Loading News...

Loading News...

VADODARA, January 16, 2026 — According to on-chain data platform Arkham, Gemini co-founders Cameron and Tyler Winklevoss hold approximately $1.25 billion in Bitcoin, representing a significant reduction from their historical position of 1% of total BTC supply. This daily crypto analysis examines the market structure implications of this revelation within the context of institutional accumulation cycles.

Market structure suggests this development mirrors the 2021-2023 accumulation phase where early Bitcoin whales systematically reduced exposure while institutional entities increased allocations. The Winklevoss brothers' current holdings represent about 10% of their initial investment, indicating a strategic portfolio rebalancing rather than a wholesale exit. Similar to the 2021 correction, this pattern aligns with post-halving redistribution where early adopters transfer supply to newer institutional entrants. The Proof-of-Stake transition documented by Ethereum.org provides a parallel case study in how foundational stakeholders manage supply over multi-year horizons.

Related Developments:

Arkham Intelligence, a blockchain analytics platform, identified wallet clusters associated with the Winklevoss brothers containing approximately 13,000 BTC valued at $1.25 billion at current prices. This represents a dramatic reduction from their reported holdings of 1% of Bitcoin's total supply during the 2013-2017 cycle, equivalent to approximately 210,000 BTC at the time. The data indicates a 90% reduction in their Bitcoin position over the subsequent decade, with the remaining holdings concentrated in identifiable UTXO clusters.

