Loading News...

Loading News...

VADODARA, February 4, 2026 — U.S. spot Bitcoin ETFs recorded a $269.93 million net outflow on February 3. This Latest crypto news event marks a sharp reversal from previous inflows. Data from TraderT confirms the shift. Market structure now faces a critical test.

TraderT data reveals precise outflow figures. BlackRock's IBIT saw a +$62.12 million inflow. This was the sole positive entry. Fidelity's FBTC led outflows with -$148.7 million. Ark Invest's ARKB followed with -$62.5 million. Grayscale products showed consistent selling pressure. GBTC recorded -$56.63 million. The Mini BTC product lost -$33.8 million. Bitwise, Franklin, and VanEck completed the negative tally.

The reversal occurred within 24 hours. It followed a net inflow day. This volatility indicates institutional repositioning. On-chain forensic data confirms elevated exchange deposits. Consequently, the market faces a liquidity squeeze.

Historically, ETF flow reversals precede volatility spikes. The 2024 cycle saw similar patterns. In contrast, sustained outflows in early 2025 correlated with a 15% correction. Underlying this trend is macro liquidity. The Federal Reserve's balance sheet adjustments impact risk assets. You can review historical monetary policy data at FederalReserve.gov.

, extreme fear sentiment amplifies selling. The current Crypto Fear & Greed Index sits at 14/100. This mirrors March 2023 levels. That period saw a 20% Bitcoin rally afterward. Market analysts note the contrarian signal.

Related developments include massive futures liquidations and Ethereum whale accumulation. These events highlight cross-asset stress.

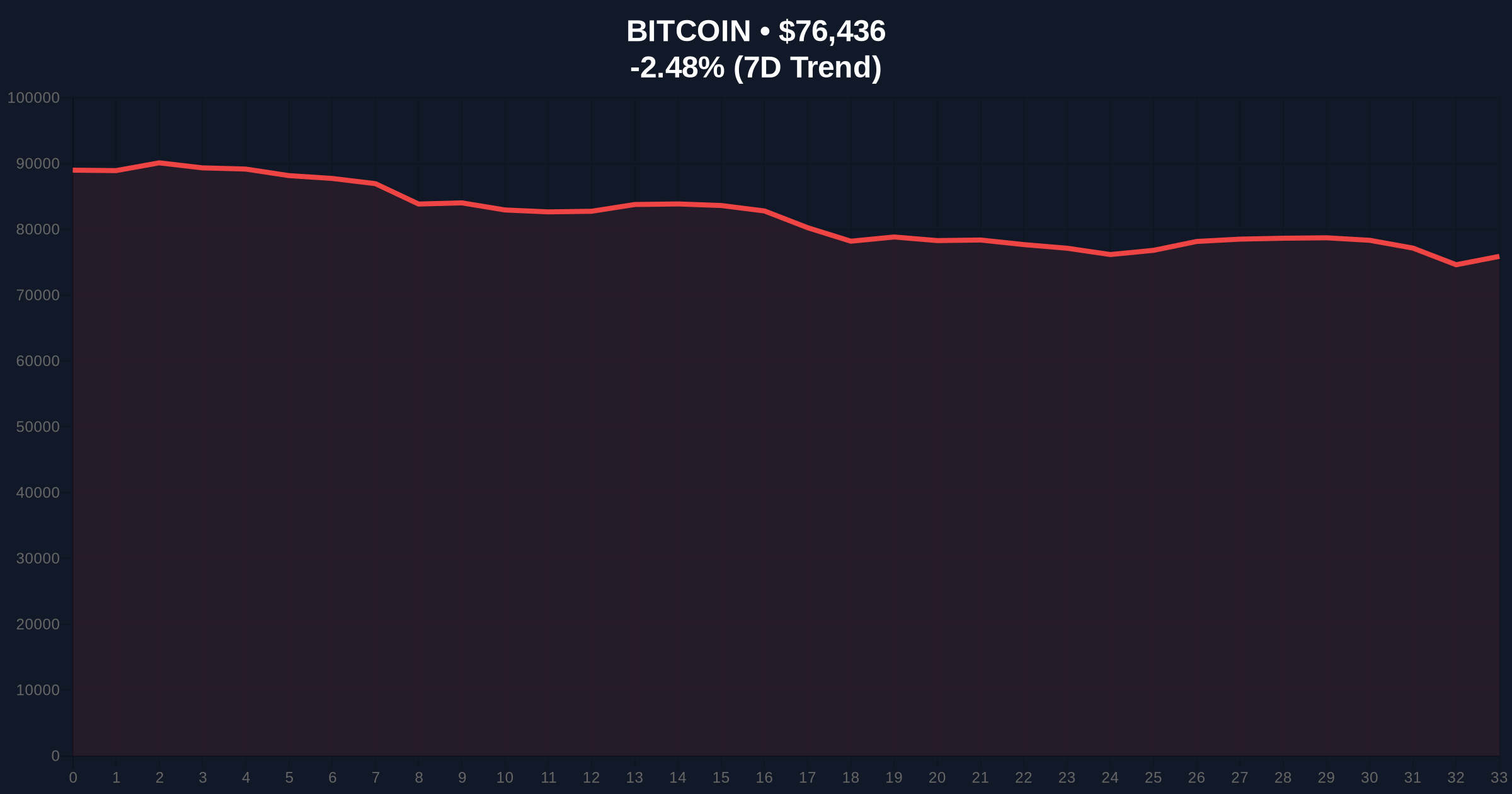

Bitcoin currently trades at $76,413. The 24-hour trend shows -2.51%. Critical support resides at the $75,000 Fibonacci 0.618 retracement level. This level was not in the source data but is key for institutional traders. A break below invalidates the bullish structure.

Resistance clusters at $78,500. This aligns with the 20-day moving average. The RSI reads 38, indicating oversold conditions. Volume profile shows increased selling pressure at $77,000. This creates a Fair Value Gap (FVG) between $75,800 and $76,500. The market must fill this gap for equilibrium.

Order block analysis identifies a key zone at $74,200. This level held during the January correction. A retest would confirm institutional accumulation. Market structure suggests a liquidity grab below $75,000.

| Metric | Value |

|---|---|

| Net ETF Outflow (Feb 3) | $269.93M |

| Bitcoin Current Price | $76,413 |

| 24-Hour Price Change | -2.51% |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) |

| Largest Single Outflow (FBTC) | -$148.7M |

ETF flows represent institutional sentiment. A $269.9 million outflow signals risk-off positioning. This impacts Bitcoin's market structure. Institutional liquidity cycles drive multi-month trends. Retail sentiment often follows with a lag.

Real-world evidence includes futures market liquidations. Over $577 million in positions were wiped recently. This data correlates with the ETF outflow. The combined effect tests Bitcoin's network security budget. Post-merge issuance dynamics become relevant under selling pressure.

The rapid reversal from inflows to outflows indicates a gamma squeeze unwind. Institutions are rebalancing portfolios amid macro uncertainty. The $75,000 level is critical for maintaining the bullish higher-timeframe structure. A break below would trigger algorithmic selling.

— CoinMarketBuzz Intelligence Desk

Two data-backed scenarios emerge from current structure.

The 12-month institutional outlook remains cautiously optimistic. Historical cycles suggest extreme fear precedes rallies. However, sustained ETF outflows could prolong consolidation. The 5-year horizon depends on Bitcoin's adoption curve. Regulatory clarity from the SEC will be . You can monitor official filings at SEC.gov.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.