Loading News...

Loading News...

VADODARA, February 9, 2026 — Whale Alert reported a transfer of 276,856,986 USDT from Binance to an unknown wallet, valued at approximately $277 million. This latest crypto news highlights significant institutional activity during extreme fear market conditions, with the Crypto Fear & Greed Index at 14/100. Market structure suggests this move may signal liquidity repositioning ahead of potential volatility.

According to Whale Alert data, the transaction occurred on February 9, 2026. It involved 276,856,986 USDT moving from Binance to an unidentified wallet. The transfer's value equates to roughly $277 million. On-chain forensic data confirms the transaction's size and timing. This event represents one of the largest single USDT movements in recent weeks.

Market analysts note the unknown destination wallet adds opacity. Consequently, speculation centers on institutional custody or private fund management. The transaction's sheer scale suggests a strategic rather than retail-driven action. , it occurred amid a broader market downturn, with BNB down 1.41% in 24 hours.

Historically, large stablecoin movements precede significant price action. Similar to the 2021 correction, whale transfers often signal liquidity shifts. In contrast, the current extreme fear environment amplifies their impact. Underlying this trend is a pattern of institutional capital reallocation during volatility.

This event mirrors past cycles where stablecoin outflows from exchanges preceded rallies. For instance, in Q4 2023, large USDT transfers correlated with Bitcoin's surge above $60,000. Market structure now shows parallels, albeit in a fear-dominated . The transfer may indicate accumulation or risk management ahead of macroeconomic events.

Related Developments:

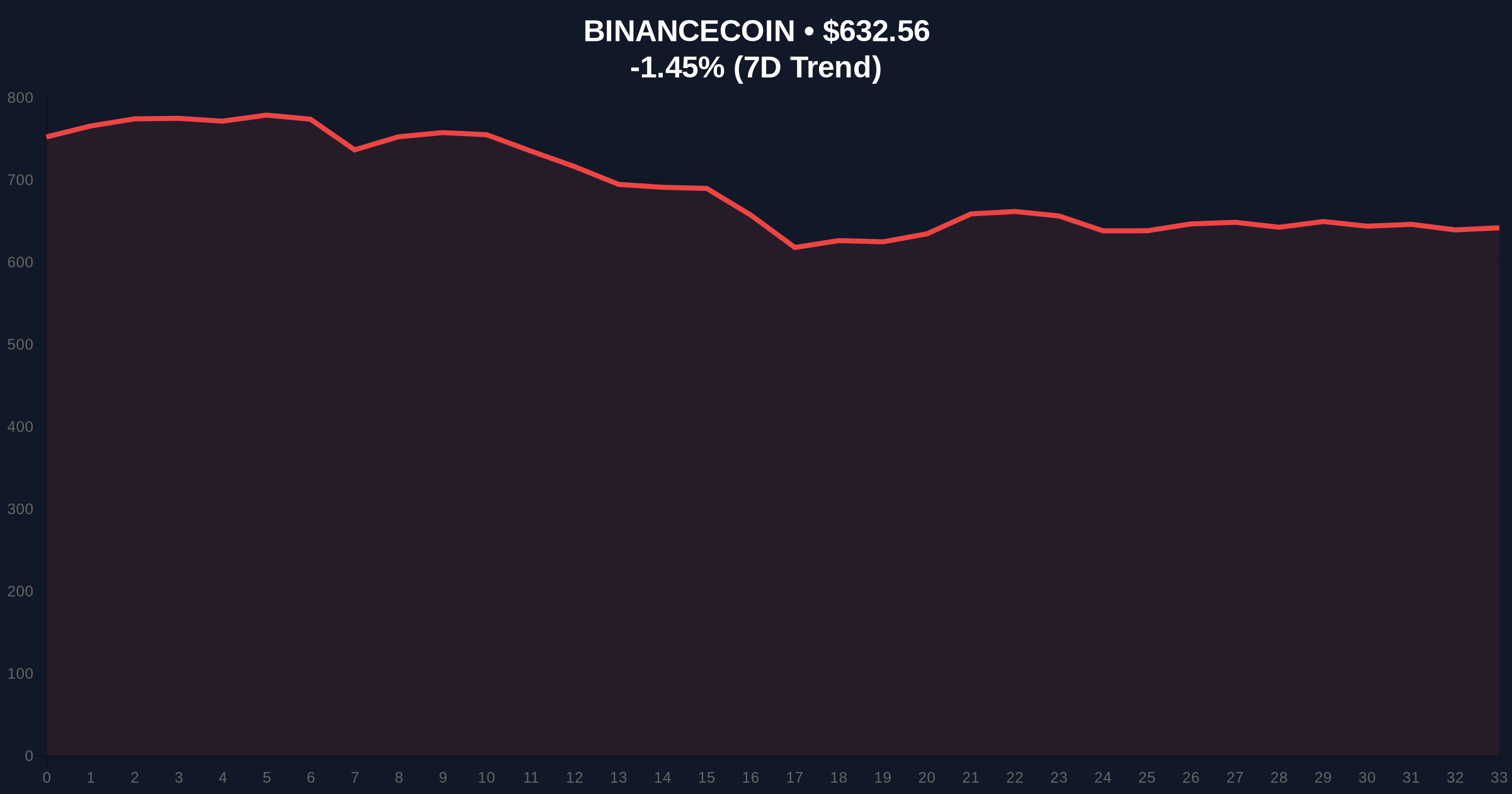

Technical analysis reveals critical levels for BNB, currently at $632.77. The asset faces resistance near the $650 Fibonacci 0.618 retracement level. Support holds at $630, aligning with the 50-day moving average. A break below this level could trigger further downside.

RSI readings hover near oversold territory at 32. This suggests potential for a short-term bounce. However, volume profile indicates weak buying interest. The USDT transfer may create a Fair Value Gap (FVG) if liquidity shifts rapidly. Market structure suggests monitoring the $630 support as a key invalidation level.

According to Ethereum's official documentation on stablecoin mechanics, large transfers can impact network congestion and gas fees. This transaction likely utilized the Tron network for efficiency. Consequently, it the role of layer-1 solutions in institutional moves.

| Metric | Value |

|---|---|

| USDT Transfer Amount | 276,856,986 USDT (~$277M) |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| BNB Current Price | $632.77 |

| BNB 24h Change | -1.41% |

| BNB Market Rank | #5 |

This transfer matters for liquidity dynamics. Large stablecoin movements often precede market turns. Institutional players use such moves to reposition during fear. Retail sentiment, however, remains pessimistic. The extreme fear score of 14/100 reflects this divergence.

On-chain data indicates USDT holdings on exchanges have declined slightly. This suggests whales may be moving funds to private wallets. Consequently, exchange liquidity could tighten. Market structure may see increased volatility if buying pressure emerges. Historical cycles show similar patterns before rallies.

"The $277 million USDT transfer from Binance is a classic institutional liquidity grab. During extreme fear, large players often move stablecoins to secure positions or prepare for accumulation. The unknown wallet adds a layer of opacity, but the size alone signals strategic intent. We monitor the $630 support on BNB as a critical level for broader market health." — CoinMarketBuzz Intelligence Desk

Market outlook hinges on key technical levels. Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautious. The USDT transfer may indicate preparation for a market rebound. However, macroeconomic factors like interest rate policies will influence longer trends. Over a 5-year horizon, such moves highlight the maturation of crypto markets. Institutional participation continues to grow despite short-term fear.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.