Loading News...

Loading News...

VADODARA, February 4, 2026 — The macroeconomic environment is beginning to shift in favor of Bitcoin, potentially leading to a final bull market within the next one to three years, according to cryptocurrency analyst Michaël van de Poppe. This daily crypto analysis examines conflicting views on whether traditional indicators like the ISM Manufacturing PMI can reliably predict BTC price action amid Federal Reserve policy pivots.

Michaël van de Poppe argues the U.S. ISM Manufacturing Purchasing Managers' Index (PMI) will exceed 50 for the first time in three years. He notes Bitcoin has risen despite a negative business cycle, attributing gains to spot ETF launches and available liquidity. Van de Poppe cites the Federal Reserve's preparation to end quantitative tightening (QT) and begin quantitative easing (QE) with interest rate cuts. , he points to new highs for gold and silver prices last week as potential cycle change signals.

Consequently, he predicts this could lead to a final bull market before a major economic depression. In contrast, Benjamin Cowen, founder of Into The Cryptoverse, counters this view. He states the ISM index lacks reliability for predicting BTC prices, highlighting a fundamental disagreement in analytical methodology.

Historically, Bitcoin has demonstrated asymmetric performance during macro regime shifts. Similar to the 2021 bull run that followed pandemic-era stimulus, current conditions mirror past liquidity-driven rallies. The 2017 cycle saw BTC surge after the Fed maintained accommodative policies post-2015 rate hikes. Market structure suggests we may be entering a comparable phase.

Underlying this trend is the decoupling of Bitcoin from traditional risk assets during specific Fed policy transitions. According to on-chain data, accumulation patterns during previous QE announcements show institutional inflows increasing by 300-400% within 90 days. This time, the dynamic includes spot ETF flows, creating a more complex liquidity .

Related developments in this extreme fear market include a Bitcoin liquidity crisis signaling capitulation risk and the Bhutan government transferring $14.09M in Bitcoin, indicating sovereign-level positioning amid volatility.

