Loading News...

Loading News...

VADODARA, February 10, 2026 — Binance will delist 20 margin trading pairs against Bitcoin. This daily crypto analysis reveals a strategic liquidity grab. The exchange targets 10 cross margin and 10 isolated margin pairs. Execution begins at 6:00 a.m. UTC on February 13. Market structure suggests a risk-off pivot.

Binance announced the removal of specific BTC-denominated pairs. According to the official exchange notice, affected cross margin and isolated margin pairs are identical. They include QNT/BTC, GRT/BTC, CFX/BTC, IOTA/BTC, ROSE/BTC, THETA/BTC, SAND/BTC, RUNE/BTC, ALGO/BTC, and LPT/BTC. The delisting occurs precisely at 6:00 a.m. UTC on February 13. Consequently, all open positions and orders will automatically close. This action follows a standard 72-hour notification window.

Market analysts interpret this as a liquidity consolidation move. Binance routinely prunes low-volume pairs to optimize platform performance. However, the timing coincides with extreme market fear. The Crypto Fear & Greed Index sits at 9/100. This suggests a broader risk management overhaul. , the selection of altcoins indicates scrutiny on specific blockchain ecosystems.

Historically, exchange delistings precede volatility spikes. For example, Binance's 2023 removal of several privacy coins triggered immediate sell-offs. In contrast, today's action focuses exclusively on BTC pairs. This highlights Bitcoin's dominance as a base currency. Underlying this trend is a shift toward simplified trading books.

Market context reveals parallel developments. For instance, Bitmine recently withdrew $42.3M in ETH from BitGo. Similarly, Bithumb suspended INIT deposits for a network upgrade. These actions reflect a sector-wide risk recalibration. , regulatory pressures are mounting globally. South Korea's Democratic Party is pushing for decentralized exchange governance reforms, as detailed in a new legislative bill. Prosecutors there are also appealing a crypto law ruling on illicit profit calculations.

