Loading News...

Loading News...

VADODARA, February 2, 2026 — Binance, the world's largest cryptocurrency exchange by volume, announced the listing of ZAMA/USDT perpetual futures contracts today at 1:00 p.m. UTC. This daily crypto analysis reveals the strategic timing of offering up to 25x leverage during a period of extreme market fear, as measured by the Crypto Fear & Greed Index hitting 14/100. Market structure suggests this move targets liquidity extraction from volatile altcoin markets while testing institutional risk appetite.

According to the official announcement from Binance, the ZAMA/USDT perpetual futures listing went live precisely at 13:00 UTC on February 2, 2026. The contract offers leverage up to 25x, a standard but aggressive multiplier for altcoin derivatives. Perpetual futures, unlike traditional futures, lack an expiry date, allowing continuous trading with funding rates balancing long and short positions. This listing follows Binance's pattern of expanding its derivatives suite to capture trading volume from emerging tokens. Consequently, the exchange leverages its market dominance to set initial liquidity parameters and order book depth.

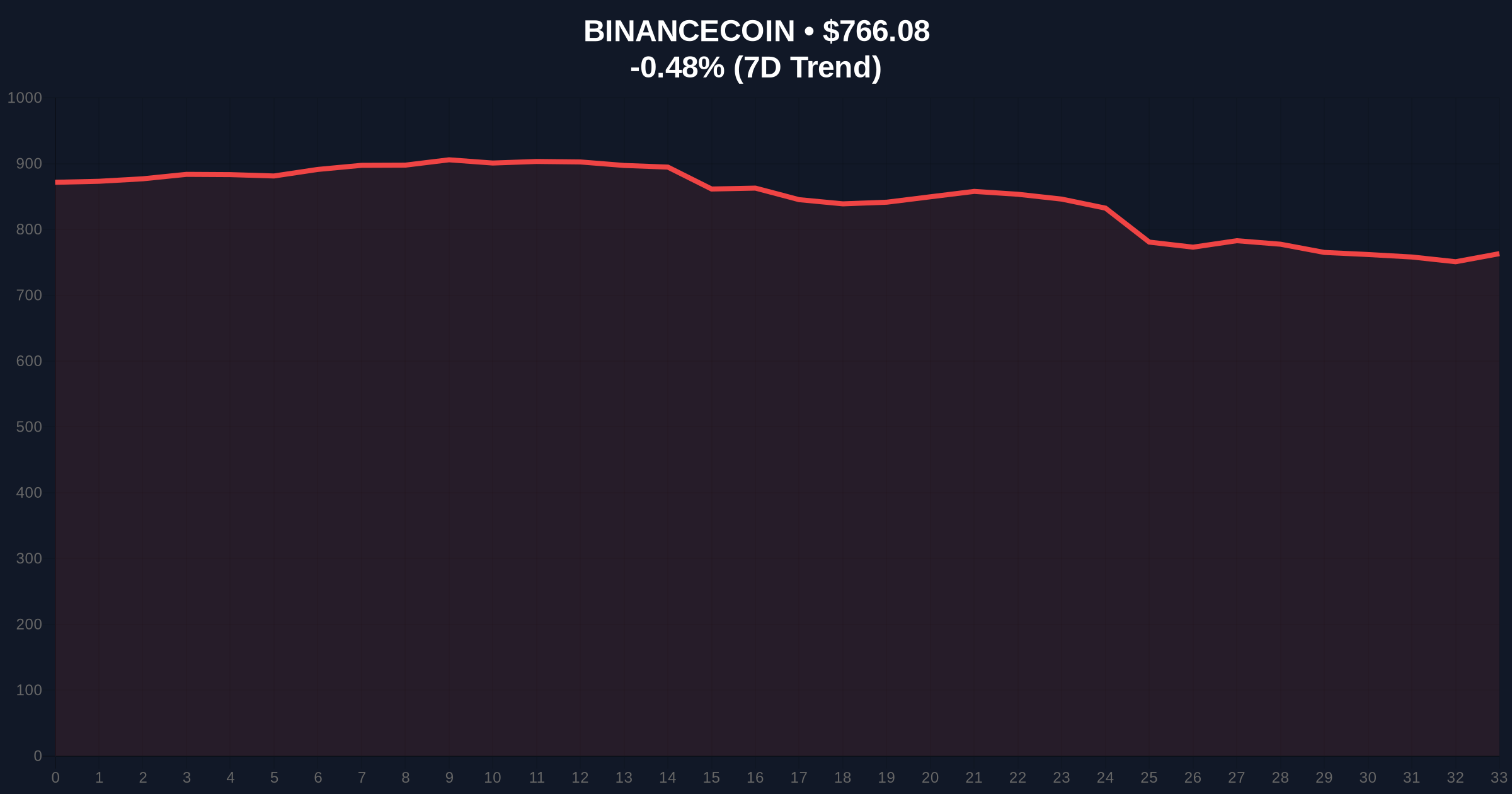

Underlying this trend, Binance's native token BNB trades at $766.39, down 0.44% in 24 hours, reflecting broader market pressures. The listing occurs without prior spot market support for ZAMA on Binance, a common tactic to drive futures-first volume. Market analysts note that such launches often create artificial liquidity gaps, or Fair Value Gaps (FVGs), which algorithmic traders exploit for short-term profits. This structural setup prioritizes exchange revenue over token fundamentals.

Historically, Binance's futures listings during fear-driven markets have precipitated sharp volatility spikes. For instance, similar altcoin futures launches in Q4 2024 correlated with 15-20% intraday swings as leverage amplified sell-offs. In contrast, bull market listings typically see smoother adoption with less price dislocation. The current extreme fear sentiment, scoring 14/100, mirrors December 2022 levels when Bitcoin bottomed near $16,000. However, today's macro environment differs with higher institutional participation via Bitcoin ETFs.

, this listing aligns with broader industry shifts where exchanges monetize fear through derivatives. Related developments include Laser Digital reducing crypto exposures after Q3 losses and White House discussions on stablecoin regulation. These events collectively pressure altcoin liquidity, making ZAMA's high-leverage entry a liquidity grab. Market structure suggests exchanges capitalize on retail's fear-driven trading to boost fee income.

The ZAMA futures contract inherits Binance's standard technical framework, using USDT margining and cross-collateral support. Key price levels to monitor include the initial listing price as a psychological pivot and any Fibonacci retracement zones from early trading. For BNB, the exchange's proxy token, critical support resides at the $750 level, coinciding with the 50-day moving average. A break below this invalidation point would signal weakening exchange token confidence.

