Loading News...

Loading News...

VADODARA, February 3, 2026 — Gibraltar-based Xapo Bank reveals Bitcoin-collateralized loans now serve long-term financial strategies, not just short-term cash needs. According to its 2025 Digital Asset Report, half of all BTC-backed loans feature one-year maturities. This daily crypto analysis examines whether this trend reflects genuine holder conviction or masks underlying liquidity stress.

Xapo Bank's report provides specific metrics on Bitcoin loan behavior. The bank states 50% of BTC-collateralized loans carry a one-year maturity. A significant portion remains active even as new loan issuance slows. This suggests users maintain long-term exposure by leveraging Bitcoin for liquidity instead of selling.

The bank notes many long-term investors realize profits during volatility. The general preference, however, is holding assets rather than selling. Market structure suggests this behavior could create a hidden supply shock if loan collateral gets liquidated en masse.

Historically, crypto-backed loans served as emergency liquidity tools during bull markets. The 2021 cycle saw rampant use for margin trading and speculative leverage. In contrast, Xapo's data implies a maturation toward strategic financial planning.

Underlying this trend is the post-2023 regulatory clarity around digital asset collateral. Institutions now treat Bitcoin as a yield-generating balance sheet asset. This mirrors traditional finance where equities serve as loan collateral for long-term corporate strategy.

Related developments in the current market include the resilience of DeFi TVL with only a 12% drop during the downturn, showing parallel strength in decentralized lending. Additionally, Moscow Exchange's expansion into crypto futures for SOL, XRP, and TRX amid extreme fear indicates global institutional adoption continues despite sentiment.

