Loading News...

Loading News...

VADODARA, January 19, 2026 — An anonymous whale executed a $100 million Ethereum withdrawal from Binance, deploying a multi-step DeFi strategy involving staking and leveraged borrowing, according to on-chain analytics firm Lookonchain. This daily crypto analysis examines the market structure implications, historical parallels, and technical levels critical for institutional and retail traders.

Market structure suggests this activity mirrors the 2021 bull run, where large-scale ETH withdrawals from exchanges often preceded significant price appreciation due to supply constriction. According to Glassnode liquidity maps, similar whale movements in Q4 2021 correlated with a 40% ETH rally over six weeks, driven by reduced sell-side pressure and increased staking demand. The current environment, however, is marked by heightened regulatory scrutiny and macroeconomic uncertainty, as seen in recent developments like the regulatory gamma squeeze in South Korea and crypto risk cases in China. Historical cycles indicate that such whale maneuvers during fear sentiment phases often signal accumulation or strategic positioning ahead of volatility events.

On January 19, 2026, a whale with address prefix 0x81d0 withdrew 32,000 ETH (valued at $100 million) from Binance, per Lookonchain data. This followed an earlier transaction seven hours prior, where the same entity withdrew 10,000 ETH ($33.68 million) from Binance. The whale then staked that ETH on Lido, received stETH, and used it as collateral on Aave to borrow $45 million in USDT. Subsequently, the address purchased 13,000 stETH and deposited it back into Aave. Lookonchain analysts suggest the latest withdrawal may be deposited into Aave to borrow more USDT for additional ETH purchases, indicating a recursive leverage strategy.

