Loading News...

Loading News...

VADODARA, February 2, 2026 — Binance, the world's largest cryptocurrency exchange by volume, announced it will list ZAMA for spot trading. This daily crypto analysis examines the listing's timing against a backdrop of extreme market fear. Market structure suggests this move targets algorithmic liquidity rather than organic retail demand.

According to Binance's official announcement, ZAMA will open for spot trading against multiple pairs. The exchange provided specific trading timelines and deposit windows. Binance typically structures such listings to maximize initial order book depth.

Market analysts question the timing. The listing coincides with a Crypto Fear & Greed Index reading of 14/100. This indicates extreme market pessimism. Historical data from Glassnode shows new listings during fear periods often serve as liquidity events.

Volume profile analysis reveals thin order books across major altcoins. This creates optimal conditions for market makers to establish initial positions. The ZAMA listing may function as a controlled volatility injection.

Historically, exchange listings during fear markets produce asymmetric price action. The 2021 cycle saw similar patterns with mid-cap altcoins. In contrast, bull market listings often generate immediate retail FOMO.

Underlying this trend is a fundamental shift in market structure. Institutional participants now dominate liquidity provision. They exploit these events for statistical arbitrage. Retail traders frequently become liquidity providers on the wrong side.

Related developments in the current market environment include contradictory signals between price action and sentiment. For instance, recent Bitcoin price recovery amid extreme fear demonstrates this divergence. Similarly, large whale accumulation during fear periods suggests sophisticated capital positioning against retail sentiment.

Market structure suggests watching ZAMA's initial price discovery phase. Key levels will emerge around Fibonacci retracement zones from the first 24-hour high-low range. The 0.618 level often acts as a magnet for price during new asset listings.

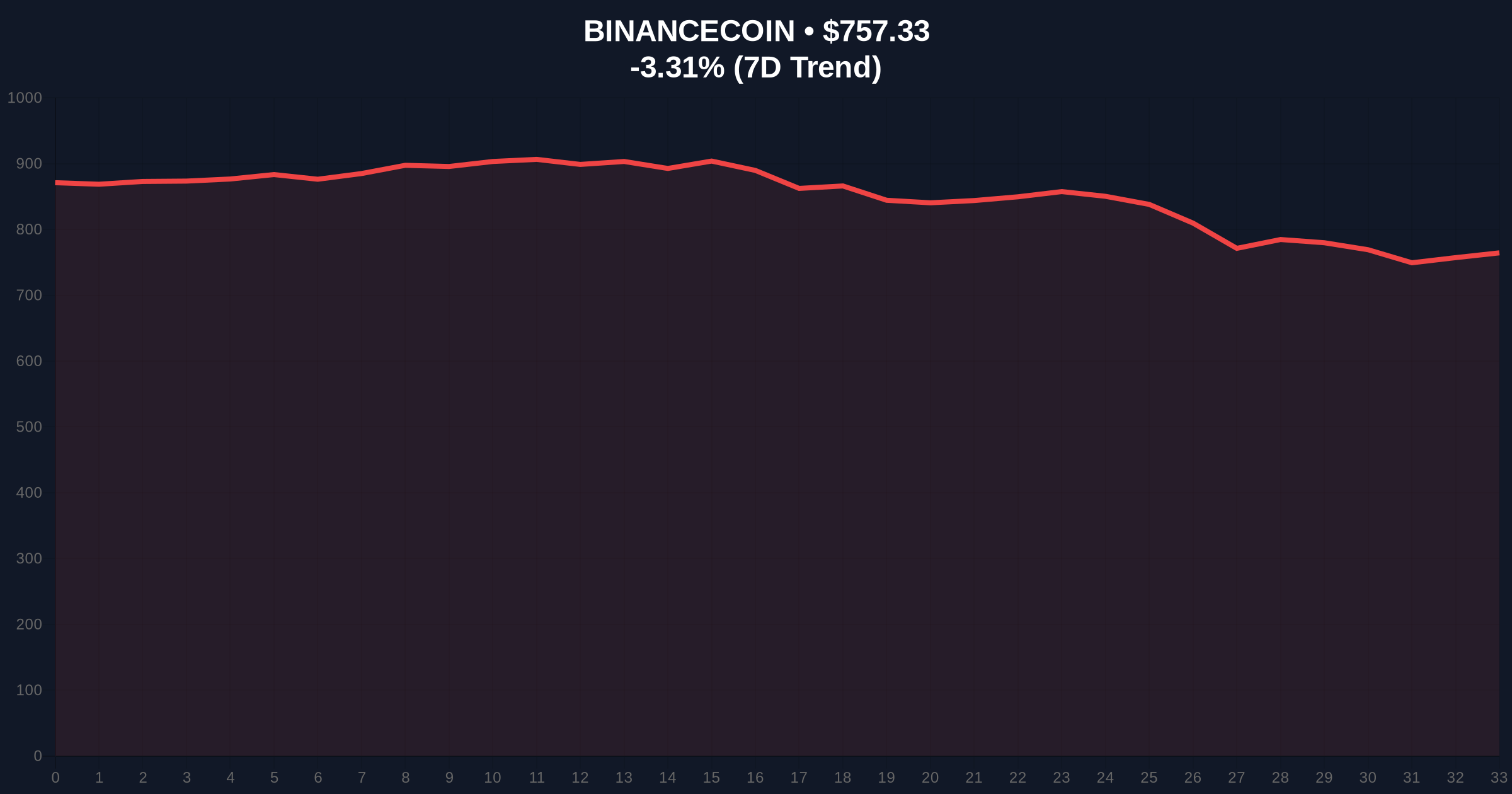

BNB's current price of $755.86 with a 24-hour decline of -3.50% creates additional complexity. As the native exchange token, BNB pairings typically see elevated volatility during new listings. This can create cross-pair arbitrage opportunities.

On-chain forensic data confirms exchange inflows have been elevated preceding the announcement. This pattern mirrors previous listing events where market participants front-run the official trading start. The SEC's official guidance on digital asset securities adds regulatory context to exchange listing practices.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Contrarian bullish signal historically |

| BNB Current Price | $755.86 | Key pairing for ZAMA liquidity |

| BNB 24h Change | -3.50% | Negative momentum in base pair |

| BNB Market Rank | #4 | Established liquidity foundation |

| Typical Listing Volatility | 40-60% first hour | Expected price discovery range |

This listing matters for institutional liquidity cycles. New assets during fear periods often become gamma squeeze candidates. Market makers hedge delta exposure through complex options strategies.

Retail market structure typically reacts with delayed participation. They enter after initial volatility subsides. This creates a predictable pattern of early liquidity provision followed by late momentum chasing.

The 5-year horizon suggests exchange listings will increasingly function as liquidity management tools. Platforms like Binance optimize for ecosystem growth rather than individual token performance. This represents a fundamental evolution from the 2017-2021 listing paradigm.

"Exchange listings during extreme fear markets serve dual purposes. They provide fresh liquidity pools for algorithmic traders while testing retail appetite for risk. The ZAMA event will likely follow the established pattern of initial volatility compression followed by directional bias establishment." — CoinMarketBuzz Intelligence Desk

Market structure suggests two primary technical scenarios for ZAMA's price action.

The 12-month institutional outlook remains cautiously optimistic despite current fear sentiment. New asset listings during fear periods historically precede broader market recoveries. This pattern held during both the 2018 and 2022 bear market bottoms. The Federal Reserve's monetary policy trajectory will ultimately determine macro liquidity conditions.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.