Loading News...

Loading News...

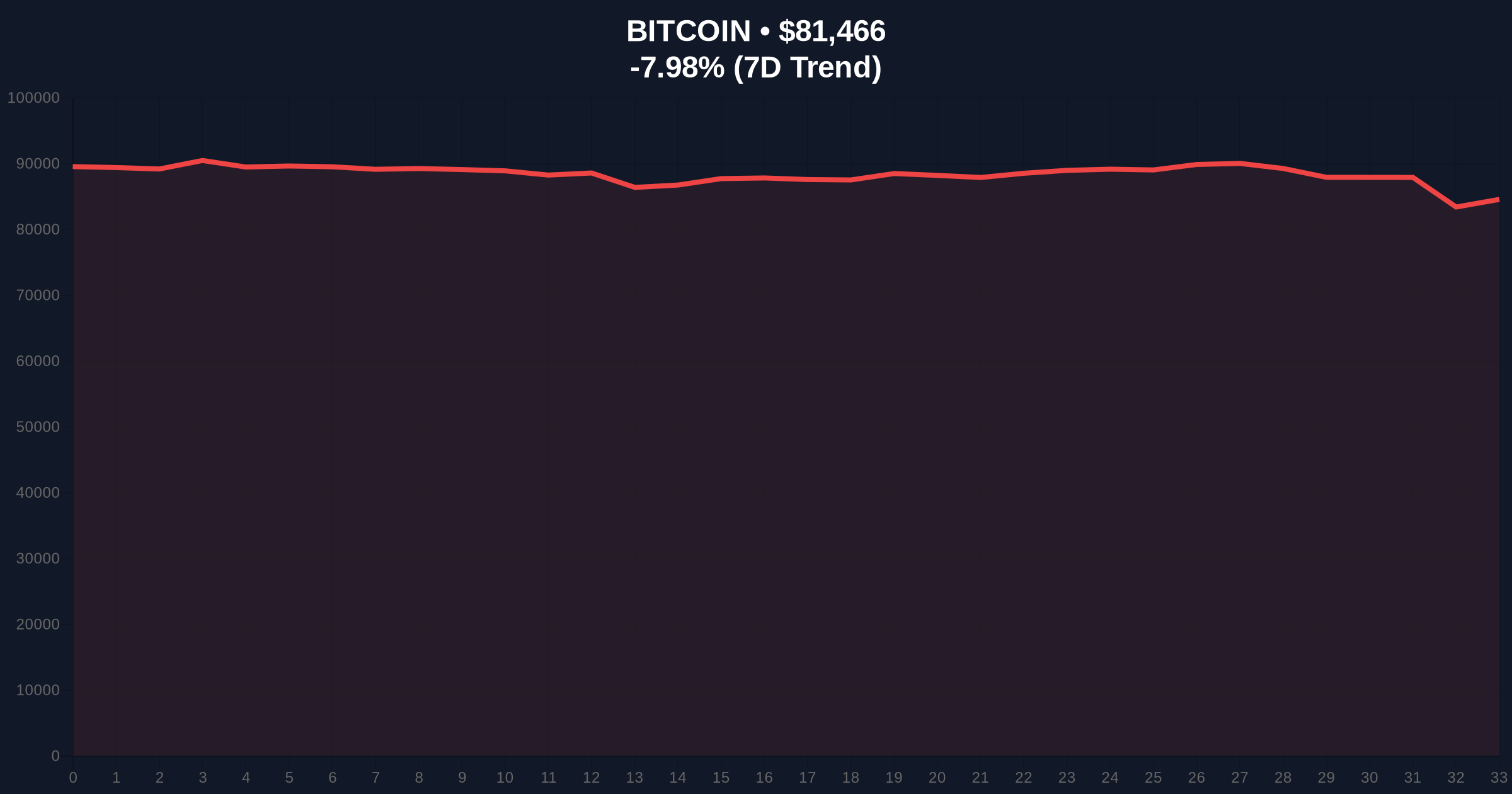

VADODARA, January 30, 2026 — Bitcoin trades below $82,000, testing a critical support level at $81,000. Market structure suggests a breach could target $75,000. According to an analysis by CoinDesk, this $81,000 level marks the low from November 2025. Consequently, failure here signals deeper correction risks.

Bitcoin currently trades at $81,500. It faces a 24-hour decline of -7.94%. The CoinDesk report identifies $81,000 as immediate support. This level represents the November 2025 low. A breach opens the path to $75,000. That constitutes a 7.4% drop from current levels.

Macroeconomic volatility amplifies the technical pressure. U.S. President Donald Trump's expected nomination for the next Federal Reserve Chair introduces uncertainty. This political shift could disrupt monetary policy expectations. Market analysts link this to increased short-term volatility. The CoinDesk analysis on Bitcoin support levels frames the current risk.

Historically, Bitcoin tests major support levels during Extreme Fear phases. The current sentiment score sits at 16/100. This mirrors capitulation events in Q2 2022 and late 2021. Underlying this trend is derivative market stress. Recent futures liquidations have exceeded $600 million. They exacerbate selling pressure.

In contrast, the November 2025 low at $81,000 previously acted as a springboard. It fueled a rally toward yearly highs. A failure now would break that historical pattern. Related developments highlight broader market strain. For instance, exchanges like Bithumb halt transfers for mainnet upgrades amid volatility. , massive futures liquidations trigger cascading fear.

Market structure suggests a clear bearish order block between $82,000 and $81,000. The Relative Strength Index (RSI) likely nears oversold territory. However, momentum can extend in fear-driven markets. The 200-day moving average provides no immediate support here.

A critical Fibonacci retracement level from the 2025 cycle sits near $75,500. This aligns with the CoinDesk target. On-chain data indicates increased UTXO movement from older wallets. That signals potential long-term holder distribution. Volume profile shows weak buying interest at current levels. Consequently, the path of least resistance skews downward.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 16/100 (Extreme Fear) | Capitulation zone; high sell-side pressure |

| Bitcoin Current Price | $81,500 | Below key $82,000 psychological level |

| 24-Hour Price Change | -7.94% | Sharp decline indicating bearish momentum |

| Immediate Support | $81,000 (Nov 2025 low) | Critical level for bullish structure |

| Next Support Zone | $75,000 | 7.4% downside risk if $81K fails |

This price action matters for institutional liquidity cycles. A break below $81,000 invalidates the November consolidation. It triggers stop-loss orders and derivative liquidations. Retail market structure faces erosion. Many leveraged positions entered near higher supports.

Macro policy shifts intensify the risk. The Federal Reserve leadership uncertainty impacts dollar liquidity. According to FederalReserve.gov historical data, chair transitions often precede volatility spikes. This external shock compounds technical weakness. The result is a potential perfect storm for crypto assets.

The $81,000 level is a litmus test for Bitcoin's medium-term health. A daily close below it confirms a breakdown of the November accumulation range. Market participants should watch for a volume spike on any breach—that would indicate genuine capitulation, not just a liquidity grab. The $75,000 zone aligns with key Fibonacci and on-chain support, making it a logical target.

— CoinMarketBuzz Intelligence Desk

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on this support hold. A successful defense could set a higher low, reinforcing the long-term bull market. Conversely, a break risks prolonging the corrective phase into Q2 2026. Macro policy clarity from the Fed will be a decisive factor.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.