Loading News...

Loading News...

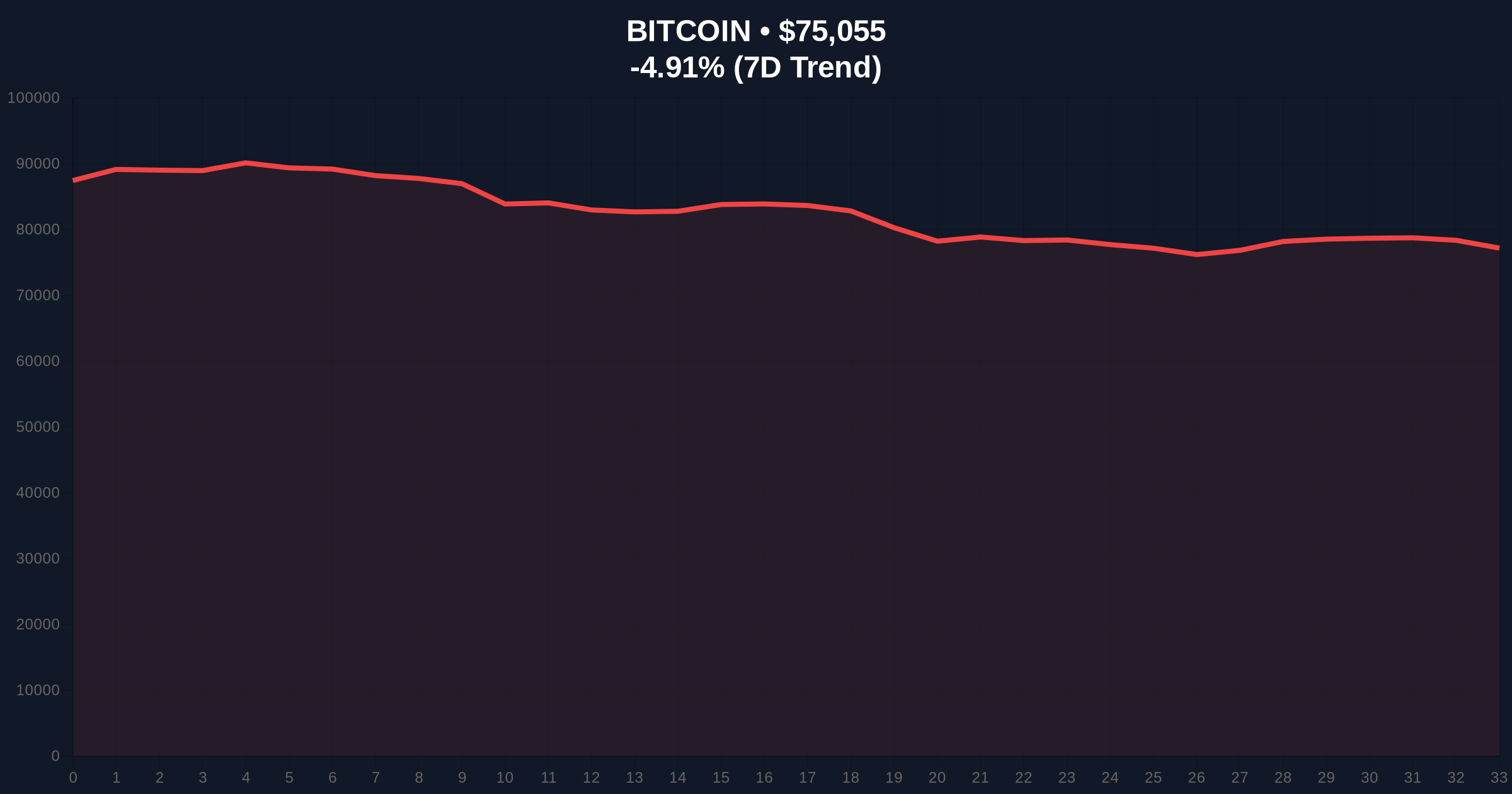

VADODARA, February 3, 2026 — VistaShares launches the BTYB ETF. This active fund blends Bitcoin price returns with U.S. Treasury bond investments. Market structure suggests a strategic liquidity grab. Bitcoin currently trades at $75,101. The Crypto Fear & Greed Index hits 17/100. This signals extreme market fear.