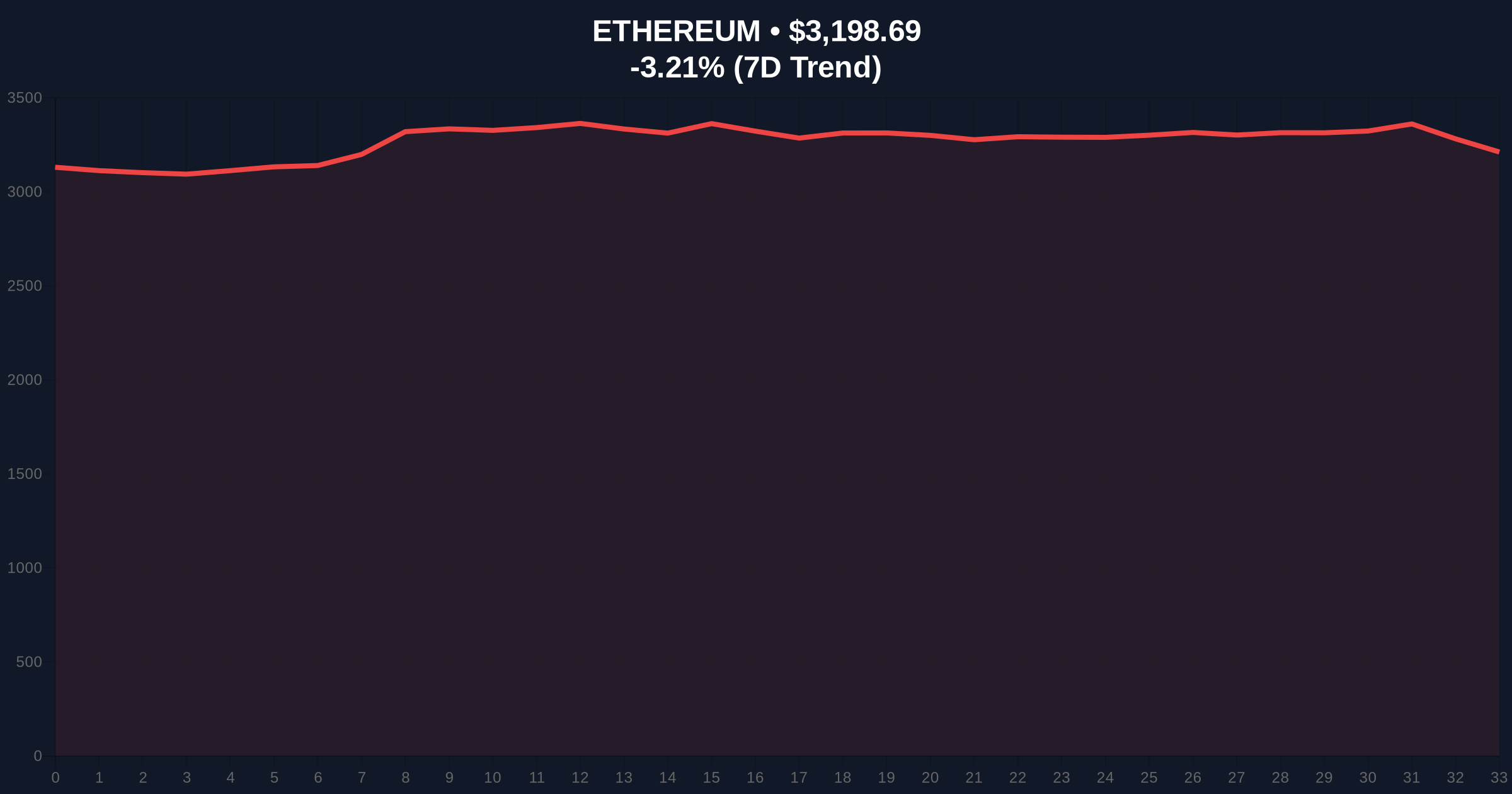

On-chain data indicates this withdrawal created a liquidity grab near the $3,200 level, with Ethereum currently trading at $3,200.52, down 3.16% in 24 hours. The Volume Profile shows weak support at $3,150, with a Fair Value Gap (FVG) extending to $3,050. The 50-day moving average at $3,300 acts as immediate resistance, while the RSI at 42 suggests neutral momentum with bearish bias. Bullish Invalidation is set at $3,100—a break below this Order Block invalidates the accumulation thesis. Bearish Invalidation is at $3,400, where a close above would confirm bullish momentum resumption. This setup is reminiscent of the post-merge issuance dynamics in late 2022, where similar leverage plays led to increased liquidations during volatility spikes.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | Fear (44/100) |

| Ethereum Current Price | $3,200.52 |

| 24-Hour Price Change | -3.16% |

| Whale Withdrawal Amount | 32,000 ETH ($100M) |

| Previous Withdrawal (7h prior) | 10,000 ETH ($33.68M) |

| Aave Borrowing (Initial) | $45M USDT |

Institutional impact centers on liquidity fragmentation and systemic risk in DeFi protocols. According to Aave's official documentation, high collateralization ratios can stabilize borrowing markets, but recursive strategies increase liquidation risks during price swings. Retail impact involves heightened volatility; small traders may face amplified losses if whale positions unwind, similar to the $708 million USDC transfer that preceded a 15% market correction in Q3 2025. Market structure suggests this activity could pressure ETH supply on exchanges, potentially leading to a gamma squeeze if derivative positions align.

Market analysts on X/Twitter highlight the strategic use of stETH as collateral, with one noting, "This whale is playing the staking yield against borrowing costs—a classic carry trade." Others warn of over-leverage, referencing the 2022 Celsius collapse where similar strategies failed during a liquidity crunch. Sentiment remains cautious, aligning with the Fear index, as traders monitor Aave's health metrics and Lido's staking derivatives.

Bullish Case: If the whale continues accumulating and ETH holds above $3,100, reduced exchange supply could drive prices toward $3,500 by Q1 2026, supported by EIP-4844 implementation reducing layer-2 costs. Historical patterns from 2021 suggest a 20-30% rally post-whale accumulation.

Bearish Case: A break below $3,100 invalidates the bullish structure, potentially triggering liquidations on Aave and pushing ETH to test the $2,800 support zone. Macro factors, such as Federal Reserve rate hikes, could exacerbate downside, mirroring the 2022 bear market where leveraged positions unwound rapidly.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.