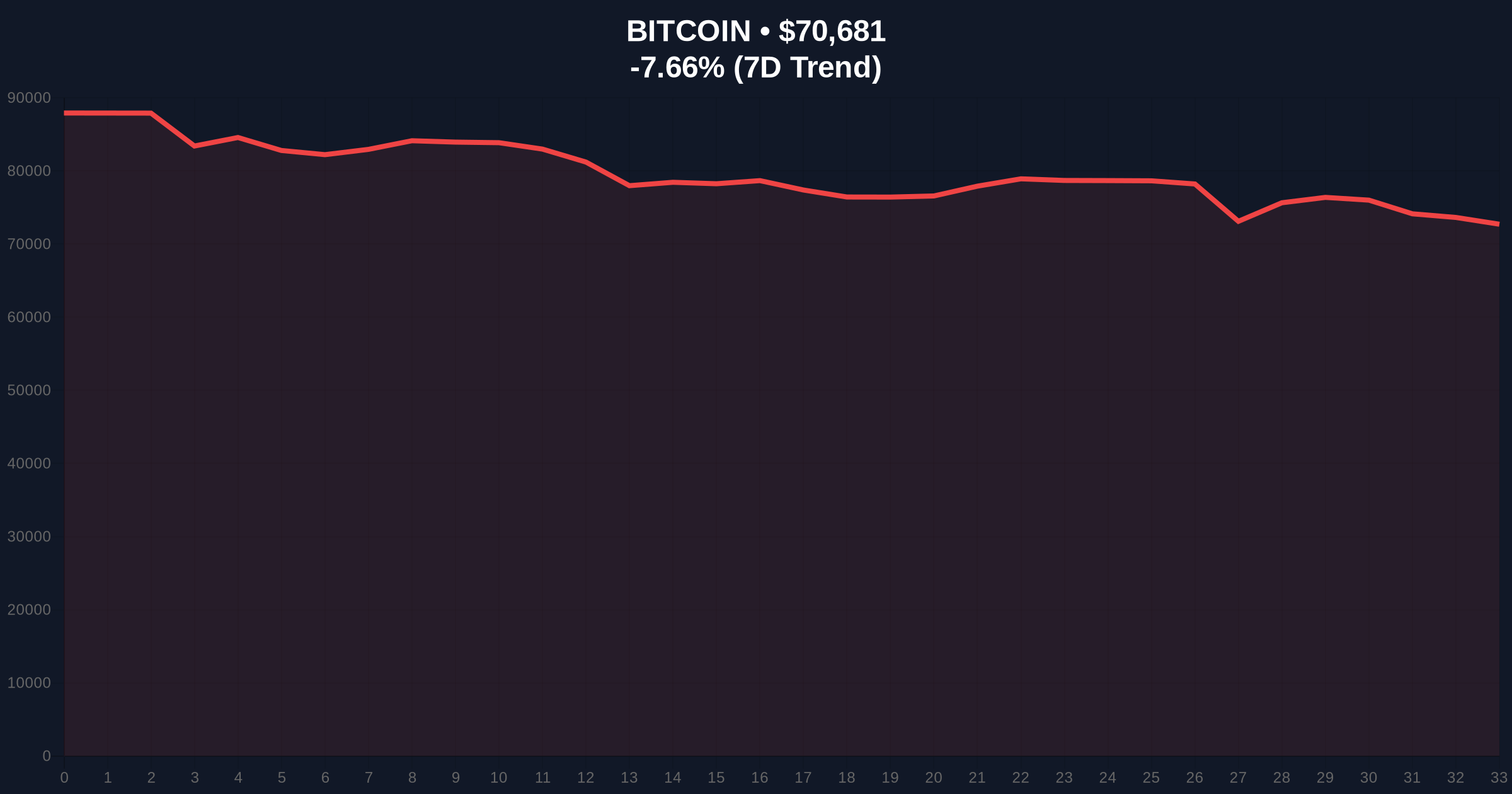

VADODARA, February 5, 2026 — U.S. Bitcoin spot ETFs recorded a net outflow of $545.34 million on February 4, marking the second consecutive day of institutional withdrawals. According to data compiled by TraderT, no single ETF saw inflows, with BlackRock's IBIT leading losses at -$373.83 million. This latest crypto news highlights a sharp sentiment shift as Bitcoin trades at $70,838, down 7.46% in 24 hours amid extreme market fear.

TraderT's compiled data reveals a systematic withdrawal across all major U.S. Bitcoin spot ETFs. BlackRock's IBIT experienced the largest outflow at -$373.83 million, followed by Fidelity's FBTC at -$86.44 million. Ark Invest's ARKB lost $31.72 million, while Franklin Templeton's EZBC and VanEck's HODL saw outflows of $6.38 million and $5.20 million, respectively. Grayscale's GBTC, often a volatility indicator, recorded -$41.77 million in outflows. This coordinated move suggests institutional rebalancing rather than retail panic.

Historically, consecutive ETF outflows of this magnitude mirror the liquidity drains seen in Q4 2021. That period preceded a 50% correction in Bitcoin's price. In contrast, the 2023-2024 bull run saw consistent inflows, supporting prices above $60,000. Underlying this trend, the current extreme fear score of 12/100 matches levels last observed during the FTX collapse. Market structure suggests this is a classic liquidity grab, where large players exit positions to trigger stop-losses below key supports.

Related developments include Bitcoin futures showing a bearish skew and analysts predicting a final bull run within three years amid macro shifts.

Bitcoin's price action reveals a critical Fair Value Gap (FVG) between $72,000 and $74,000. This zone acted as a previous order block during the January rally. Currently, the price has broken below the 50-day moving average at $71,500. On-chain data from Glassnode indicates increased UTXO (Unspent Transaction Output) movement from older wallets, signaling distribution. The Fibonacci 0.618 retracement level from the 2024 low sits at $68,500, a key support. A break below this level would invalidate the bullish structure established in Q4 2025.

| Metric | Value | Source |

|---|---|---|

| Total ETF Net Outflow (Feb 4) | $545.34M | TraderT |

| Bitcoin Current Price | $70,838 | Live Market Data |

| 24-Hour Price Change | -7.46% | Live Market Data |

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Live Market Data |

| Largest Single ETF Outflow (IBIT) | -$373.83M | TraderT |

This event matters because ETF flows directly impact Bitcoin's liquidity profile. Institutional withdrawals reduce buying pressure, exacerbating downside volatility. According to the SEC's official filings, ETF holdings represent over 5% of Bitcoin's circulating supply. A sustained outflow could trigger a gamma squeeze in derivatives markets, as seen in March 2024. Retail market structure is fragile, with many leveraged positions clustered near $70,000. Consequently, a break below support could cascade into a broader sell-off.

"The $545 million outflow is a clear signal of institutional risk-off behavior. Historical cycles suggest such moves often precede a retest of major supports, like the $68,500 Fibonacci level. We are watching for a volume profile shift to confirm whether this is a short-term correction or a trend reversal." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on current data. The bullish scenario requires holding the $68,500 support and reclaiming the $72,000 FVG. The bearish scenario involves a break below $68,500, targeting the next support at $65,000. Historical patterns indicate that extreme fear readings often precede sharp reversals, but only if buying volume returns.

For the 12-month outlook, institutional adoption cycles suggest that ETF outflows may normalize if macroeconomic conditions stabilize. The 5-year horizon remains positive due to Bitcoin's fixed supply and increasing regulatory clarity, as seen in developments like South Korea's insurance institute accepting stablecoins.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.