Loading News...

Loading News...

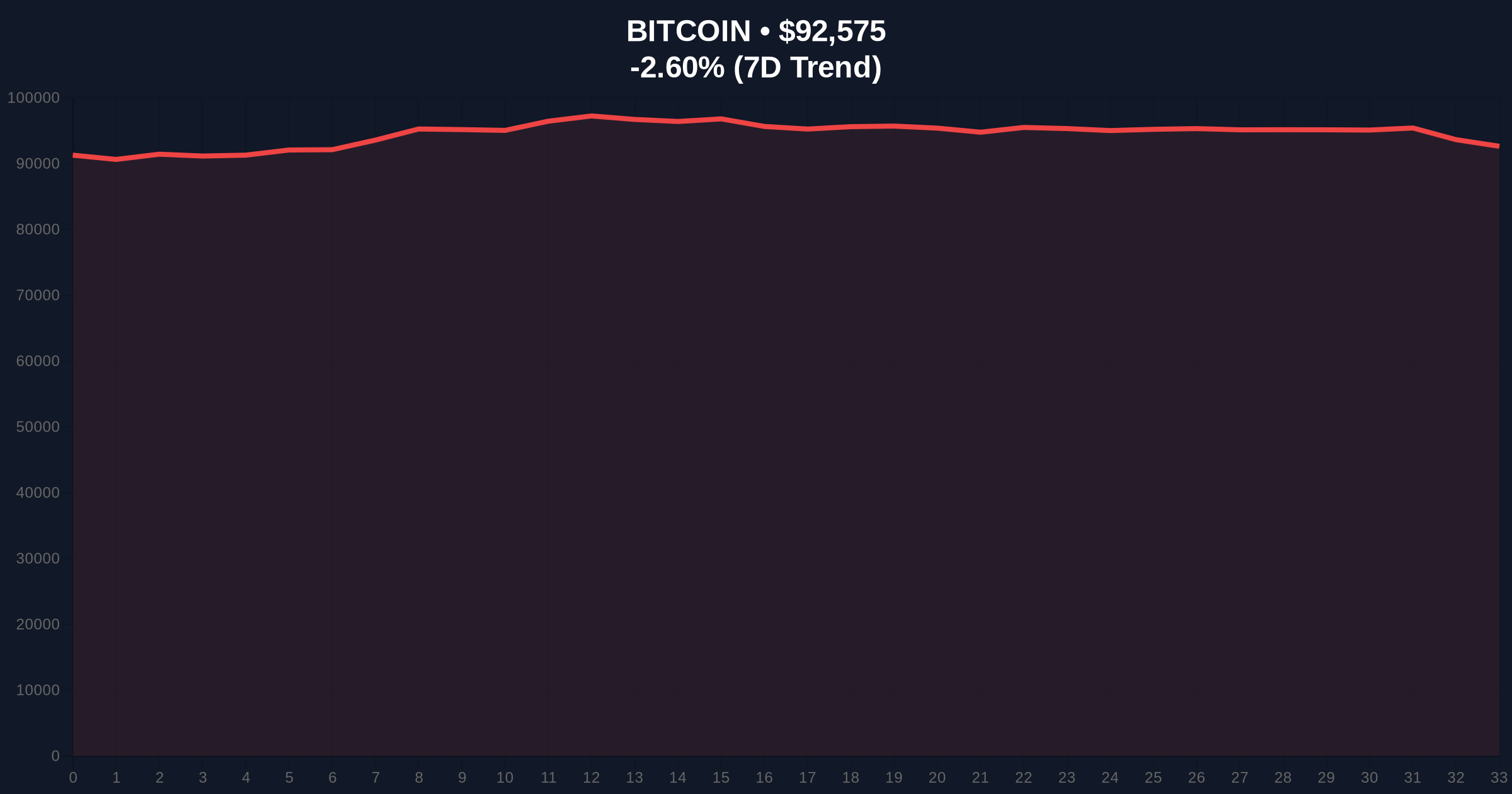

VADODARA, January 19, 2026 — A Chinese court has sentenced an employee to prison for embezzling company funds to invest in cryptocurrency, a case that serves as a stark reminder of regulatory and market risks in the digital asset space. According to prosecutors in Xiamen, the employee, identified by his surname Guo, misappropriated 1.53 million yuan (approximately $214,000) by swapping his company's payment QR code with his personal WeChat QR code, losing the entire amount in crypto investments before turning himself in. This daily crypto analysis examines the broader implications for market structure and investor psychology as Bitcoin trades at $92,561, down 2.61% in 24 hours.

