Loading News...

Loading News...

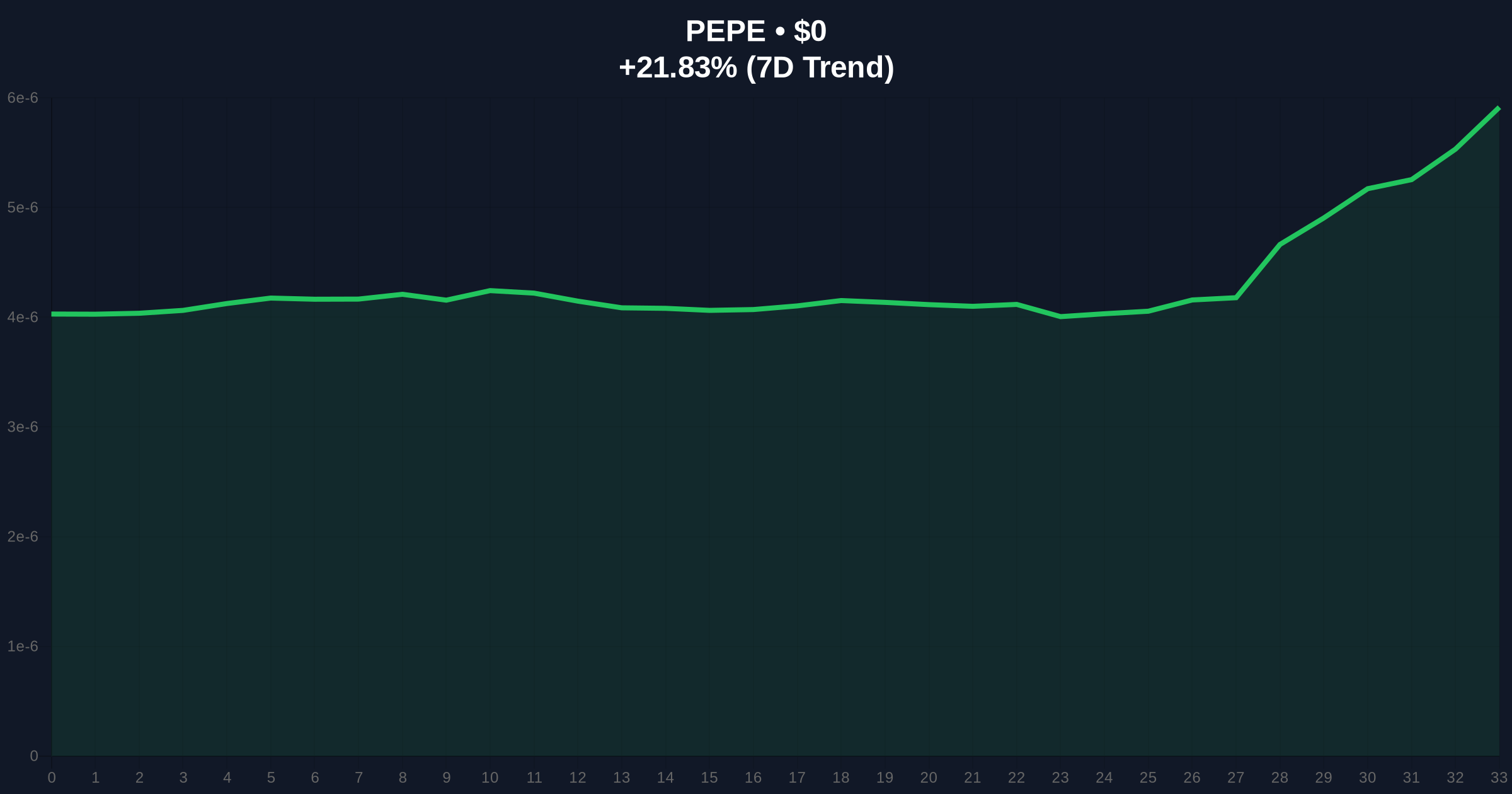

VADODARA, January 3, 2026 — PEPE surged 32% on January 2, leading a memecoin rally that outperformed broader altcoin recovery. According to The Block analysis, this daily crypto analysis reveals capital rotation into historically oversold sectors. Market structure suggests this is a liquidity grab targeting weak hands from the October liquidation event.

Memecoins were the hardest-hit sector following the October 10 liquidation cascade. On-chain data from Nansen indicates significant capital outflow during that period. The current rebound aligns with historical January effects where underperforming assets experience mean reversion. This mirrors the 2021 post-correction pattern where speculative capital returned to high-beta assets first.

Related developments include The Block Research 2026 Outlook highlighting liquidity pressure and recent USDC mint activity suggesting potential liquidity grabs.

On January 2, PEPE price action showed a 32% intraday surge. The Block analysis confirms this led memecoin gains. Solana-based POPCAT followed with significant momentum. Other tokens including DOGE, SHIB, BONK, FLOKI, and WIF showed short-term strength. The artificial intelligence sector and newly launched tokens also participated in the recovery.

VanEck analyst Matt Sigel noted assets with poor year-end performance tend to rebound stronger in January. Nansen analyst Jake Kenis identified memecoins as the most oversold sector post-October. He suggested early-year capital flow indicates position building after months of sideways trading.

PEPE's surge created a Fair Value Gap (FVG) between $0.0000012 and $0.0000015. This zone represents inefficient price discovery that may be filled later. The Volume Profile shows accumulation near yearly lows. RSI readings exited oversold territory but remain below 60.

Bullish Invalidation: Break below $0.0000012 order block would invalidate the recovery thesis. This level corresponds to the 0.382 Fibonacci retracement of the October decline.

Bearish Invalidation: Sustained move above $0.0000018 resistance would confirm trend reversal. This aligns with the 200-day moving average convergence zone.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 28/100 (Fear) |

| PEPE 24h Change | 21.97% |

| PEPE Market Rank | #50 |

| Memecoin Sector Performance | Highest gains on Jan 2 |

| Key Technical Level | $0.0000012 Order Block |

For institutions, memecoin volatility creates gamma squeeze opportunities in options markets. Retail traders face asymmetric risk with high leverage common in these assets. The recovery tests whether October's liquidity event fully cleared weak positions. According to Ethereum.org documentation on market mechanics, such rebounds often precede broader altcoin rotations.

Market analysts on X/Twitter highlight the "January effect" in crypto. Bulls point to historical data showing mean reversion in oversold assets. Bears caution about low trading volumes and potential fakeouts. The consensus: this needs confirmation on weekly charts to establish a sustainable trend.

Bullish Case: PEPE holds above $0.0000012 and fills the FVG to $0.0000018. Memecoin sector leads altcoin recovery through Q1 2026. Capital rotation continues into other oversold sectors like AI tokens.

Bearish Case: PEPE fails at current resistance and retraces to test October lows. The rally proves to be a liquidity grab before further downside. Broader market fear prevents sustained recovery in speculative assets.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.