Loading News...

Loading News...

VADODARA, February 3, 2026 — The Moscow Exchange (MOEX) will launch futures for Solana (SOL), XRP, and TRON (TRX). This latest crypto news signals institutional expansion despite extreme market fear. According to CoinDesk, MOEX will first create indices for these assets. It will then roll out ruble-settled futures contracts.

MOEX plans to introduce futures products for SOL, XRP, and TRX. The exchange already offers futures for Bitcoin (BTC) and Ethereum (ETH). It will launch indices for the new coins first. These indices will underpin the futures contracts. All contracts will settle in Russian rubles.

This move follows MOEX's existing crypto derivatives framework. Market structure suggests a calculated liquidity grab. The exchange targets altcoins with established ecosystems. SOL ranks #7 by market cap. XRP and TRX maintain top-20 positions. On-chain data indicates growing institutional interest in these assets.

Historically, futures launches increase volatility and liquidity. The CME's Bitcoin futures debut in 2017 preceded a major bull run. In contrast, MOEX's ruble settlement localizes exposure. This shields traders from direct dollar volatility.

Underlying this trend is Russia's evolving crypto stance. The Bank of Russia has cautiously allowed crypto trading. MOEX's expansion aligns with this regulatory shift. It provides a regulated venue for Russian institutional capital.

Related developments highlight current market stress. Crypto futures liquidations recently hit $411 million. , TrendResearch sold $80.85 million in ETH. These events occur amid extreme fear conditions.

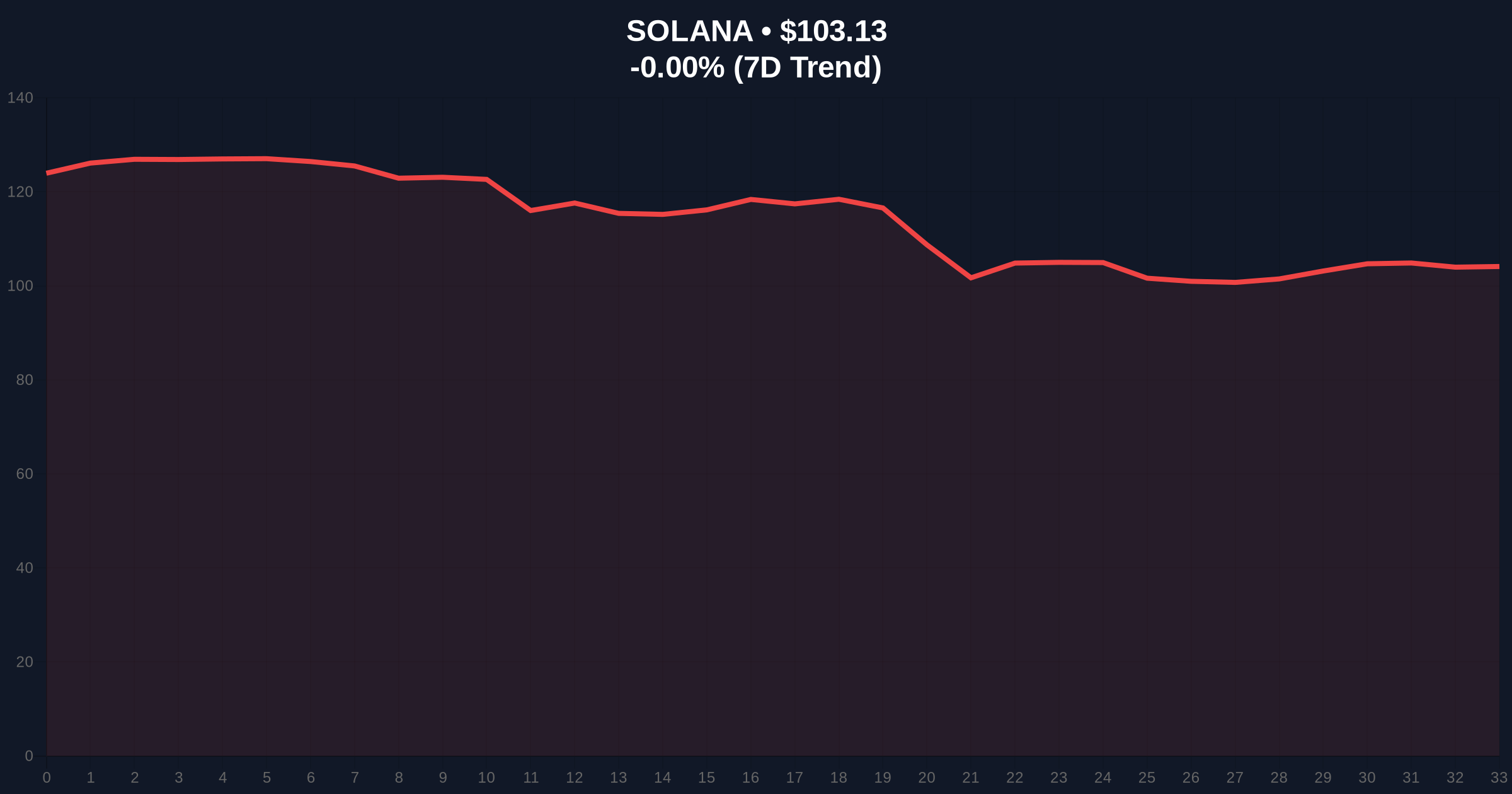

SOL currently trades at $103.11. Its 24-hour trend shows a minor decline of -0.03%. Market structure suggests a critical Fair Value Gap (FVG) between $100,000 and $105,000. This FVG represents a liquidity void from recent sell-offs.

Technical analysis reveals key levels. SOL's Fibonacci 0.618 retracement support sits at $98,500. This level aligns with a high-volume node on the Volume Profile. A break below invalidates the current bullish structure. RSI hovers near 45, indicating neutral momentum.

XRP and TRX show similar consolidation patterns. Order blocks from January provide support. These blocks represent institutional accumulation zones. A failure to hold these levels triggers bearish scenarios.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Extreme Fear (17/100) |

| Solana (SOL) Price | $103.11 |

| SOL 24h Change | -0.03% |

| SOL Market Rank | #7 |

| MOEX Existing Futures | BTC, ETH |

This expansion matters for institutional liquidity cycles. MOEX provides a regulated gateway for Russian capital. Ruble settlement reduces forex risk for local traders. It also insulates the market from dollar-based regulatory shocks.

Retail market structure may see increased volatility. Futures introduce leverage and short-selling capabilities. This can amplify price swings during stress events. Historical cycles suggest futures markets mature over 12-18 months.

Long-term, this supports crypto integration into traditional finance. According to Federal Reserve research, derivatives markets enhance price discovery. MOEX's move aligns with global trends toward crypto institutionalization.

Market structure suggests MOEX is targeting altcoin liquidity. This expansion diversifies institutional exposure beyond BTC and ETH. Ruble settlement localizes risk but may limit global arbitrage. The key watch level is SOL's $98,500 Fibonacci support.

CoinMarketBuzz Intelligence Desk synthesized this analysis. No direct quotes from MOEX officials were available.

Two data-backed technical scenarios emerge. Both depend on SOL's $98,500 support.

The 12-month institutional outlook remains cautiously optimistic. MOEX's expansion provides regulatory clarity in Russia. This may attract $500 million to $1 billion in new capital. Over a 5-year horizon, such moves accelerate crypto's mainstream adoption.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.