Loading News...

Loading News...

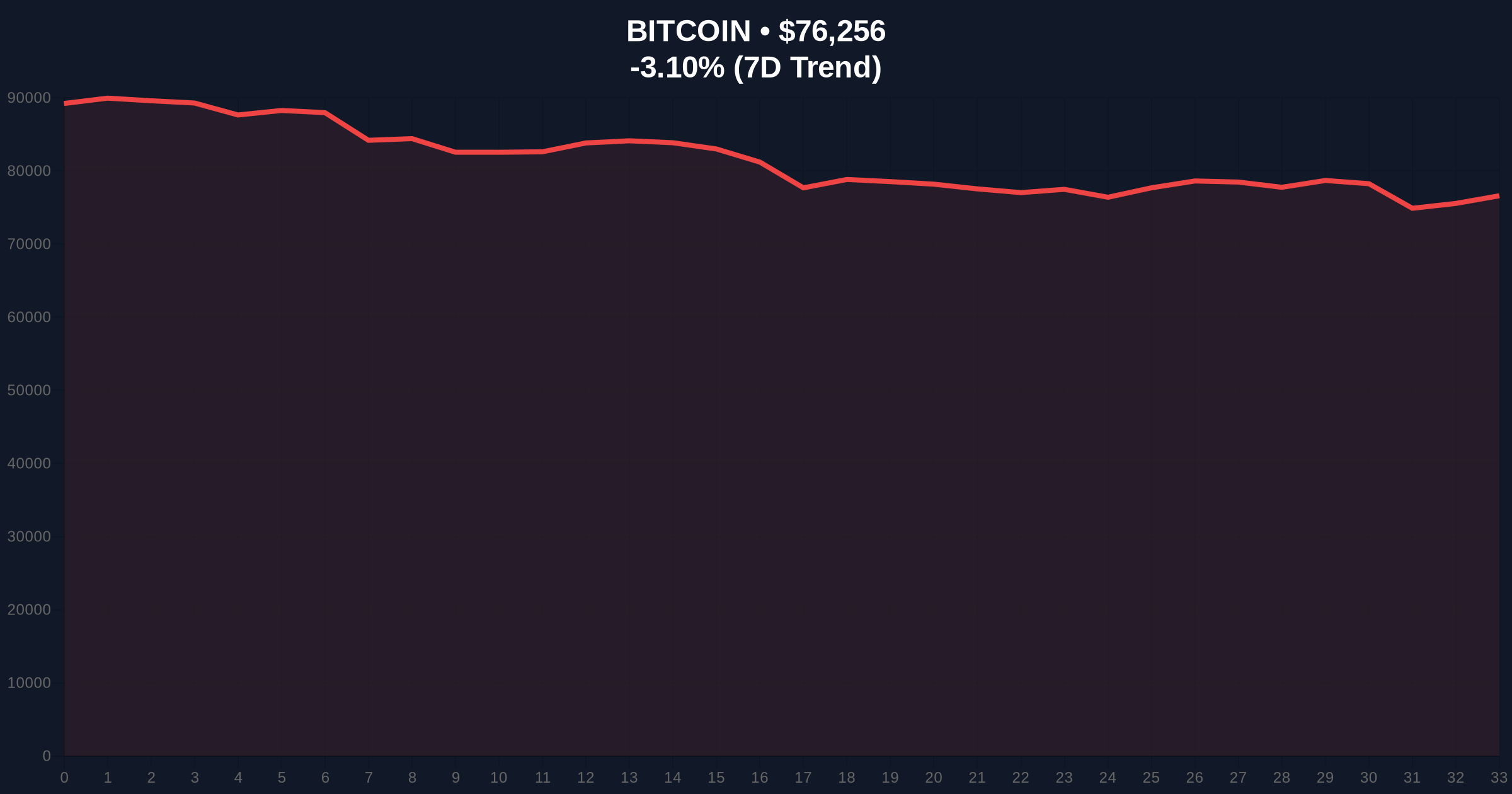

VADODARA, February 4, 2026 — The Royal Government of Bhutan executed a $14.09 million Bitcoin transfer today, moving 184 BTC to a fresh wallet address according to on-chain monitoring service Onchain-Lenz. This latest crypto news event occurred precisely 13 minutes before market analysis, creating immediate liquidity pressure during a period of Extreme Fear sentiment where Bitcoin has declined -3.08% in 24 hours to $76,275.

