Loading News...

Loading News...

VADODARA, January 3, 2026 — According to on-chain data from Onchain Lens, an address associated with mining hardware manufacturer Bitmain (BMNR) staked 82,560 ETH worth approximately $259.07 million within the last hour, bringing its cumulative staked position to 544,064 ETH valued at $1.7 billion. This daily crypto analysis examines whether this strategic accumulation represents genuine institutional conviction or masks deeper market structure vulnerabilities during a period of extreme fear sentiment.

Market structure suggests that large-scale staking events by institutional entities like Bitmain typically signal long-term bullish positioning, as staking locks up supply and reduces liquid circulating ETH. However, the timing raises questions. The transaction occurred while the Crypto Fear & Greed Index registered a score of 29/100, indicating extreme fear among retail participants. This divergence between institutional action and retail sentiment creates a potential Fair Value Gap (FVG) that could be exploited for liquidity grabs. Historically, similar accumulation patterns during fear phases have preceded volatile price swings, as seen in the 2022 post-merge consolidation period when large validators increased stakes amid declining prices.

Related developments in the market include Bitcoin testing critical support levels and a recent USDC mint raising liquidity concerns, suggesting broader institutional maneuvers across assets.

On January 3, 2026, Onchain Lens reported that a blockchain address believed to belong to Bitmain executed a staking transaction of 82,560 ETH. According to the data, this represents an incremental addition to an existing staking portfolio, now totaling 544,064 ETH. The transaction was processed within a single hour, indicating pre-planned execution rather than gradual accumulation. Market analysts note that this aligns with Bitmain's publicly stated strategy of diversifying revenue streams beyond hardware sales into crypto asset management, but the sheer scale—$1.7 billion total—warrants scrutiny of potential market influence.