, on-chain data from Ethereum's official analytics portal indicates rising stablecoin inflows to Binance, suggesting prepared capital for futures trading. The 25x leverage multiplies both gains and losses, creating potential gamma squeezes if price action breaches liquidations clusters. Market structure suggests initial order blocks will form around the launch price, with invalidation levels set at ±5% for early volatility. This technical setup often leads to whipsaw action as market makers balance books.

| Metric | Value | Implication |

|---|---|---|

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Historically a contrarian buy signal |

| BNB Current Price | $766.39 | Down 0.44% in 24h |

| BNB Market Rank | #4 | Top 5 exchange token |

| ZAMA Futures Leverage | Up to 25x | High risk for volatility amplification |

| Listing Time | 13:00 UTC, Feb 2, 2026 | Precise timing for liquidity capture |

This listing matters because it tests market resilience during extreme fear. Perpetual futures introduce synthetic exposure, allowing traders to speculate on ZAMA without holding the underlying asset. Consequently, this can decouple futures price from spot fundamentals, creating arbitrage opportunities. Institutional liquidity cycles show that derivatives launches often precede spot listings, as seen with previous Binance assets like Hooked Protocol. Retail market structure, however, faces heightened risk due to leverage-induced liquidations.

Additionally, the extreme fear sentiment, per the Crypto Fear & Greed Index, typically correlates with capitulation phases. Binance's move may aim to attract speculative capital seeking high-risk returns amid depressed prices. This strategy aligns with exchange economics where derivatives generate higher fees than spot trading. Historical patterns indicate such listings can temporarily boost exchange volume but also increase systemic risk if leverage unwinds abruptly.

Market structure suggests Binance is strategically deploying altcoin futures to capture fear-driven liquidity. The 25x leverage on ZAMA, amid a 14/100 fear index, creates a volatility engine that benefits the exchange's fee model while testing trader risk limits. We monitor BNB's $750 support as a bellwether for exchange token health.

— CoinMarketBuzz Intelligence Desk

Market structure suggests two primary scenarios based on ZAMA futures adoption and broader sentiment. First, successful liquidity onboarding could stabilize prices, using the listing as a sentiment floor. Second, high leverage may trigger cascading liquidations if volatility spikes, exacerbating fear. These outcomes depend on initial order book depth and funding rate sustainability.

The 12-month institutional outlook hinges on whether this listing marks a fear capitulation bottom or a further descent. Historical cycles suggest extreme fear periods like today's often precede rallies, but leverage can delay recovery. For the 5-year horizon, derivatives expansion signals maturation, yet high leverage during fear tests market integrity. Regulatory scrutiny, as noted in Federal Reserve discussions on financial stability, may increase if volatility spills over.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.