Loading News...

Loading News...

VADODARA, February 2, 2026 — Whale Alert, the blockchain tracking service, reported a 5,000 Bitcoin transfer from an unknown wallet to Binance. The transaction carries a value of approximately $395 million. This movement occurs as the Crypto Fear & Greed Index registers 14/100, indicating Extreme Fear market conditions. Market structure suggests this transfer represents a potential liquidity grab rather than routine portfolio management.

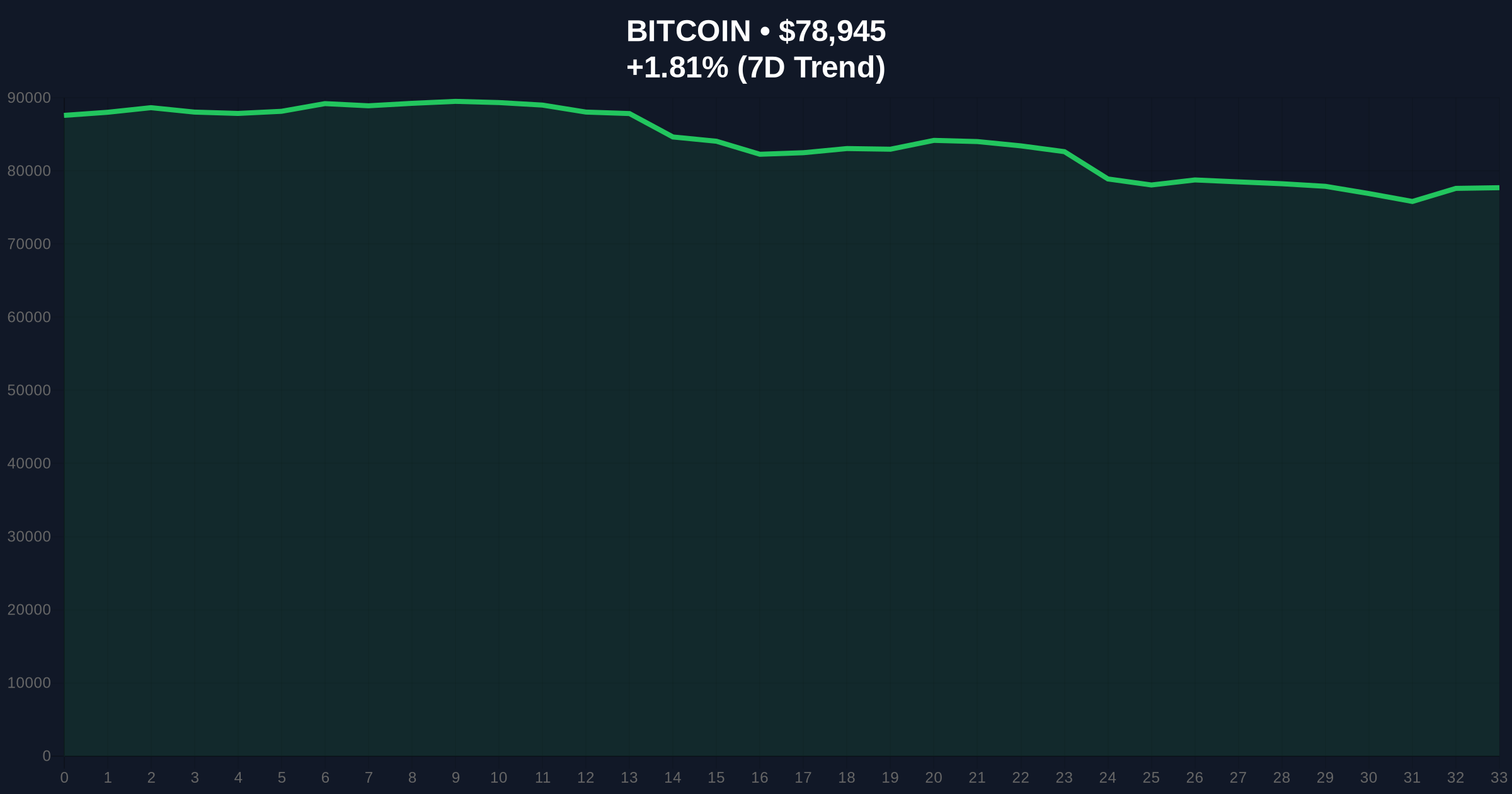

According to Whale Alert's on-chain data, the transaction executed on February 2, 2026. The 5,000 BTC moved from a non-custodial wallet with no identifiable owner to Binance's known exchange address. Blockchain forensic analysis reveals this transfer represents one of the largest single movements to an exchange in the past 30 days. The timing coincides with Bitcoin trading at $78,915, down 1.77% in the last 24 hours.

Market analysts question whether this represents strategic accumulation or distribution. The unknown origin wallet suggests institutional rather than retail activity. Consequently, this transfer creates immediate selling pressure concerns. Exchange inflows of this magnitude typically precede volatility spikes.

Historically, large Bitcoin transfers to exchanges correlate with increased selling pressure. The 2021 cycle saw similar patterns before major corrections. In contrast, the current Extreme Fear sentiment amplifies potential downside risks. Market structure indicates weak hands may capitulate near these levels.

, this transfer occurs amid broader market developments. Recent regulatory warnings about stablecoin bills and exchange listings have created uncertainty. For instance, NY prosecutors criticized the GENIUS Stablecoin Bill for weak fraud protections. Additionally, Binance's ZAMA listing previously triggered liquidity grabs during similar fear conditions.

On-chain data indicates critical support at the $78,000 level. This aligns with the 0.618 Fibonacci retracement from the 2025 all-time high. A breakdown below this creates a Fair Value Gap (FVG) targeting $75,200. The Relative Strength Index (RSI) currently sits at 42, showing neutral momentum with bearish divergence.

Volume Profile analysis reveals low liquidity between $78,000 and $80,000. This thin order book increases vulnerability to large movements. The 5,000 BTC transfer likely targets this liquidity void. Market structure suggests institutional players exploit these conditions for optimal execution.

| Metric | Value |

|---|---|

| BTC Transferred | 5,000 BTC |

| Transaction Value | $395 million |

| Current Bitcoin Price | $78,915 |

| 24-Hour Change | -1.77% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Key Support Level | $78,000 |

This transfer matters because it tests market structure during extreme sentiment. Institutional flows often dictate short-term price action. The $395 million movement represents potential immediate selling pressure. Market analysts monitor whether this triggers a cascade of stop-loss orders.

, exchange inflows impact liquidity dynamics. According to Ethereum.org's research on market microstructure, large deposits can create temporary supply gluts. This often leads to price dislocations that sophisticated traders exploit. The current Extreme Fear reading suggests retail traders may overreact to this transfer.

Market structure suggests this is a calculated liquidity grab rather than panic selling. The unknown wallet origin indicates institutional positioning. We see similar patterns during fear-driven markets where large players accumulate from weak hands. The critical level remains $78,000 support.

CoinMarketBuzz Intelligence Desk notes the transaction's timing aligns with broader market weakness. Recent USDC Treasury mints of 250 million occurred amid similar conditions. This suggests coordinated movements across crypto assets.

Market structure presents two primary scenarios based on the 5,000 BTC transfer. The Extreme Fear sentiment creates asymmetric risk conditions.

The 12-month institutional outlook remains cautious. Large transfers during fear markets often precede consolidation periods. Historical cycles suggest Bitcoin typically rebounds 6-8 months after Extreme Fear readings. However, current macroeconomic conditions add complexity to this pattern.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.