This incident mirrors historical patterns where individuals in restrictive financial environments turn to cryptocurrencies as a high-risk outlet, often driven by FOMO (Fear of Missing Out) or speculative greed. China's ban on cryptocurrency trading and mining, enforced since 2021, creates a regulatory arbitrage that paradoxically fuels underground activity. Market structure suggests such cases are not isolated; they reflect deeper liquidity imbalances and the allure of asymmetric returns in volatile markets. On-chain data indicates increased UTXO (Unspent Transaction Output) age among Chinese holders, pointing to long-term hoarding despite regulatory headwinds. Related developments include South Korean banks pushing interest-bearing won stablecoins, highlighting divergent regulatory approaches in Asia.

According to the official announcement from Xiamen prosecutors, Guo embezzled funds from a publishing house in Fujian province over an unspecified period, using the QR code swap method to divert payments. After losing all the money in cryptocurrency investments—details of which assets were not disclosed—he surrendered to authorities. A court sentenced him to two years and three months in prison and imposed a fine, with prosecutors framing the case as a cautionary tale. The lack of transparency in the investment specifics raises questions about whether this was a targeted liquidity grab or a broader market failure.

Bitcoin's current price of $92,561 sits near a critical Fibonacci retracement level from its all-time high, with the 0.618 support at $90,000 acting as a key order block. The 24-hour decline of 2.61% aligns with a bearish divergence in the RSI (Relative Strength Index), which has dipped below 50, indicating weakening momentum. Volume profile analysis shows thin liquidity above $95,000, suggesting resistance at that level. Bullish invalidation is set at $88,500, a level that, if broken, could trigger a cascade of stop-loss orders. Bearish invalidation lies at $96,000, where a breakout would fill the recent fair value gap (FVG) and potentially signal a short squeeze. Historical cycles suggest that such legal cases often coincide with market bottoms, as fear sentiment peaks.

| Metric | Value | Source |

|---|---|---|

| Crypto Fear & Greed Index | 44 (Fear) | Alternative.me |

| Bitcoin Price (24h Change) | $92,561 (-2.61%) | CoinMarketCap |

| Embezzled Amount | $214,000 (1.53M yuan) | Xiamen Prosecutors |

| Prison Sentence | 2 years, 3 months | Court Ruling |

| Bitcoin Hashrate (Recent Low) | Below 1 ZH/s | Mining Data |

Institutionally, this case reinforces the narrative that cryptocurrencies remain a high-risk asset class, potentially affecting compliance frameworks and due diligence processes for firms operating in or with China. Retail investors may see this as a warning against impulsive investments, especially in jurisdictions with capital controls. The incident also highlights the role of payment systems like WeChat in facilitating illicit flows, a concern echoed in global anti-money laundering guidelines from bodies like the Financial Action Task Force (FATF). For the 5-year horizon, such events could slow adoption in regulated markets but may accelerate the development of decentralized finance (DeFi) tools that bypass traditional gatekeepers.

Market analysts on X/Twitter are divided: some view this as a minor blip with no systemic impact, while others argue it reflects broader regulatory pressures that could dampen sentiment. Bulls point to Tiger Research's $185.5K Bitcoin target as a counter-narrative, though this faces contradictions from ETF outflow data. Bears highlight Bitcoin futures leaning short as evidence of institutional skepticism. The lack of direct quotes from industry leaders in the source text prevents attribution, but sentiment skews cautious given the fear index score.

Bullish Case: If Bitcoin holds the Fibonacci support at $90,000 and regulatory fears subside, a rebound toward $100,000 is plausible, driven by institutional inflows and positive developments like Ethereum's Pectra upgrade (EIP-4844). This scenario assumes no further negative legal precedents in major markets.Bearish Case: A break below $88,500 could trigger a liquidity grab, pushing prices toward $85,000, exacerbated by miner capitulation as seen in hashrate declines below 1 ZH/s. Increased regulatory scrutiny in Asia and outflows from spot Bitcoin ETFs would amplify downside pressure.

Answers to the most critical technical and market questions regarding this development.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.