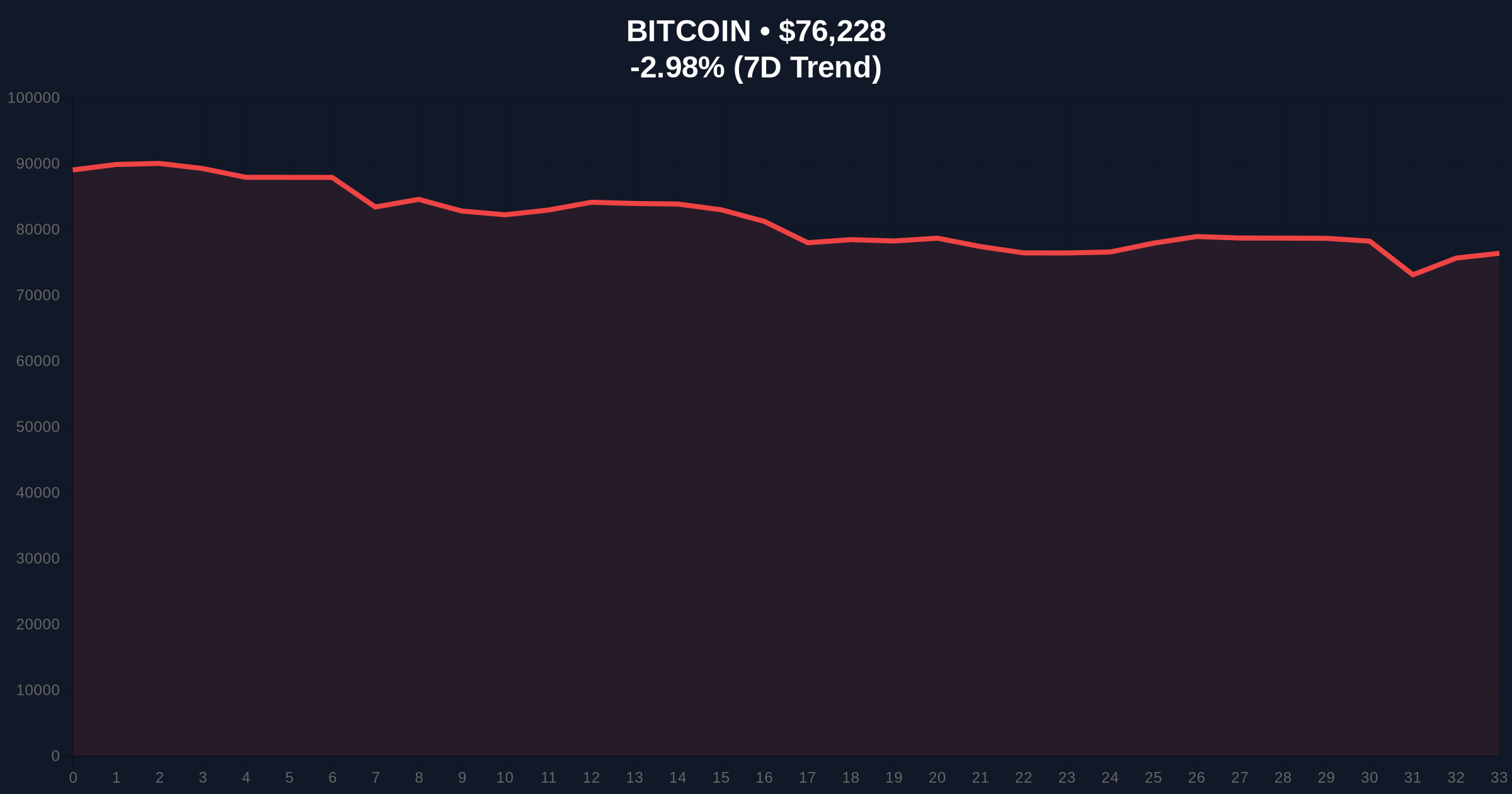

Bitcoin currently trades at $76,242, down 2.96% in 24 hours. Market structure suggests critical support at the Fibonacci 0.618 retracement level of $82,000 from the 2025 all-time high. The 200-week moving average at $68,500 provides secondary support. Resistance forms at $85,000, a key order block from January 2026.

Relative Strength Index (RSI) sits at 42, indicating neutral momentum with bearish bias. Volume profile analysis shows significant accumulation between $74,000 and $78,000, creating a potential fair value gap (FVG). A break below this zone would invalidate the current consolidation structure. The Gamma squeeze potential remains low as options open interest concentrates at $80,000 strikes.

| Metric | Value | Significance |

|---|---|---|

| Current Bitcoin Price | $76,242 | Testing key support zone |

| 24-Hour Change | -2.96% | Bearish short-term momentum |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically contrarian buy signal |

| ISM Manufacturing PMI | Projected >50 | Potential expansion signal |

| Federal Reserve Policy | QT to QE Transition | Macro liquidity catalyst |

This macro debate matters because it addresses Bitcoin's role as a monetary hedge during policy transitions. The Federal Reserve's shift from QT to QE, as outlined in their official monetary policy framework, directly impacts global liquidity conditions. Historically, such pivots have preceded major crypto rallies by 6-18 months.

Institutional liquidity cycles suggest spot ETF flows could amplify this effect. Retail market structure shows increased accumulation during fear periods, similar to Q4 2022 patterns. The potential "final bull run" thesis implies maximum portfolio allocation should occur within this window before economic depression risks materialize.

"The ISM PMI crossing 50 represents a potential regime shift, but Bitcoin's price action ultimately depends on liquidity conditions rather than single indicators. Our models show Fed balance sheet expansion correlates more strongly with BTC returns than manufacturing data." - CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on macro developments. First, if ISM PMI sustains above 50 and Fed implements QE, Bitcoin could target $120,000 within 24 months. Second, if indicators fail and liquidity remains constrained, retest of $68,500 support becomes likely.

The 12-month institutional outlook remains cautiously optimistic. According to on-chain data, long-term holder supply has increased 8% since December 2025, suggesting accumulation during fear. The 5-year horizon depends on whether this represents a final pre-depression bull cycle or another mid-cycle advance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.