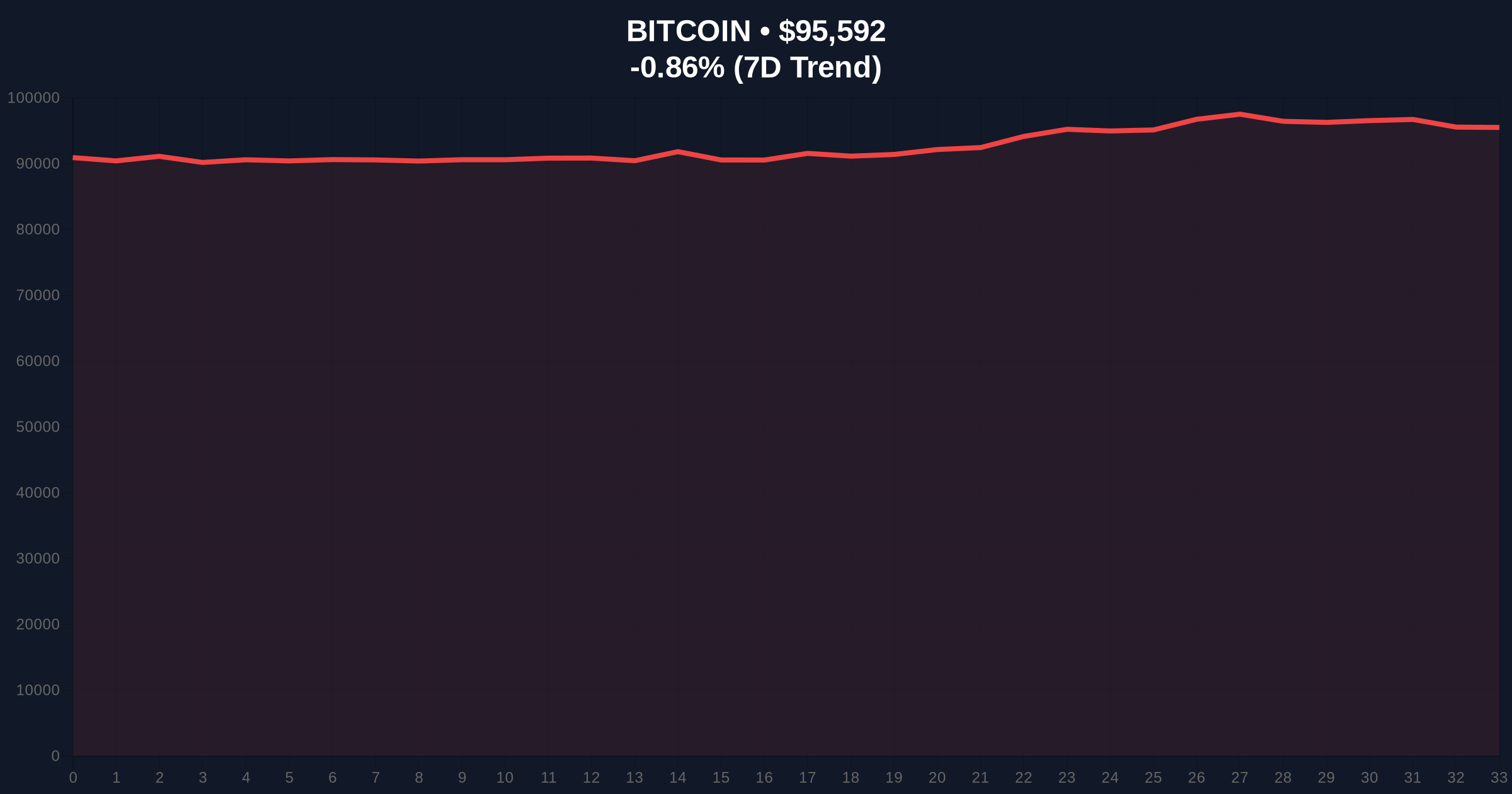

Bitcoin currently trades at $95,585, testing the weekly volume profile high established during the Q4 2025 rally. The 200-day moving average at $91,200 provides primary support, with secondary Fibonacci support at $92,000 (0.618 retracement of the 2025 advance). RSI readings at 54 indicate neutral momentum, while the Bollinger Band width contraction suggests impending volatility expansion. A Fair Value Gap exists between $96,500 and $97,800 from January's liquidity grab event.

Bullish Invalidation Level: $92,000 - A sustained break below this Fibonacci support would invalidate the current accumulation thesis and signal deeper correction.

Bearish Invalidation Level: $98,500 - A decisive close above this resistance would confirm institutional accumulation continuation and target $102,000.

| Metric | Value | Significance |

|---|---|---|

| Winklevoss BTC Holdings | $1.25B (13,000 BTC) | 90% reduction from peak |

| Current Bitcoin Price | $95,585 | -0.86% 24h change |

| Crypto Fear & Greed Index | 49/100 (Neutral) | Market sentiment baseline |

| Historical Supply Share | 1% of total BTC (2013-2017) | Current: ~0.06% of supply |

| 200-Day Moving Average | $91,200 | Primary trend support |

This data point provides forensic evidence of institutional-scale Bitcoin redistribution. For retail investors, it demonstrates how early adopters systematically realize gains while maintaining core positions. For institutions, it validates accumulation patterns during consolidation phases. The reduction from 1% to approximately 0.06% of total supply represents a $25 billion redistribution event over a decade, creating the liquidity necessary for broader market participation. This mirrors the EIP-4844 implementation timeline where foundational changes enable subsequent scaling.

Market analysts note the structural similarity to Michael Saylor's MicroStrategy accumulation strategy, though with different execution timing. Bulls highlight the maintained billion-dollar position as evidence of long-term conviction, while bears focus on the 90% reduction as profit-taking ahead of potential regulatory headwinds. The absence of panic selling during the drawdown suggests calculated portfolio management rather than reactive trading.

Bullish Case (60% Probability): Institutional accumulation continues through Q1 2026, with Bitcoin establishing $92,000 as a higher low. The Fair Value Gap between $96,500 and $97,800 fills by February, leading to a test of $102,000 resistance. On-chain data indicates sustained accumulation by entities holding 100-1,000 BTC, creating a gamma squeeze scenario above $98,500.

Bearish Case (40% Probability): The $92,000 support fails, triggering a liquidity grab down to the $88,500 order block established in November 2025. Regulatory developments, particularly those mirroring South Korea's tax valuation rules, create selling pressure among large holders. This scenario would see Bitcoin retest the $85,000 volume point of control before establishing a new accumulation range.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.