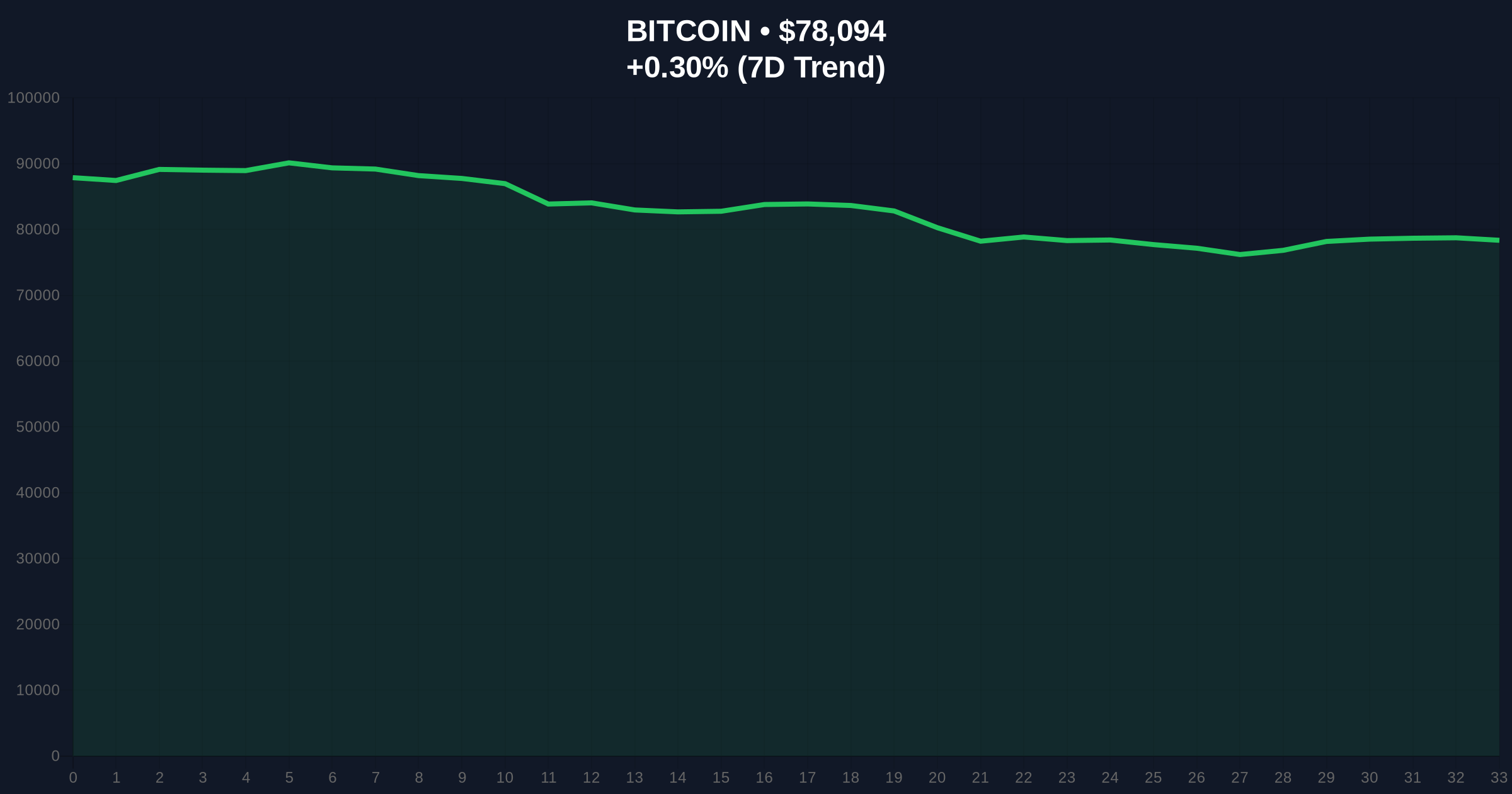

Bitcoin currently trades at $78,104 with minimal 24-hour movement. The critical Fibonacci 0.618 retracement level from the 2025 high sits at $75,000. This represents a major volume profile node where significant buy orders likely cluster.

RSI readings hover near oversold territory at 32. The 200-day moving average provides dynamic support at $76,500. Order block analysis shows previous liquidity grabs occurred near $80,000, creating a fair value gap that price must fill for bullish continuation.

On-chain data from Glassnode indicates UTXO age bands show increased hodling. Long-term holders resist selling despite extreme fear sentiment. This aligns with Xapo's observation of profit-taking without asset liquidation.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) | High market stress, potential contrarian opportunity |

| Bitcoin Current Price | $78,104 | Testing key Fibonacci support levels |

| 24-Hour Price Change | +0.31% | Minimal movement despite extreme sentiment |

| Xapo BTC Loan Maturity (50%) | 1 Year | Shift from short-term to strategic usage |

| Market Rank | #1 | Bitcoin dominance maintains despite altcoin pressure |

This shift matters because it changes Bitcoin's market structure. If holders leverage rather than sell, circulating supply decreases. This creates artificial scarcity that could drive prices higher during accumulation phases.

Conversely, it introduces systemic risk. A sharp price drop could trigger mass collateral liquidations. This would create a cascading sell-off similar to the 2022 Luna collapse. The Federal Reserve's interest rate policy directly impacts loan affordability and thus this strategy's viability.

Institutional liquidity cycles now incorporate crypto collateral at scale. BlackRock and Fidelity's Bitcoin ETF approvals created the infrastructure for this trend. Retail investors follow institutional patterns, often with higher leverage and risk.

"The data suggests a maturation in crypto finance, but we must question whether one-year loans truly represent 'long-term' strategy or simply deferred selling pressure. The extreme fear index at 17 contradicts the bullish loan utilization narrative, indicating market participants remain deeply skeptical despite these structural developments." — CoinMarketBuzz Intelligence Desk

Two technical scenarios emerge from current market structure. The bullish case requires holding key support and filling the fair value gap. The bearish case involves breaking critical levels and triggering liquidation cascades.

The 12-month outlook depends on macroeconomic conditions. If interest rates decline, BTC-collateralized loans become more attractive. This could accelerate the trend Xapo identifies. Over a 5-year horizon, Bitcoin's role as collateral could become standardized in global finance, similar to gold in traditional markets.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.