Loading News...

Loading News...

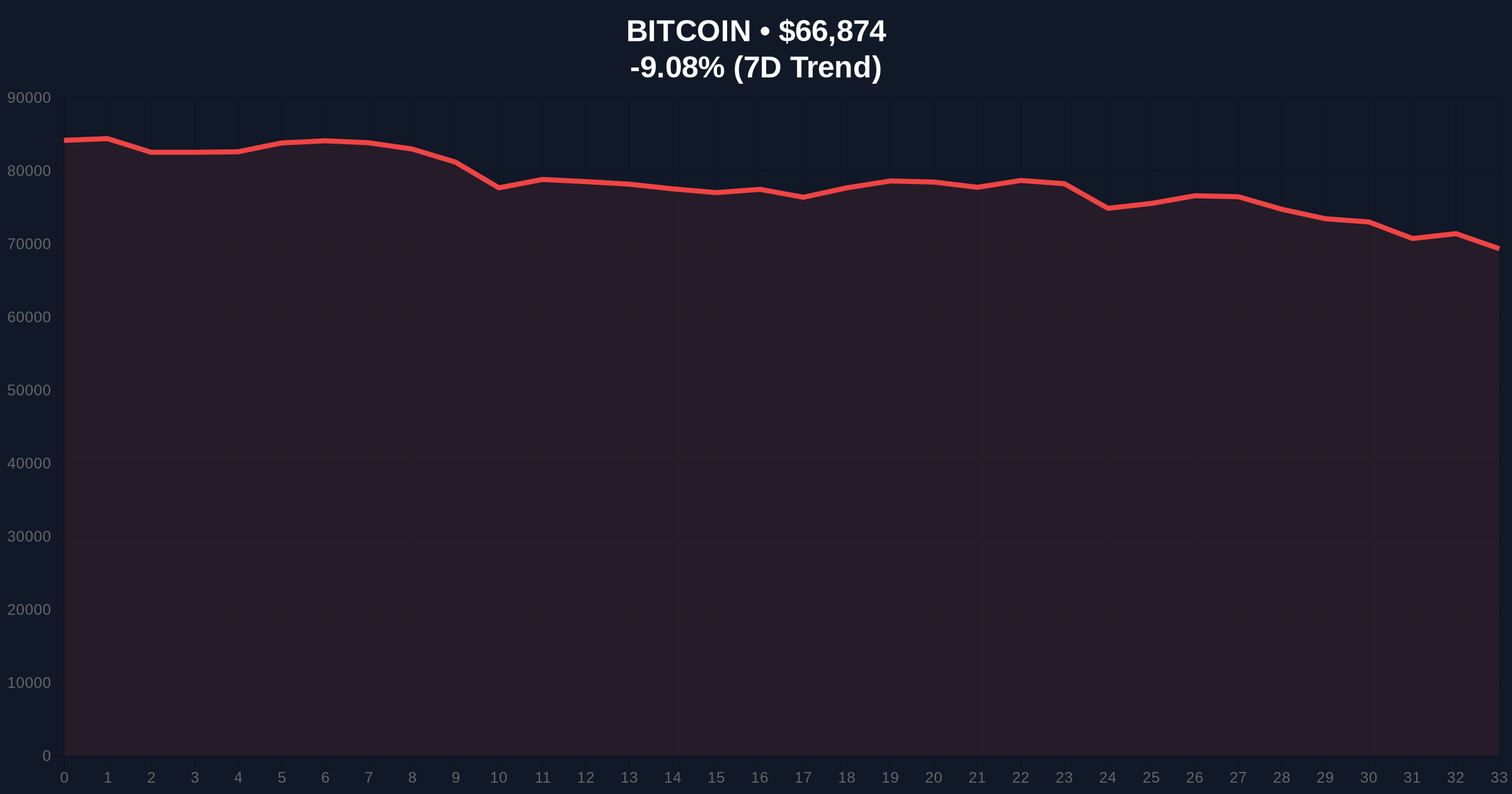

VADODARA, February 5, 2026 — Legendary hedge fund manager Bill Miller estimates Bitcoin's bottom at approximately $60,000, according to his recent statement on X. This latest crypto news arrives as Bitcoin trades at $66,907 amid extreme fear sentiment. Miller anchors his projection to mining costs and on-chain profitability metrics. Market structure suggests this estimate faces immediate technical challenges.

