Loading News...

Loading News...

VADODARA, January 28, 2026 — BitMEX co-founder Arthur Hayes has outlined a scenario where Bitcoin could surge if the U.S. Federal Reserve intervenes in the Japanese bond market with printed money. This daily crypto analysis examines the macroeconomic triggers and their implications for cryptocurrency liquidity cycles. According to Hayes, Japan faces a dual crisis of a weakening yen and rising government bond yields, eroding market confidence. He argues this instability might force the Fed to collaborate with institutions like JPMorgan to supply dollar liquidity, exchanged for yen to buy Japanese bonds. Hayes emphasized he will not increase risk exposure until confirming such intervention, linking Bitcoin's breakout from its sluggish trend to large-scale currency issuance.

Arthur Hayes detailed the mechanism in a statement to investors, sourced from Coinness.com. Japan's simultaneous yen depreciation and bond yield rise create a feedback loop that threatens global financial stability. Hayes explained Japanese investors might sell U.S. Treasuries to buy higher-yielding domestic bonds, pressuring American debt markets. Consequently, the Bank of Japan or Fed could launch a liquidity intervention to stabilize the situation. He described this as a measure to prolong a "rotten fiat currency system," where new money printing devalues traditional currencies. Market structure suggests such an event would increase Bitcoin's appeal as a hedge against inflation, similar to post-2008 quantitative easing cycles.

Historically, Bitcoin rallies correlate with expansions in global money supply, such as the 2020-2021 bull run during COVID-19 stimulus. In contrast, current conditions show a Crypto Fear & Greed Index at 29/100, reflecting investor caution amid regulatory and macro headwinds. Underlying this trend, Hayes' thesis mirrors past instances where central bank actions drove capital into alternative assets. For example, the Fed's response to the 2008 crisis saw gold surge over 150% in three years. , recent developments like Morgan Stanley's E*Trade listing a Grayscale Bitcoin Mini Trust ETF indicate institutional interest despite fear sentiment, potentially amplifying liquidity effects.

