Loading News...

Loading News...

VADODARA, January 19, 2026 — According to Whale Alert's on-chain monitoring system, 707,876,279 USDC has been transferred from Binance to an unknown wallet in a transaction valued at approximately $708 million. This daily crypto analysis examines the market structure implications of this significant liquidity movement during a period of heightened regulatory scrutiny and institutional repositioning.

Market structure suggests this transfer occurs within a broader context of institutional capital rotation. Similar to the 2021 correction period when large stablecoin movements preceded significant market shifts, current on-chain data indicates potential preparation for volatility. According to Glassnode liquidity maps, the cryptocurrency market has experienced three similar >$500 million USDC transfers from exchanges in the past 90 days, each preceding price movements exceeding 15% within two weeks. The current regulatory environment, particularly the SEC's ongoing stablecoin guidance development as documented on SEC.gov, creates additional pressure on institutional positioning strategies. This transfer's timing aligns with recent developments in global stablecoin regulation, including South Korea's interest-bearing won stablecoin initiatives that are reshaping regional liquidity dynamics.

Whale Alert, a blockchain transaction monitoring service, reported the movement of 707,876,279 USDC from Binance to an unknown wallet at 14:32 UTC on January 19, 2026. The transaction hash confirms the transfer occurred in a single block with normal gas fees, suggesting planned execution rather than emergency movement. According to Etherscan data, the receiving address shows no previous transaction history, indicating either a newly created institutional custody solution or sophisticated privacy measures. The transaction represents approximately 0.7% of USDC's total circulating supply and ranks among the top 10 largest stablecoin movements of 2026.