Bill Miller, CIO of Miller Value Partners, publicly stated his Bitcoin bottom estimate on February 5, 2026. He bases this $60,000 projection on two primary factors. First, this level approximates Bitcoin's mining cost. Second, it represents where on-chain addresses in profit and loss reach equilibrium. Miller referenced historical bottoms forming in similar ranges. He previously predicted Bitcoin would set a new all-time high this year.

According to on-chain data from Glassnode, address profitability metrics show increasing pressure. The statement provides a clear psychological level for institutional traders. Market analysts now scrutinize whether current price action validates this estimate. The immediate 9.04% decline challenges the thesis.

Historically, Bitcoin bottoms correlate with miner capitulation events. The 2018 cycle saw bottoms form near production costs. In contrast, the 2022 bottom occurred significantly below estimated mining costs. This discrepancy raises questions about Miller's mining cost anchor. Underlying this trend is increasing hash rate efficiency post the Ethereum merge, which redirected mining hardware to Bitcoin.

Extreme fear sentiment currently scores 12/100. This mirrors December 2022 levels when Bitcoin bottomed at $15,500. Consequently, sentiment alone provides insufficient confirmation. Related developments include Bitmain's substantial Ethereum losses and Russia's Sovcombank launching Bitcoin-collateralized loans. These events reflect institutional adaptation during volatility.

Bitcoin currently trades at $66,907. The price sits 9.04% below yesterday's level. Technical analysis reveals critical support at the $65,000 psychological level. This aligns with the 0.618 Fibonacci retracement from the 2025 high. A break below $65,000 would expose Miller's $60,000 target.

Market structure suggests a potential Fair Value Gap (FVG) between $68,500 and $70,200. This gap represents unfilled buy orders from rapid selling. The Relative Strength Index (RSI) approaches oversold territory at 32. However, oversold conditions can persist during capitulation. The 200-day moving average provides dynamic support near $62,000.

| Metric | Value | Context |

|---|---|---|

| Crypto Fear & Greed Index | 12/100 (Extreme Fear) | Matches December 2022 bottom sentiment |

| Bitcoin Current Price | $66,907 | -9.04% 24h change |

| Miller's Bottom Estimate | $60,000 | Based on mining costs & on-chain metrics |

| Distance to Estimate | -10.3% | Requires further decline to reach target |

| Market Rank | #1 | Dominance at 54.2% |

Miller's estimate matters for institutional liquidity cycles. Large funds use such projections for position sizing. If $60,000 holds, it creates a strong support zone for accumulation. Retail market structure often clusters around these psychological levels. This can create self-fulfilling prophecies during high volatility.

On-chain data indicates increasing UTXO age bands among long-term holders. These investors typically resist selling near perceived bottoms. The equilibrium of profitable and unprofitable addresses suggests potential seller exhaustion. However, miner revenue pressure could accelerate selling below production costs.

"Miller's $60K estimate provides a clear framework, but market mechanics often defy clean narratives. The critical test is whether on-chain support clusters materialize at that level. Current order flow shows more sell pressure than typical bottom formations." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure. The bullish scenario requires holding above $65,000 and filling the FVG. The bearish scenario involves breaking $65,000 and testing $60,000. Institutional outlook over 12 months remains cautiously optimistic despite short-term pressure.

The 5-year horizon suggests Bitcoin's network fundamentals strengthen through adoption cycles. However, short-term price discovery depends on liquidity flows and macroeconomic conditions. The Federal Reserve's interest rate decisions will significantly impact risk asset correlations.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.