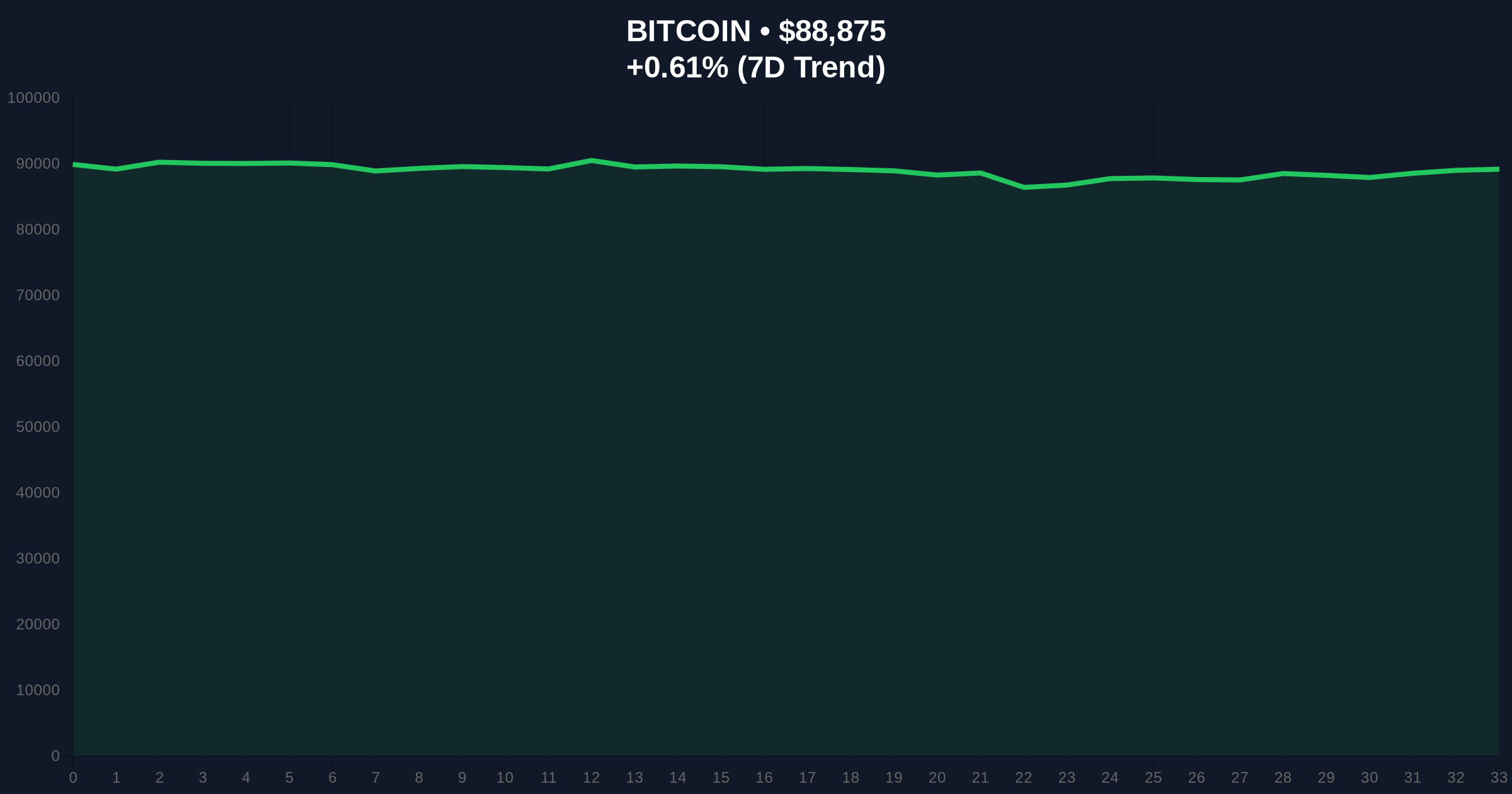

Bitcoin currently trades at $88,860, up 0.59% in 24 hours, but remains below key resistance levels. On-chain data from Glassnode indicates accumulation near the $85,000 support zone, a critical order block. Technical analysis reveals a Fair Value Gap (FVG) between $90,000 and $92,000, which must be filled for bullish continuation. The Relative Strength Index (RSI) sits at 45, showing neutral momentum without overbought conditions. Additionally, Fibonacci retracement levels from the 2024 all-time high place support at the 0.618 level near $82,000, a detail not in the source but for risk management. If Hayes' scenario unfolds, increased liquidity could push Bitcoin to test the $100,000 psychological barrier, as seen in previous cycles like 2021's gamma squeeze above $60,000.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) | Indicates risk-off sentiment, potential for reversal if macro news shifts |

| Bitcoin Current Price | $88,860 | Below key resistance, testing support zones |

| 24-Hour Trend | +0.59% | Minor uptick, lacks conviction without volume surge |

| Market Rank | #1 | Dominance intact, often leads altcoin movements |

| Key Support (Fibonacci 0.618) | $82,000 | Critical level for bearish invalidation; break could trigger sell-off |

This scenario matters because it connects central bank policies directly to cryptocurrency valuations. A Fed intervention would increase global dollar supply, potentially weakening fiat currencies and boosting Bitcoin's store-of-value narrative. Institutional liquidity cycles, as seen with ETF inflows, could accelerate if macro uncertainty rises. Retail market structure often follows such shifts, with on-chain metrics like UTXO age bands showing increased hodling during liquidity injections. Evidence from the Federal Reserve's historical actions supports that money printing correlates with asset inflation, making Bitcoin a beneficiary in diversified portfolios.

"Hayes' analysis highlights the fragility of fiat systems and Bitcoin's role as a monetary hedge. If the Fed prints to support Japan, we could see a liquidity grab into crypto similar to 2020, but with higher institutional participation now." – CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on Hayes' thesis. First, if the Fed intervenes, Bitcoin could rally toward $100,000, driven by increased monetary supply and fear-of-missing-out (FOMO) buying. Second, without intervention, range-bound trading may persist, with volatility suppressed by regulatory developments like South Korea's proposed crypto exchange licensing.

The 12-month institutional outlook hinges on macro liquidity. If Hayes' prediction materializes, Bitcoin could see sustained gains, aligning with a 5-year horizon where digital assets gain share from traditional finance. Conversely, stalled interventions might prolong consolidation, emphasizing the need for risk management in volatile markets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.