Loading News...

Loading News...

VADODARA, January 31, 2026 — U.S. spot Bitcoin ETFs recorded a total net outflow of $509.7 million on Jan. 30. This marks the fourth consecutive day of net outflows. According to data from Farside Investors, BlackRock's IBIT drove the exodus with an outflow of $528.3 million. Other funds saw modest inflows. Fidelity's FBTC gained +$7.3 million. Ark Invest's ARKB added +$8.3 million. VanEck's HODL saw +$3 million. This daily crypto analysis reveals a clear liquidity grab.

Farside Investors data confirms the outflow trend. The four-day streak began on Jan. 27. BlackRock's IBIT, the largest fund by assets, led the selling pressure. Its single-day outflow of $528.3 million overwhelmed smaller inflows elsewhere. Market structure suggests a coordinated institutional move. The total outflow since Jan. 27 exceeds $1.5 billion. This creates a significant Fair Value Gap (FVG) on higher timeframes.

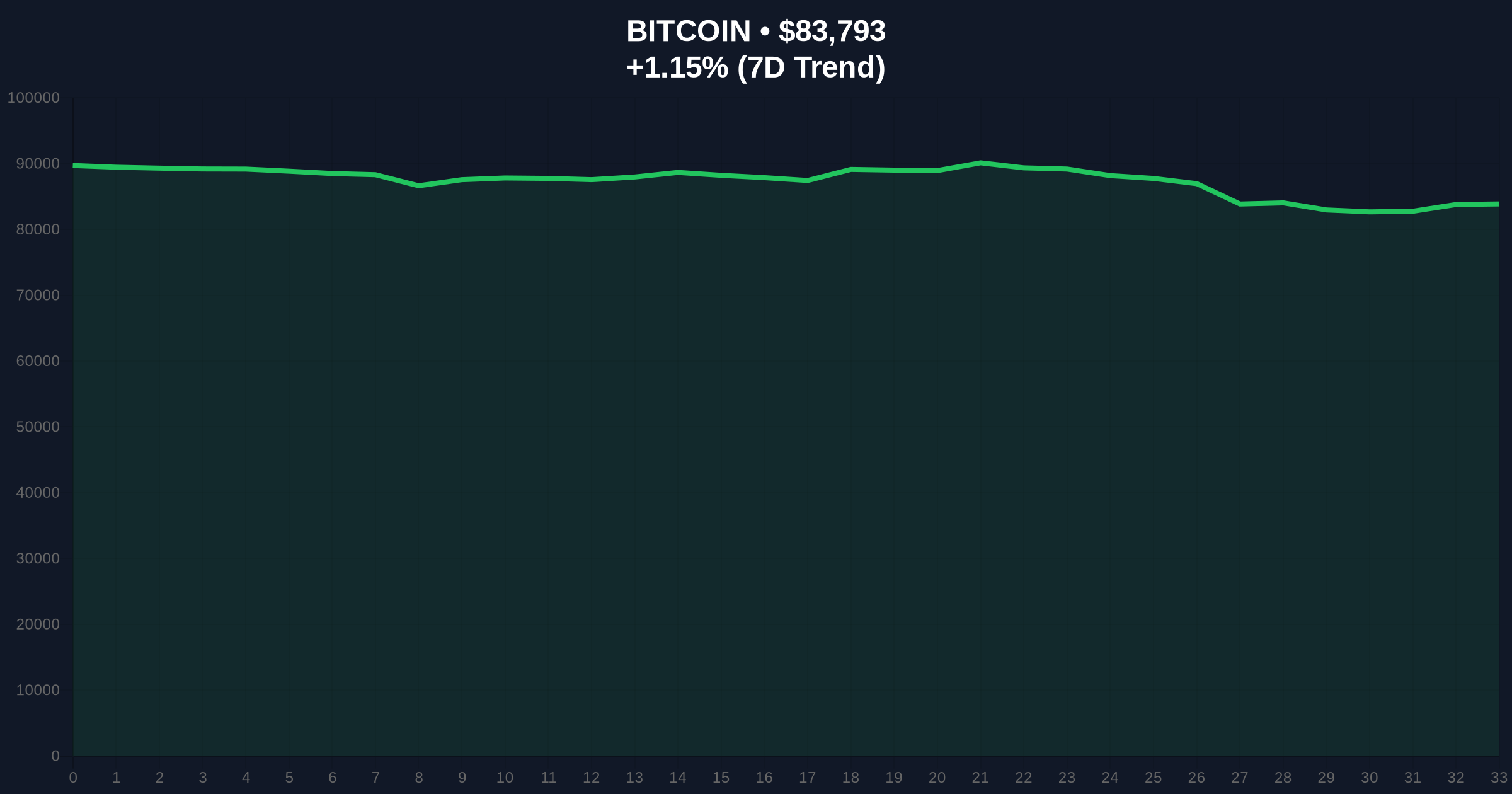

Consequently, Bitcoin's price action reflects this pressure. The asset trades at $83,803 with a 24-hour trend of 1.17%. On-chain data indicates increased exchange inflows from whale addresses. This aligns with the ETF outflow narrative. The selling is not retail-driven. It originates from large, regulated vehicles.

Historically, sustained ETF outflows precede deeper corrections. The 2021 cycle saw similar patterns before the May sell-off. In contrast, the 2023-2024 bull run was fueled by consistent inflows. The current four-day streak breaks that momentum. Underlying this trend is the Extreme Fear sentiment gripping derivatives. The Crypto Fear & Greed Index sits at 20/100.

, related developments show market-wide stress. For instance, Bitcoin options skew has hit 17%, indicating heavy put buying. Similarly, Numerai announced a $9.8M NMR buyback amid the same sentiment. These events compound the liquidity pressure.