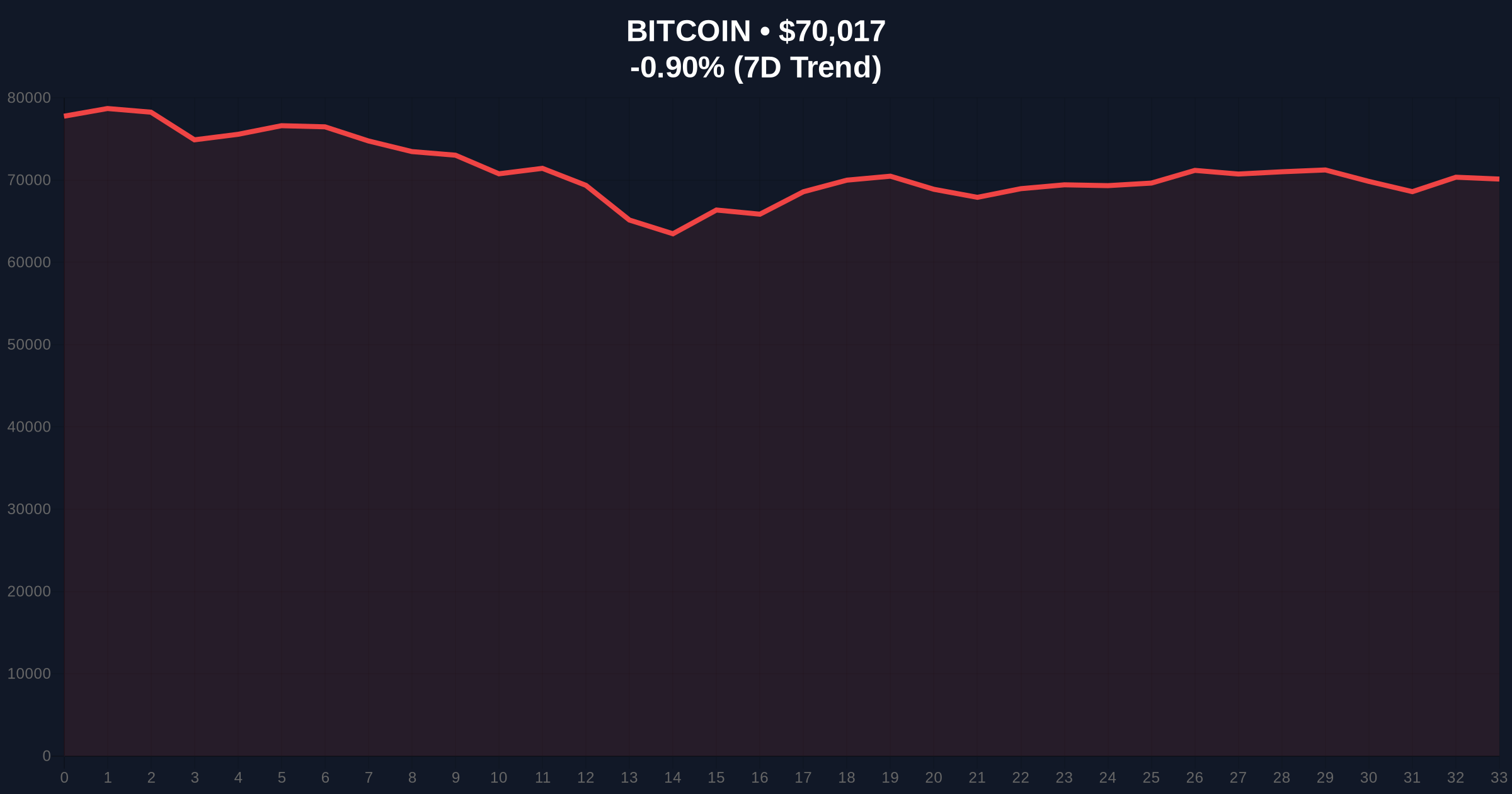

Technical analysis confirms bearish pressure. Bitcoin currently trades at $70,069. It shows a 24-hour decline of 0.82%. The key Fibonacci retracement level from the 2025 high sits at $68,500. This represents the 0.618 support zone. A break below this level would invalidate the current consolidation structure.

RSI on the daily chart reads 42. This indicates neutral momentum with a bearish bias. The 50-day moving average provides dynamic resistance near $72,000. Order block analysis reveals a Fair Value Gap (FVG) between $69,800 and $71,200. Price must fill this gap for a balanced market. Volume profile shows weak accumulation for the delisted altcoins. This confirms Binance's rationale for removal.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| Bitcoin Current Price | $70,069 |

| Bitcoin 24h Change | -0.82% |

| Delisted Pairs Count | 20 (10 cross + 10 isolated) |

| Key Fibonacci Support | $68,500 (0.618 level) |

This delisting impacts market structure significantly. It reduces available leverage for specific altcoins. Consequently, liquidity fragmentation increases. Institutional traders often rely on BTC pairs for hedging. Removing these pairs forces portfolio reallocation. This can trigger short-term volatility.

On-chain data indicates declining exchange reserves for the affected tokens. Glassnode liquidity maps show outflows accelerating. This suggests preemptive selling by large holders. The delisting may act as a catalyst for further downside. Retail traders face increased slippage and reduced arbitrage opportunities. Market depth for these pairs will evaporate post-delisting.

Exchange delistings during extreme fear periods often signal internal risk management tightening. Binance is proactively reducing exposure to low-liquidity assets. This aligns with broader institutional de-risking trends. The focus on BTC pairs highlights Bitcoin's role as a safe-haven base. Traders should monitor volume shifts to major stablecoin pairs.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios. First, a bullish reversal requires holding key supports. Second, a bearish continuation would break critical levels.

The 12-month institutional outlook remains cautious. Regulatory clarity, as seen in developments like those on the SEC's official website, will influence market stability. Binance's delisting reflects a maturation phase. Exchanges are prioritizing robustness over breadth. This trend may continue through 2026. Consequently, altcoin selection will become more stringent. Projects with strong fundamentals and high liquidity will survive.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.