U.S. ETF manager VistaShares listed the BTYB ETF on the New York Stock Exchange. According to Cointelegraph, the fund provides returns linked to Bitcoin's price. It invests primarily in U.S. Treasury bonds. The allocation splits 80% to Treasurys and related products. The remaining 20% targets Bitcoin exposure. This exposure uses option strategies. Specifically, it employs call options on BlackRock's IBIT Bitcoin ETF. This structure creates a synthetic Bitcoin-Treasury hybrid. The fund's prospectus, filed with the SEC, outlines this active management approach. Market analysts note the timing. Launch occurs during a sharp Bitcoin correction. The 24-hour trend shows a -4.85% decline.

Historically, hybrid products emerge during volatility. They aim to capture upside while mitigating risk. The 2021 cycle saw similar structured products. They failed to gain traction during bull markets. In contrast, the current environment features extreme fear. This ETF launch mirrors institutional behavior in downturns. It seeks to attract risk-averse capital. Underlying this trend is a broader shift. Traditional finance increasingly integrates crypto derivatives. The BTYB ETF's use of IBIT options demonstrates this. It leverages established ETF infrastructure for Bitcoin exposure. , this launch coincides with other significant developments. For instance, TeraWulf's mining expansion shows industry resilience. Additionally, S&P's stablecoin forecast highlights long-term growth narratives amid current fear.

Bitcoin price action reveals critical levels. The current price of $75,101 sits above key Fibonacci support. Market structure suggests a Fair Value Gap (FVG) between $78,000 and $80,000. This gap acts as immediate resistance. On-chain data from Glassnode indicates increased exchange inflows. This often precedes further selling pressure. The Relative Strength Index (RSI) on daily charts reads 38. This shows oversold conditions but not extreme. The 50-day moving average at $82,500 serves as dynamic resistance. A break above this level would invalidate the bearish structure. Volume profile analysis shows low liquidity near current prices. This increases volatility risk. The Order Block from January 2026 around $72,500 (Fibonacci 0.618 level) is . It must hold to prevent a deeper correction. Historical cycles suggest such levels often attract institutional buying during fear phases.

| Metric | Value |

|---|---|

| Crypto Fear & Greed Index | 17/100 (Extreme Fear) |

| Bitcoin Current Price | $75,101 |

| Bitcoin 24h Change | -4.85% |

| BTYB ETF Treasury Allocation | 80% |

| BTYB ETF Bitcoin Exposure | 20% (via IBIT call options) |

This ETF matters for institutional liquidity cycles. It offers a regulated path to Bitcoin exposure. The Treasury backbone provides perceived safety. This could attract pension funds and conservative investors. Retail market structure may see indirect effects. Increased institutional participation often stabilizes prices long-term. However, the synthetic exposure via options introduces counterparty risk. It also decouples direct Bitcoin ownership. This contrasts with spot Bitcoin ETFs like IBIT. The launch signals maturation. Crypto derivatives integrate deeper into traditional finance. According to Ethereum.org's documentation on financial primitives, such hybrid instruments can enhance market efficiency. They also introduce new complexities in risk assessment.

Market structure suggests VistaShares targets a specific investor niche. The 80/20 split balances yield and crypto beta. This product launches amid extreme fear. That timing is strategic. It aims to capture sidelined capital seeking entry with downside protection. The use of IBIT options is clever. It leverages existing ETF liquidity. However, the gamma squeeze risk in options markets remains a concern during volatility spikes.

CoinMarketBuzz Intelligence Desk synthesized this analysis from on-chain data and market microstructure.

Two data-backed technical scenarios emerge. Scenario A: Bitcoin holds the $72,500 Fibonacci support. Institutional products like BTYB attract inflows. This stabilizes the market. A slow grind higher toward the FVG at $78,000 follows. Scenario B: Support breaks. Fear escalates. Liquidity grabs intensify. A test of the $68,000 level (previous cycle high) becomes likely. The BTYB ETF's performance in each scenario will test its hybrid design.

The 12-month institutional outlook hinges on macroeconomic factors. Federal Reserve policy on interest rates will impact Treasury yields. This directly affects BTYB's 80% allocation. Bitcoin's adoption trajectory remains key. The 5-year horizon suggests increased product innovation. Hybrid instruments may become standard. They bridge traditional and crypto finance.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.