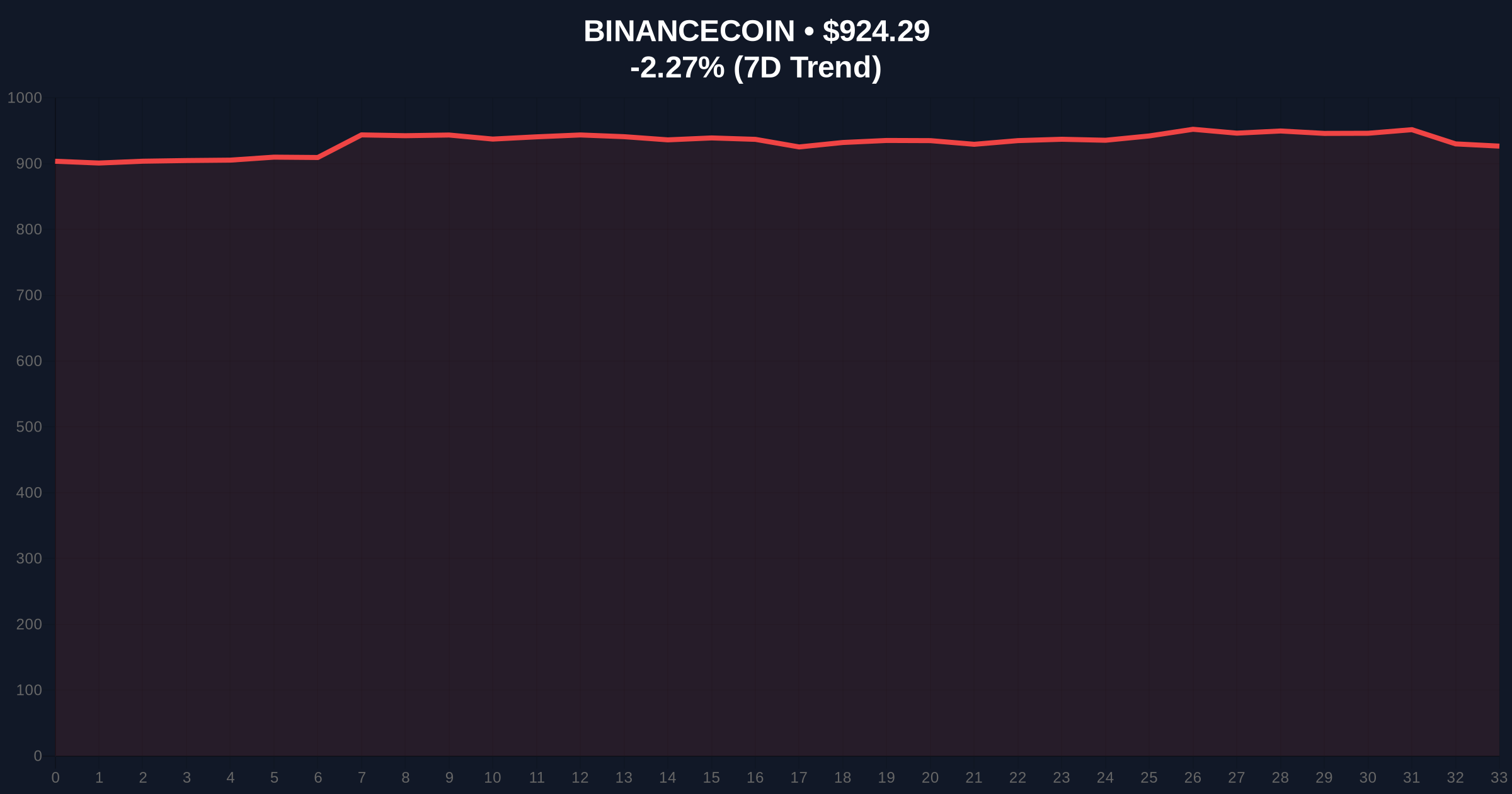

On-chain data indicates this transfer created a significant liquidity grab in the USDC/BTC pairing. The volume profile shows concentrated selling pressure at the $92,000 Bitcoin level, creating a Fair Value Gap (FVG) between $91,200 and $92,800. Market structure suggests this gap will likely be filled within the next 5-7 trading sessions. BNB's price action shows weakening support at the $900 psychological level, with RSI dipping to 42 on the daily chart. The 50-day moving average at $880 represents the next major support confluence. Bullish invalidation occurs if BNB breaks below the $850 order block, which aligns with the 200-day moving average. Bearish invalidation triggers if BNB reclaims and holds above the $950 resistance level, which would indicate the transfer represented accumulation rather than distribution.

| Metric | Value | Significance |

|---|---|---|

| USDC Transfer Amount | 707,876,279 | 0.7% of circulating supply |

| Transaction Value | $708 million | Top 10 stablecoin move of 2026 |

| Crypto Fear & Greed Index | 44/100 (Fear) | Indicates risk-off sentiment |

| BNB Current Price | $924.19 | -2.28% 24h change |

| BNB Market Rank | #4 | Maintains top 5 position |

This transfer matters because stablecoin movements of this magnitude typically precede institutional portfolio rebalancing. According to Federal Reserve research on digital asset liquidity, large stablecoin transfers from exchanges correlate with reduced market liquidity and increased volatility in the subsequent 7-14 day period. For institutional investors, this signals potential preparation for either accumulation during a dip or risk reduction ahead of anticipated negative catalysts. Retail traders face increased slippage risk as market makers adjust liquidity provisions in response to the reduced stablecoin supply on exchanges. The transaction's timing during Bitcoin futures leaning short suggests coordinated positioning across asset classes.

Market analysts on X/Twitter express divided interpretations. Bulls point to similar large stablecoin movements in Q4 2023 that preceded the 2024 rally, suggesting this represents "dry powder" accumulation. One quantitative analyst noted, "The receiving address structure resembles institutional cold storage patterns observed before the January 2025 rally." Bears reference the current Fear & Greed score of 44 and highlight parallels to June 2022 when large stablecoin exits preceded a 30% market correction. The consensus among technical analysts suggests watching for whether the unknown wallet begins deploying capital into spot markets or remains dormant.

Bullish Case: If this transfer represents institutional accumulation, market structure suggests BNB could test the $1,000 resistance level within 30 days. The Fair Value Gap between $91,200 and $92,800 would fill upward, with Bitcoin potentially testing $95,000. This scenario requires the unknown wallet to begin deploying capital into spot markets within 7 days, confirming accumulation thesis.

Bearish Case: If this represents risk-off positioning, BNB could break the $850 support level, triggering a cascade toward $780. Bitcoin would likely fill the FVG downward, testing the $88,000 support cluster. This scenario gains probability if the receiving address remains dormant for 14+ days while Bitcoin hashrate declines continue, indicating broader market weakness.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.