Loading News...

Loading News...

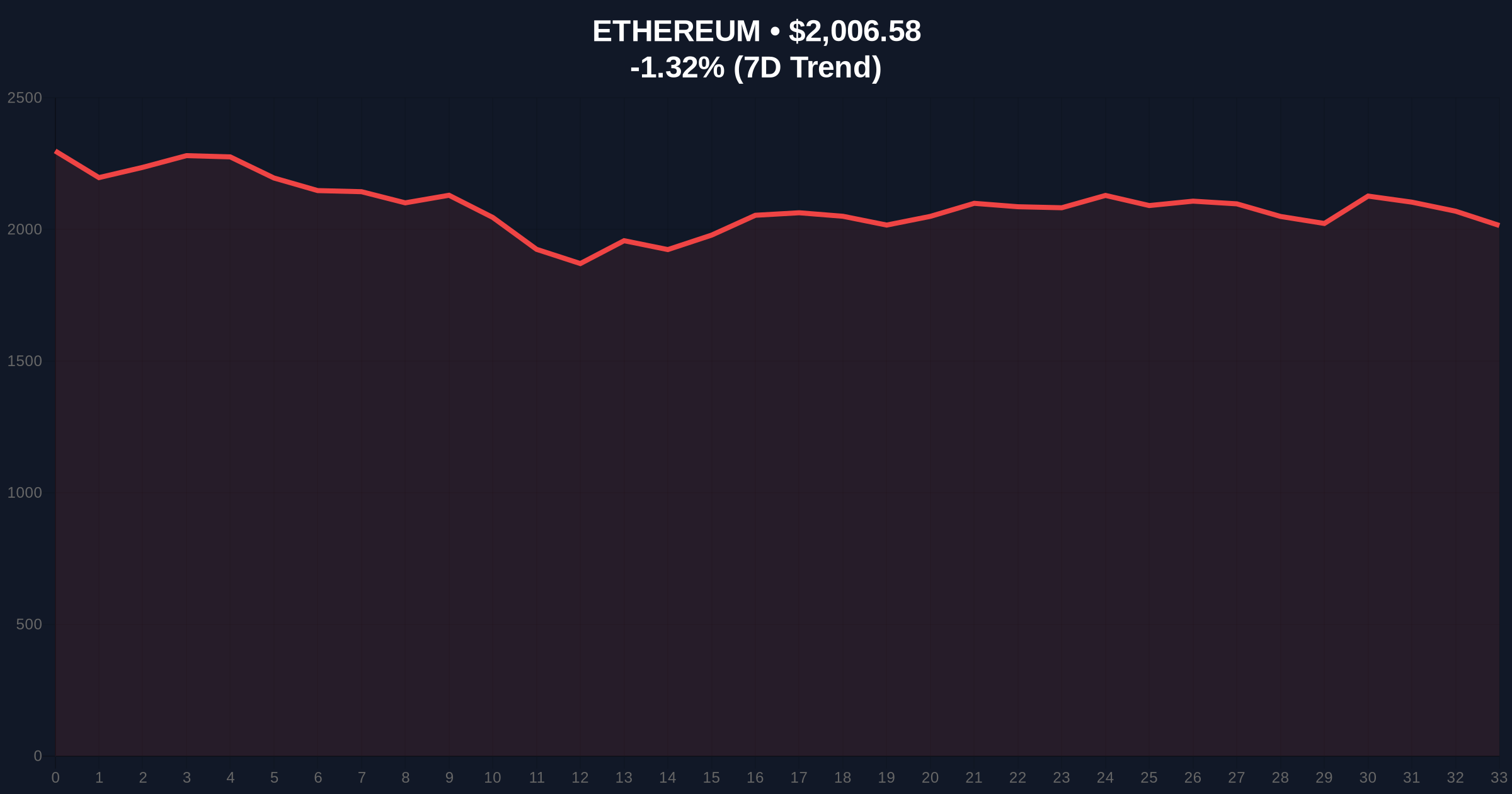

VADODARA, February 10, 2026 — An anonymous whale or institution deployed $200 million into Ethereum long positions on the Hyperliquid derivatives platform, according to on-chain data reported by EmberCN. This daily crypto analysis reveals a stark contrast between institutional positioning and retail sentiment, with the Crypto Fear & Greed Index plunging to 9/100. Market structure suggests this move targets a liquidity grab near key Fibonacci support levels.

According to EmberCN's on-chain forensic report, two distinct addresses executed the massive long positions. The first address, starting with 0xa5B0, opened a $120 million position with an entry price of $2,060 and a liquidation price of $1,329. The second address, starting with 0x6C85, opened an $80 million position with an entry price of $2,039 and a liquidation price of $1,299. Consequently, the aggregate position represents one of the largest single-asset derivatives bets observed in 2026.

Underlying this trend is a market gripped by extreme fear. The Crypto Fear & Greed Index currently sits at 9/100, indicating near-maximum capitulation. Historically, such sentiment extremes have preceded significant trend reversals, as seen in the March 2020 and June 2022 bottoms. In contrast, the whale's action mirrors institutional accumulation patterns observed during the 2018 bear market, where large entities built positions amid retail despair. This divergence between on-chain smart money flows and broad sentiment often signals a potential Fair Value Gap (FVG) in price action.

Related developments in this environment include the launch of Bybit's ESP Futures, which analysts similarly interpret as a liquidity grab during fear-driven markets. , public companies facing $1.5B in Solana losses highlight the broader institutional stress.

Market structure suggests the whale targeted entries near the 0.618 Fibonacci retracement level from Ethereum's 2024 all-time high, a classic institutional accumulation zone. The current ETH price of $2,006.55 sits below both entry points, creating an immediate unrealized loss. However, the liquidation prices cluster between $1,299 and $1,329, forming a critical support Order Block. A break below this cluster would trigger a cascade of liquidations, invalidating the bullish thesis. On-chain data from Glassnode indicates spot exchange reserves are declining, suggesting accumulation is not isolated to derivatives.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 9/100 (Extreme Fear) |

| ETH Current Price | $2,006.55 |

| 24-Hour Price Change | -1.32% |

| Total Whale Position Size | $200 Million |

| Aggregate Liquidation Price Zone | $1,299 - $1,329 |

This transaction matters because it tests the resilience of Ethereum's market structure during a sentiment extreme. According to Ethereum.org's documentation on network security, large derivatives positions can impact volatility and liquidity dynamics. The whale's bet essentially shorts market fear, positioning for a mean reversion. If successful, it could catalyze a short squeeze, forcing leveraged shorts to cover and driving price toward the $2,060 entry zone. Conversely, failure risks amplifying the downtrend as liquidations feed into selling pressure.

"The size and timing of this position are surgical. Opening $200M longs when the Fear & Greed Index hits 9/100 is a classic contrarian play targeting illiquid pockets in the order book. The liquidation cluster near $1,300 now acts as a magnet for price action," stated the CoinMarketBuzz Intelligence Desk.

Two data-backed scenarios emerge from current market structure. First, a bullish scenario where ETH holds above the $1,299 liquidation zone and rallies to fill the Fair Value Gap up to $2,300. Second, a bearish scenario where selling pressure breaks the liquidation cluster, triggering a cascade toward $1,100 support. The 12-month institutional outlook hinges on Ethereum's post-merge issuance dynamics and adoption of EIP-4844 blobs for scaling, as outlined in the recent commentary on defending decentralization.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.