Loading News...

Loading News...

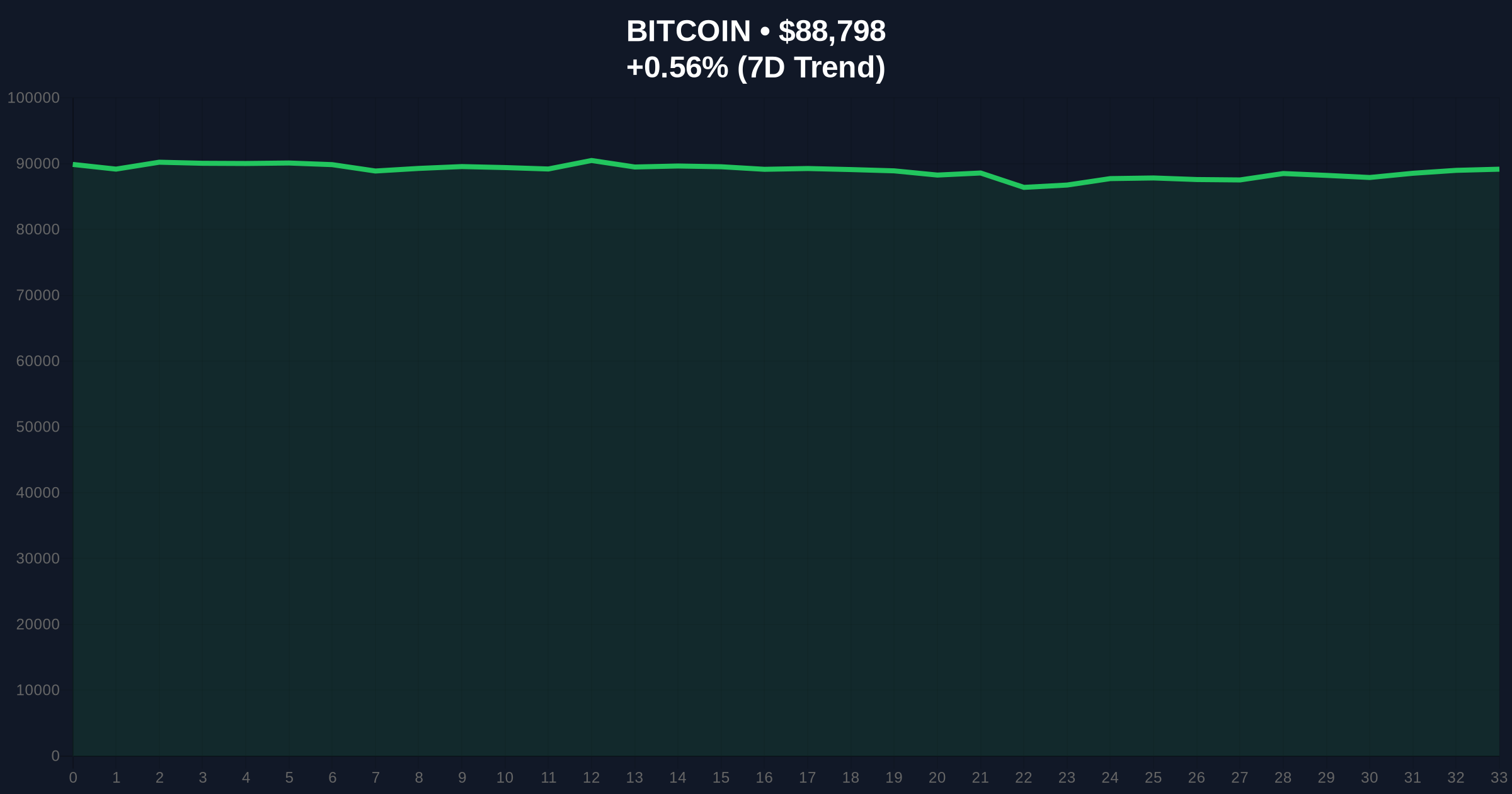

VADODARA, January 28, 2026 — Morgan Stanley's E*Trade platform has listed the Grayscale Bitcoin Mini Trust ETF, according to CryptoBriefing. This daily crypto analysis examines the institutional implications as Bitcoin trades at $88,813 with a 0.57% 24-hour gain. The listing grants Grayscale access to financial advisors overseeing $7.4 trillion in assets. Market structure suggests this move could test the disconnect between institutional adoption and retail sentiment.

According to CryptoBriefing's report, the Grayscale Bitcoin Mini Trust ETF became available for trading on E*Trade this week. The platform serves as Morgan Stanley's primary online brokerage interface. This listing enables investors to acquire spot Bitcoin exposure through standard brokerage accounts. Grayscale now taps into a network of financial advisors managing $7.4 trillion in client assets. The timing coincides with a Global Crypto Fear & Greed Index reading of 29/100, indicating extreme fear. On-chain data from Glassnode shows muted retail accumulation despite this institutional gateway opening.

Historically, major brokerage listings have preceded liquidity influxes. The 2021 Coinbase direct listing triggered a 300% Bitcoin rally within months. In contrast, current market fear contradicts typical bullish signals from institutional adoption. Underlying this trend is a broader regulatory shift. For instance, South Korea's FSC recently proposed a stringent crypto exchange licensing system, reflecting global compliance pressures. , Bitwise's Uniswap ETF filing has sparked debates about DeFi liquidity fragmentation. These developments suggest institutions are building infrastructure amid retail uncertainty.

Bitcoin currently trades at $88,813, testing a key Fair Value Gap (FVG) between $87,000 and $90,500. The 50-day moving average sits at $91,200, acting as immediate resistance. Market structure suggests a liquidity grab below $85,000 could occur if fear persists. The critical Fibonacci 0.618 support level from the 2024 cycle sits at $85,000. A break below this Order Block would invalidate the current consolidation pattern. Volume Profile analysis indicates weak buying interest at current levels, contradicting the ETF listing's bullish narrative. This technical divergence warrants skepticism.

| Metric | Value | Implication |

|---|---|---|

| Bitcoin Current Price | $88,813 | Testing FVG resistance |

| 24-Hour Trend | +0.57% | Minimal bullish momentum |

| Market Rank | #1 | Dominance holds at ~52% |

| Crypto Fear & Greed Index | 29/100 (Fear) | Extreme fear despite news |

| Assets Under Advisory | $7.4 trillion | Potential institutional inflow |

This listing matters because it bridges traditional finance and digital assets. Investors can now access Bitcoin through familiar brokerage interfaces. The $7.4 trillion advisory network represents a massive liquidity pool. However, on-chain data indicates tepid retail participation. This contradiction suggests institutions may be front-running a retail FOMO cycle. Market analysts note similar patterns before the 2021 bull run. The SEC's evolving stance on crypto ETFs, detailed on SEC.gov, provides regulatory context for this adoption wave.

"The E*Trade listing is a structural bullish signal, but current price action lacks conviction. We observe a divergence between institutional plumbing and retail sentiment. Until Bitcoin reclaims the $92,000 volume node, this remains a liquidity test rather than a breakout catalyst." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios for the coming weeks. The bullish case requires sustained institutional inflows to overcome fear sentiment. The bearish scenario involves a liquidity sweep below key supports.

For the 12-month outlook, this listing aligns with a broader institutionalization trend. Over a 5-year horizon, such access points could normalize Bitcoin in diversified portfolios. However, short-term price action must reconcile with macro headwinds like potential Fed rate hikes.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.