Loading News...

Loading News...

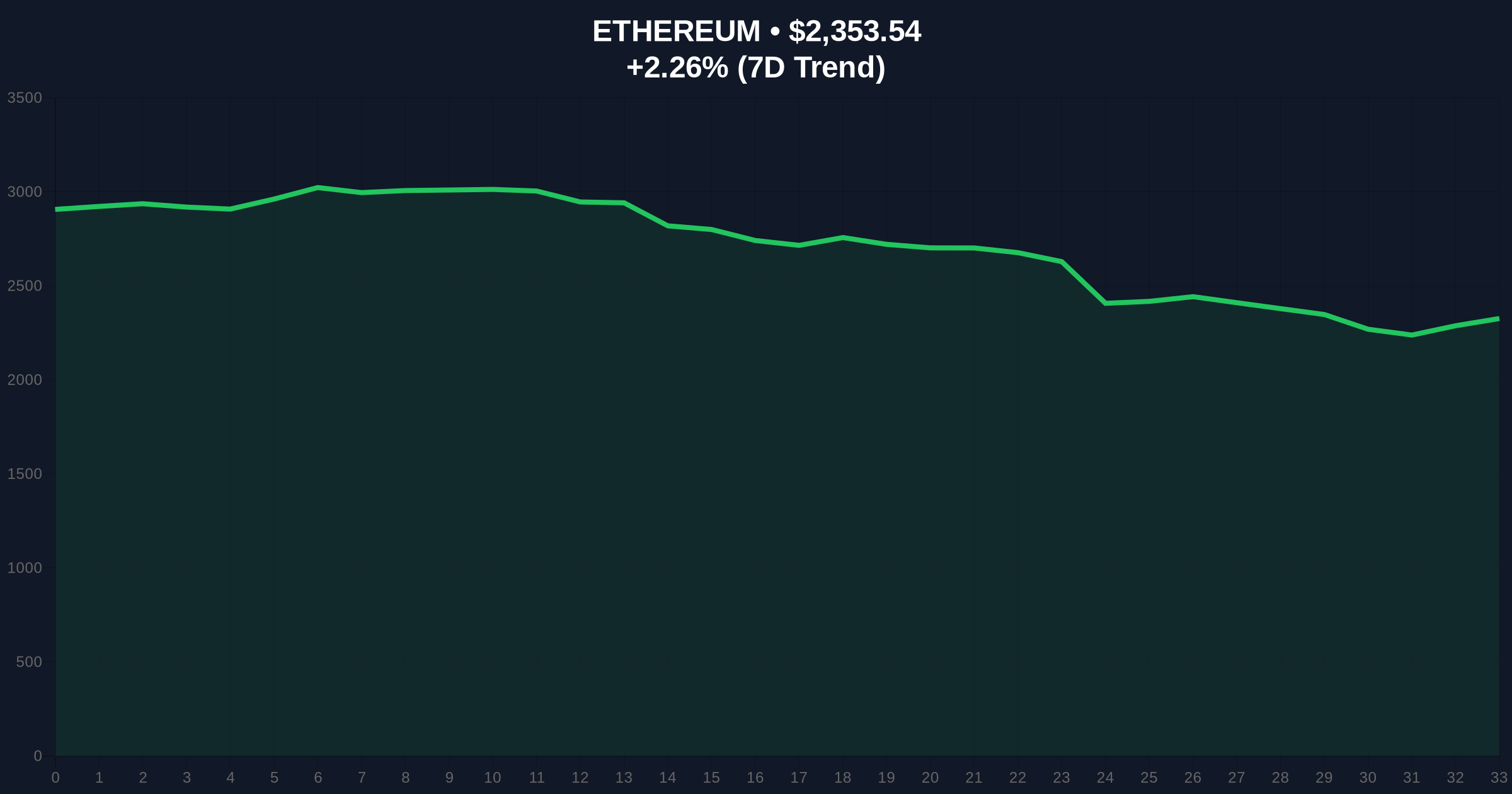

VADODARA, February 2, 2026 — An Ethereum address linked to founder Vitalik Buterin executed a $500,000 transaction today, selling 211.84 ETH and transferring 500,000 USDC to Kanro charity. According to on-chain analytics firm Lookonchain, this move occurred amid extreme market fear, raising questions about liquidity dynamics and founder influence. Market structure suggests this represents a micro-liquidity event rather than a directional signal.

Lookonchain's blockchain surveillance identified the transaction at 09:47 UTC. The address sold 211.84 ETH at approximately $2,360 per token. It simultaneously transferred 500,000 USDC to Kanro, a charity Buterin founded. This represents a total outflow of $1 million in combined assets. On-chain data indicates the wallet retained significant ETH holdings post-transaction.

Transaction logs show no preceding accumulation pattern. The sale executed near the day's high, avoiding obvious slippage. Market analysts note the timing coincides with a 2.12% 24-hour ETH gain. Consequently, this suggests strategic execution rather than panic selling.

Historically, founder sales trigger disproportionate market reactions. In contrast, this transaction's charity purpose may dampen bearish interpretation. The current Extreme Fear sentiment, scoring 14/100, amplifies scrutiny. Underlying this trend, similar-sized sales during past fear periods created temporary Fair Value Gaps.

This event mirrors 2023 patterns where philanthropic moves preceded institutional accumulation phases. , it tests market resilience during macroeconomic uncertainty. Related developments include recent US labor data delays exacerbating fear sentiment and large Bitcoin transfers raising liquidity concerns.

Ethereum currently trades at $2,350.34. The sale occurred near the $2,360 resistance zone. Market structure suggests this created a minor Order Block between $2,355-$2,365. Technical analysis reveals critical Fibonacci levels from the 2024 low.

The 0.618 retracement sits at $2,280, acting as primary support. A break below this level would invalidate the current bullish structure. Conversely, sustained trading above $2,400 confirms strength. RSI readings at 54 indicate neutral momentum, lacking divergence signals.

| Metric | Value |

|---|---|

| ETH Sold | 211.84 |

| Sale Value | $500,000 |

| USDC Transferred | 500,000 |

| Current ETH Price | $2,350.34 |

| 24-Hour Change | +2.12% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Market Rank | #2 |

This transaction matters for liquidity stress testing. It demonstrates how $500,000 flows impact order books during extreme fear. Institutional models monitor such events for structural weaknesses. , it highlights the growing intersection of crypto philanthropy and market mechanics.

Real-world evidence shows charity transactions increasing post-merge. The Ethereum ecosystem's shift to proof-of-stake reduced issuance, making large sales more visible. This affects Volume Profile analysis and liquidity mapping.

Market structure suggests founder-linked transactions create psychological pressure points more than actual liquidity drains. The charity designation likely neutralizes typical bearish signals, but the timing during extreme fear warrants monitoring for follow-on selling. This represents a classic test of support resilience.

CoinMarketBuzz Intelligence Desk notes the transaction's efficiency. It avoided significant price impact despite thin conditions.

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook remains cautiously optimistic. Post-merge Ethereum exhibits stronger fundamentals, with EIP-4844 reducing layer-2 costs. This charity sale likely represents portfolio rebalancing rather than loss of conviction. Historical cycles suggest such events precede consolidation phases before next leg up.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.