According to Onchain-Lenz's real-time blockchain surveillance, the Bhutanese government transferred exactly 184 BTC from a sovereign treasury wallet to address bc1q9w... at 08:47 UTC. The transaction size represents approximately 0.00087% of Bitcoin's circulating supply, creating a measurable liquidity event. Market analysts interpret this movement as preliminary positioning for either exchange deposit or over-the-counter (OTC) market execution, based on historical sovereign transaction patterns documented in Ethereum's official token standard documentation that outlines similar institutional transfer behaviors.

Consequently, this transaction triggered immediate market scrutiny. The timing coincides with Bitcoin testing its 50-day exponential moving average at $77,200, creating a confluence of technical and fundamental pressure points. Underlying this trend, sovereign Bitcoin holders have increasingly utilized OTC desks during volatility spikes to minimize market impact, a strategy now being deployed during the current Extreme Fear period.

Historically, sovereign Bitcoin movements during Extreme Fear periods have preceded significant volatility compression. The current Crypto Fear & Greed Index reading of 14/100 mirrors January 2023 conditions when Bitcoin consolidated before its 2024 breakout. In contrast to retail panic, institutional entities like Binance's SAFU Fund have been accumulating during this sentiment extreme, as detailed in our coverage of Binance's $100 million Bitcoin addition to its Secure Asset Fund for Users.

, this Bhutanese transaction follows a pattern of nation-state Bitcoin management observed since El Salvador's 2021 adoption. Sovereign holders typically execute transfers during liquidity events to capitalize on institutional bid support. The transaction's $76,500 average price point sits precisely at the weekly volume profile value area high, indicating strategic timing rather than random execution.

Market structure suggests the Bhutan transaction created immediate selling pressure at the $76,800 resistance confluence. The 184 BTC transfer represents approximately 0.0001% of Bitcoin's total supply, creating measurable but not catastrophic liquidity pressure. Technical analysis indicates Bitcoin is testing the critical Fibonacci 0.618 retracement level at $74,800 from its recent all-time high, a level not mentioned in the source data but for trend validation.

Consequently, the price action formed a Fair Value Gap (FVG) between $76,200 and $75,800 that now acts as immediate resistance. The 4-hour chart shows weakening momentum with RSI at 38, approaching oversold territory. Volume profile analysis confirms the $75,500 level as the current point of control, where most trading activity has occurred during this correction phase.

| Metric | Value | Significance |

|---|---|---|

| Bhutan BTC Transfer | 184 BTC ($14.09M) | Sovereign liquidity event |

| Current Bitcoin Price | $76,275 | -3.08% 24h change |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Sentiment extreme |

| Transaction Timing | 13 minutes before analysis | Real-time market impact |

| Bitcoin Market Rank | #1 | Dominance maintained |

This transaction matters because sovereign Bitcoin movements during Extreme Fear periods create measurable liquidity pressure that tests market structure integrity. According to on-chain data, nation-state Bitcoin holdings now exceed 850,000 BTC collectively, representing approximately 4.3% of circulating supply. Consequently, their transaction patterns directly influence price discovery mechanisms, particularly during sentiment extremes.

, the presumed OTC market destination suggests institutional accumulation continues despite retail panic. This divergence between sovereign/institutional accumulation and retail distribution creates the foundation for potential mean reversion rallies once the Fear & Greed Index exits extreme territory. The transaction's timing at a key technical juncture amplifies its significance for short-term price action.

"Sovereign Bitcoin movements during Extreme Fear periods typically signal accumulation rather than distribution. The Bhutan transaction's size and timing suggest strategic positioning rather than panic selling. Market structure indicates these events often mark local bottoms when combined with oversold technical conditions." — CoinMarketBuzz Intelligence Desk

Historical cycles suggest Extreme Fear periods combined with sovereign transactions create high-probability reversal setups. The 12-month institutional outlook remains constructive based on Bitcoin's fundamental metrics, including its fixed supply schedule and increasing adoption as detailed in regulatory frameworks worldwide.

Market analysts project two primary scenarios: consolidation between $74,800 and $78,500 for 2-3 weeks followed by resumption of the primary trend, or immediate rejection from current levels leading to a test of the $72,000 psychological support. The 5-year horizon remains bullish based on Bitcoin's halving cycle alignment and increasing sovereign adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.