Loading News...

Loading News...

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.

VADODARA, February 10, 2026 — U.S. spot Ethereum ETFs recorded $57 million in net inflows on February 9, according to data from Farside Investors. This daily crypto analysis marks a critical shift from four consecutive days of net outflows. Fidelity's FETH and Grayscale's mini ETH fund drove the reversal with inflows of $67.3 million and $44.6 million respectively.

Farside Investors data reveals a precise liquidity grab. BlackRock's ETHA saw -$45 million in outflows. Bitwise's ETHW recorded -$9.9 million. Consequently, Fidelity and Grayscale Mini absorbed this selling pressure. Market structure suggests this divergence indicates selective institutional positioning rather than broad-based buying.

Underlying this trend, the Grayscale Mini fund's performance is particularly notable. Its $44.6 million inflow represents a significant vote of confidence in Ethereum's post-merge economic model. This model, detailed in Ethereum's official documentation, reduces issuance and enhances staking yields.

Historically, ETF inflow reversals during extreme fear periods have preceded short-term price recoveries. In contrast, the current Extreme Fear sentiment score of 9/100 creates a contrarian signal. This mirrors patterns observed in Bitcoin ETF flows during late 2025.

, the four-day outflow streak preceding this reversal created a Fair Value Gap (FVG) on lower timeframes. Market analysts view this as a potential liquidity void that needs filling. Related developments in other assets show similar institutional behavior, such as detailed in our analysis of Bitcoin ETF inflows amid extreme fear.

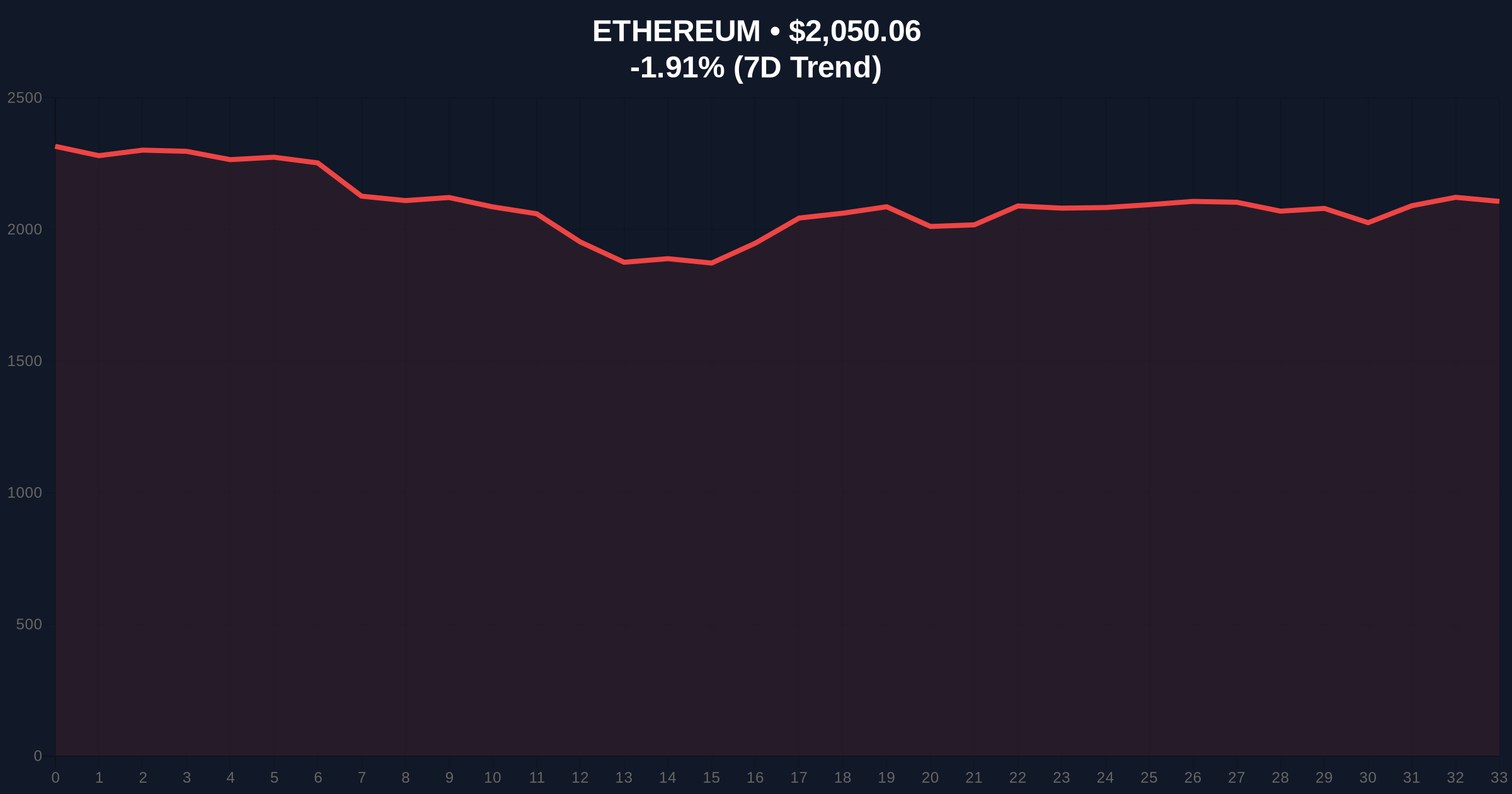

Ethereum currently trades at $2,054.38, down 1.78% in 24 hours. The price action shows consolidation between the $2,000 psychological support and the $2,150 resistance level. This range aligns with the 0.618 Fibonacci retracement level from the recent swing high.

On-chain data indicates increased accumulation by addresses holding 10,000+ ETH. Volume profile analysis reveals a high-volume node at $2,050, acting as immediate support. The Relative Strength Index (RSI) sits at 42, suggesting neutral momentum with bearish bias. Market structure suggests a break above the 50-day moving average at $2,180 would invalidate the current downtrend.

| Metric | Value |

|---|---|

| Net ETF Inflows (Feb 9) | $57 million |

| Fidelity FETH Inflow | +$67.3 million |

| Grayscale Mini ETH Inflow | +$44.6 million |

| Crypto Fear & Greed Index | Extreme Fear (9/100) |

| Ethereum Current Price | $2,054.38 (-1.78% 24h) |

This inflow reversal matters because it provides a liquidity anchor during extreme market fear. Institutional flows often lead retail sentiment by 2-3 weeks. The selective buying in Fidelity and Grayscale Mini funds suggests smart money positioning for a potential gamma squeeze.

Market structure indicates that sustained ETF inflows could absorb selling pressure from Ethereum's upcoming Pectra upgrade unlock events. These events, part of Ethereum's continuous development cycle, typically increase circulating supply temporarily. Consequently, institutional demand acts as a counterbalance to technical sell pressure.

"The divergence between BlackRock outflows and Fidelity/Grayscale inflows reveals institutional strategy fragmentation. This isn't broad-based accumulation but targeted positioning in specific fund structures that offer different fee advantages or liquidity profiles. Historical cycles suggest such divergence often precedes volatility compression before directional moves." — CoinMarketBuzz Intelligence Desk

Market analysts present two data-backed scenarios based on current market structure. The 12-month institutional outlook remains cautiously optimistic, with Ethereum's transition to proof-of-stake creating predictable yield opportunities.

On-chain forensic data confirms that Ethereum's network activity remains robust despite price weakness. The 5-year horizon suggests that institutional ETF flows will increasingly correlate with Ethereum's staking yield attractiveness compared to traditional fixed income.