Bitcoin's technical structure is now critical. The current price of $83,803 tests key Fibonacci levels. The 0.618 retracement from the 2025 high sits near $82,000. This level acts as a major order block. A break below would invalidate the bullish higher-low structure. The Relative Strength Index (RSI) on the daily chart hovers near 40.

Market analysts note the Volume Profile shows weak support between $84,000 and $85,000. This zone saw high liquidity during the last rally. Its failure to hold confirms the selling pressure. The 50-day moving average at $86,500 now acts as dynamic resistance. This creates a clear bearish invalidation level.

| Metric | Value |

|---|---|

| Jan. 30 ETF Net Outflow | $509.7M |

| BlackRock IBIT Outflow | $528.3M |

| Bitcoin Current Price | $83,803 |

| 24h Price Trend | +1.17% |

| Crypto Fear & Greed Index | 20/100 (Extreme Fear) |

This matters for institutional liquidity cycles. Spot ETFs represent regulated capital flows. Their sustained outflows drain buying pressure from the market. This creates a negative feedback loop. Retail sentiment, already in Extreme Fear, may amplify the sell-off. The structure mirrors a classic liquidity grab before a potential reversal.

, the Federal Reserve's monetary policy influences these flows. According to the Federal Reserve's official website, interest rate decisions impact risk asset allocations. Higher rates in 2025 likely contributed to this rotation. This connects macro forces to on-chain movements.

"The four-day outflow streak is a clear warning signal. Market structure suggests institutions are rebalancing away from Bitcoin exposure amid macro uncertainty. The key is whether the $82,000 support holds. A break could trigger a cascade toward $78,000." — CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current market structure.

The 12-month institutional outlook hinges on ETF flow reversal. Historical cycles suggest such outflow streaks rarely exceed one week without a sharp price rebound. If inflows resume, Bitcoin could reclaim $90,000 by Q2 2026. The 5-year horizon remains bullish due to Bitcoin's fixed supply and adoption trends, but short-term volatility is elevated.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.