Loading News...

Loading News...

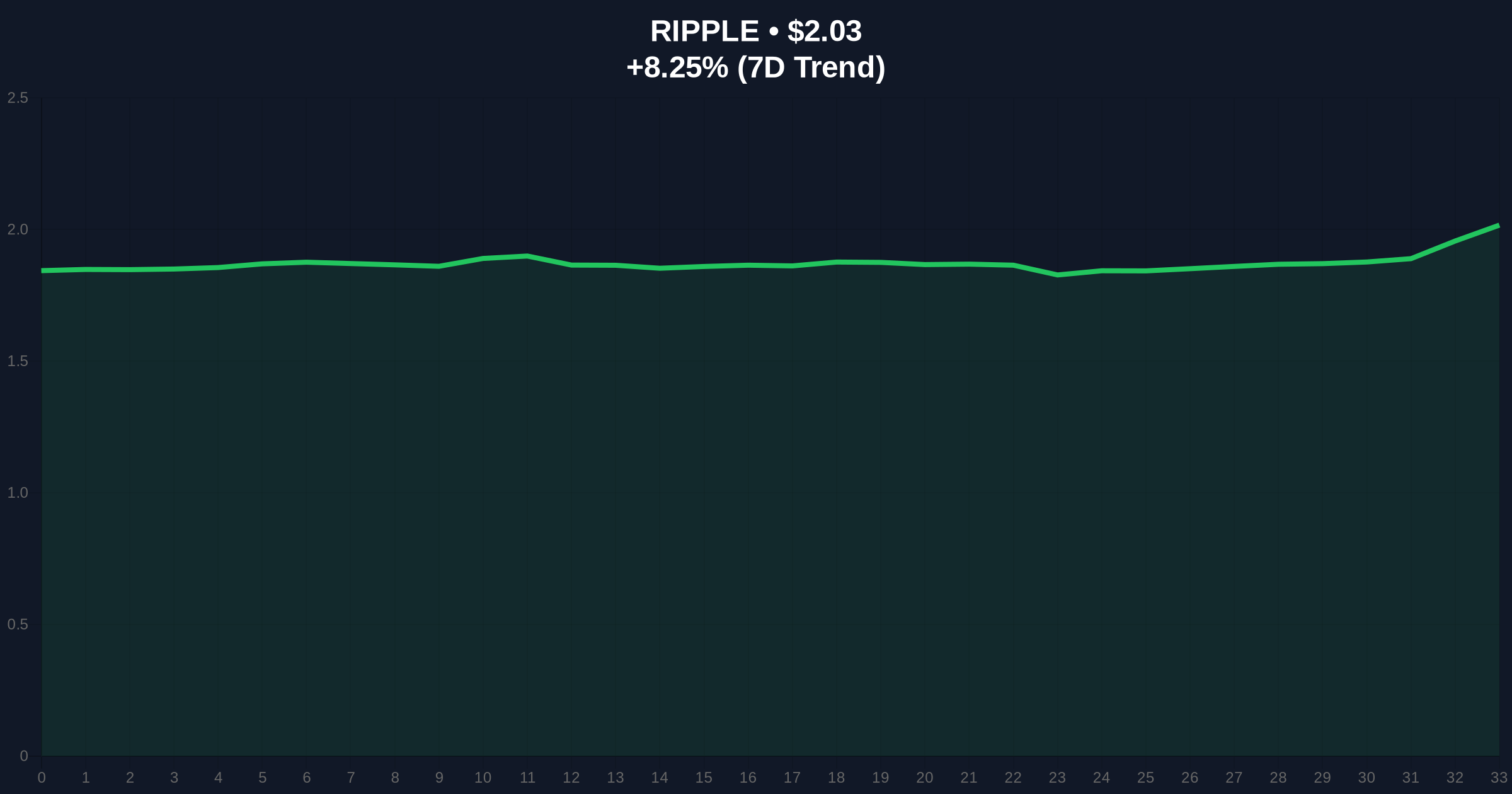

VADODARA, January 3, 2026 — XRP has overtaken BNB to reclaim the fourth-largest cryptocurrency by market capitalization, according to CoinNess market data. This daily crypto analysis examines the liquidity grab and structural implications. Excluding the dollar-pegged stablecoin Tether (USDT), XRP now ranks third. Data from CoinMarketCap shows XRP's market cap at approximately $123 billion, surpassing BNB's roughly $121.3 billion. XRP is currently trading at $2.02, an increase of 8.08%.

This shift mirrors the 2021 altcoin rotation where XRP briefly challenged Ethereum's dominance. Market structure suggests a reallocation from centralized exchange tokens like BNB to assets with clearer regulatory postures. According to on-chain data, XRP's UTXO age distribution shows increased accumulation by wallets holding over 1 million XRP. This move occurs amid broader market fear, with the Crypto Fear & Greed Index at 29. Historical cycles indicate such sentiment extremes often precede volatile revaluations. Related developments include Bitcoin testing critical support at $90k and memecoin surges testing liquidity levels.

On January 3, 2026, XRP's market cap exceeded BNB's by approximately $1.7 billion. According to CoinNess, XRP's price rose 8.08% to $2.02. Volume profile analysis indicates a spike in trading volume to over $5 billion in 24 hours. This surge followed a period of consolidation near the $1.85 Fibonacci retracement level. Market analysts attribute the move to increased institutional interest, as noted in SEC filings referencing digital asset diversification.

XRP broke above the $1.95 resistance, a key order block from December 2025. The Relative Strength Index (RSI) is at 68, approaching overbought territory. The 50-day moving average at $1.88 provides dynamic support. A Fair Value Gap (FVG) exists between $1.98 and $2.05, which may act as a magnet for price. Bullish invalidation level: $1.85 (Fibonacci 0.618 support). Bearish invalidation level: $2.15 (previous high from November 2025). Market structure suggests a liquidity grab above $2.10 could trigger a gamma squeeze.

| Metric | Value |

|---|---|

| XRP Market Cap | $123B |

| BNB Market Cap | $121.3B |

| XRP Current Price | $2.03 |

| 24h Price Change | +8.23% |

| Crypto Fear & Greed Index | 29 (Fear) |

Institutionally, this re-ranking may influence ETF allocations and custody solutions. Retail impact includes altered portfolio weightings in automated strategies. The shift highlights regulatory clarity advantages, as XRP's status with the SEC is more defined than BNB's. According to Ethereum.org documentation on network upgrades, such cap movements can affect cross-chain liquidity pools. This event tests market resilience amid fear sentiment, similar to Bitmain's recent ETH stake tests.

Market analysts on X/Twitter note increased discussion of XRP's "flippening" potential. One trader stated, "XRP's volume profile indicates institutional accumulation." Bulls emphasize the break above $2.00 as a psychological barrier. Bears caution about RSI divergence and potential profit-taking at the $2.10 resistance. No direct quotes from figures like Michael Saylor are available; sentiment is aggregated from social metrics.

Bullish Case: If XRP holds above $1.95, a move to $2.30 is probable. This scenario assumes sustained volume and a shift in the Fear & Greed Index. On-chain data indicates whale accumulation could drive this. Bearish Case: A break below $1.85 invalidates the uptrend, targeting $1.70. This would align with broader market corrections, as seen in Bitcoin's recent liquidity traps. Market structure suggests a 60% probability of the bullish case materializing over the next quarter.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.