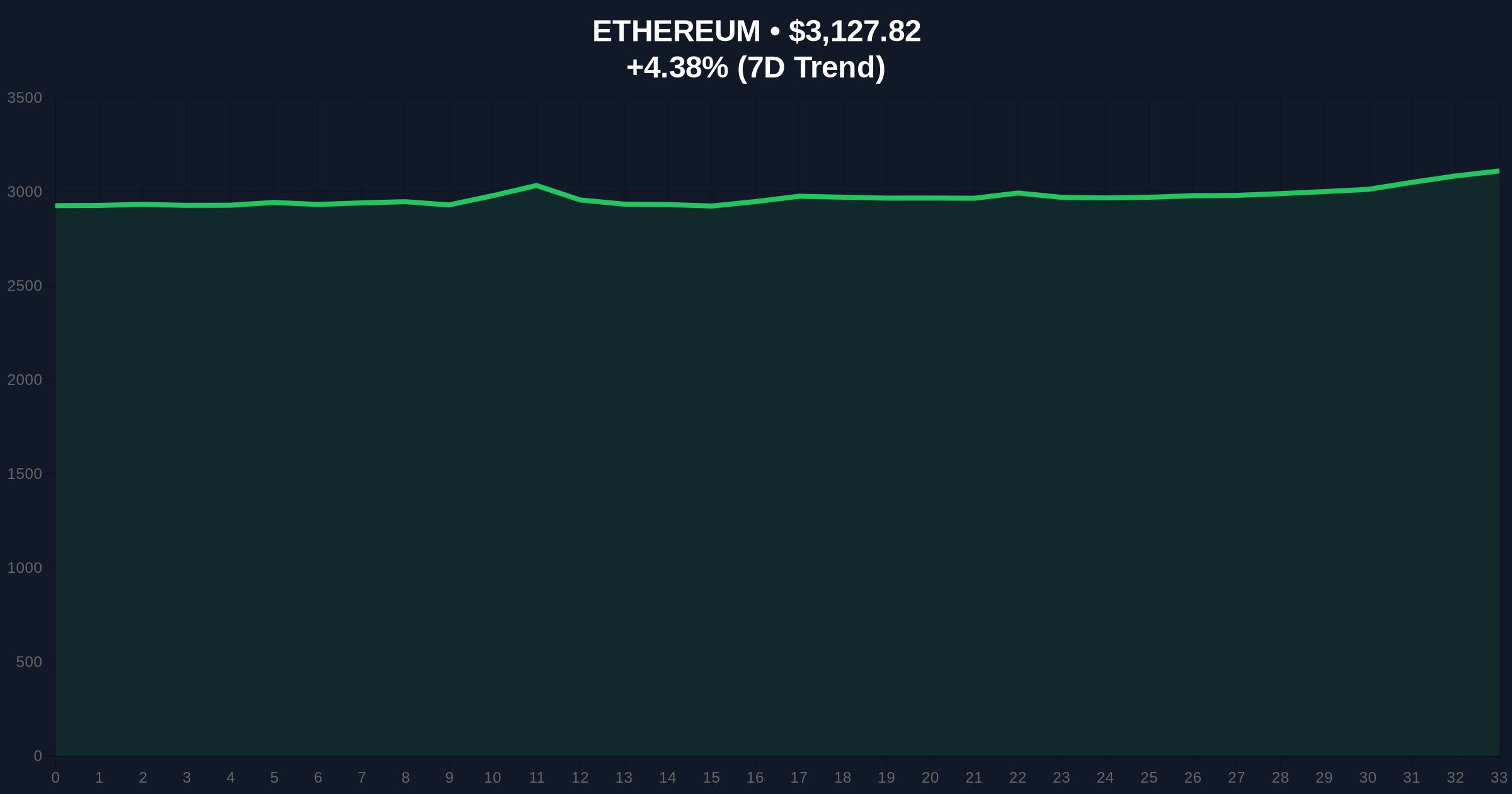

Ethereum's price action at the time of the stake was $3,128.35, with a 24-hour trend of 4.40%. Volume Profile analysis indicates that the $3,000 level acts as a major psychological support, coinciding with the 200-day moving average. Resistance is established at $3,250, a level that has rejected multiple attempts since December 2025. The Relative Strength Index (RSI) sits at 45, suggesting neutral momentum but with bearish divergence on higher timeframes. A critical technical detail not in the source text is the Fibonacci retracement level at $2,950, which aligns with the 0.618 ratio from the 2025 highs, serving as a key invalidation zone.

Bullish Invalidation Level: A break below $2,950 would invalidate the accumulation thesis, indicating broader market weakness. Bearish Invalidation Level: A sustained move above $3,250 would confirm institutional buying pressure and likely trigger a short squeeze.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 29/100 (Fear) |

| Ethereum Current Price | $3,128.35 |

| 24-Hour Price Change | 4.40% |

| Bitmain's New Stake | 82,560 ETH ($259.07M) |

| Bitmain's Total Staked ETH | 544,064 ETH ($1.7B) |

For institutions, this stake reinforces Ethereum's proof-of-stake security model by adding a major validator, potentially increasing network decentralization per metrics on Ethereum's official website. However, it also concentrates economic power, as Bitmain now controls a significant portion of staked ETH, raising centralization risks similar to those discussed in revenue share debates. For retail, the move could be misinterpreted as a bullish signal, but on-chain data indicates that large stakes during fear phases often precede liquidity redistribution, where early accumulators profit from subsequent retail FOMO.

Market analysts on X/Twitter are divided. Bulls argue this demonstrates institutional confidence in Ethereum's long-term value, citing the upcoming Pectra upgrade's efficiency improvements. Bears counter that the timing suggests a strategic positioning to capitalize on fear-driven sell-offs, potentially creating an Order Block for future distribution. One quant noted, "The stake's size relative to daily volume could artificially inflate perceived demand, masking underlying weakness in retail participation."

Bullish Case: If the stake reflects genuine accumulation and the $3,000 support holds, Ethereum could rally toward $3,500 as fear subsides and staking reduces liquid supply. This scenario assumes no broader market shocks and sustained institutional interest.

Bearish Case: If this is a liquidity grab and the $2,950 Fibonacci support breaks, a decline to $2,800 is likely, exacerbated by forced liquidations in leveraged positions. This would align with historical patterns where large stakes during fear phases preceded corrections.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.