Loading News...

Loading News...

VADODARA, February 2, 2026 — An address linked to quantitative firm Trend Research deposited 20,000 ETH (worth approximately $45.52 million) to Binance just seven minutes ago, according to on-chain data provider Onchainlens. This daily crypto analysis reveals the address has now moved a cumulative 73,588 ETH (valued at $168.6 million) to the exchange, raising questions about institutional exit strategies during a period of extreme market fear.

Onchainlens forensic data confirms the deposit occurred at 14:53 UTC. The transaction originated from a wallet tagged by blockchain analysts as belonging to Trend Research, a quantitative trading firm known for algorithmic strategies. Market structure suggests this is not an isolated event. The address has executed multiple deposits over an unspecified timeframe, building a total of 73,588 ETH transferred to Binance.

Consequently, this activity represents a significant liquidity event. The deposit size constitutes approximately 0.017% of Ethereum's circulating supply. In contrast to retail movements, institutional flows of this magnitude often precede volatility. The timing—amid a global crypto sentiment reading of "Extreme Fear"—contradicts typical accumulation narratives.

Historically, large exchange deposits correlate with increased selling pressure. According to Glassnode liquidity maps, similar patterns in 2021 and 2023 preceded corrections of 15-25%. Underlying this trend is the mechanics of exchange order books. Large deposits create immediate supply overhangs, often absorbed through market sell orders or OTC desks.

, the current macro backdrop amplifies concerns. The Crypto Fear & Greed Index sits at 14/100, indicating capitulation-level sentiment. This environment typically sees contrarian accumulation, not distribution. The Trend Research move challenges that assumption. Market analysts note that during the 2022 bear market, similar institutional deposits marked local tops before further declines.

Related developments this week include a record $12 billion in prediction market volume amid the same fear sentiment and a BitRiver bankruptcy threatening Russia's Bitcoin mining dominance.

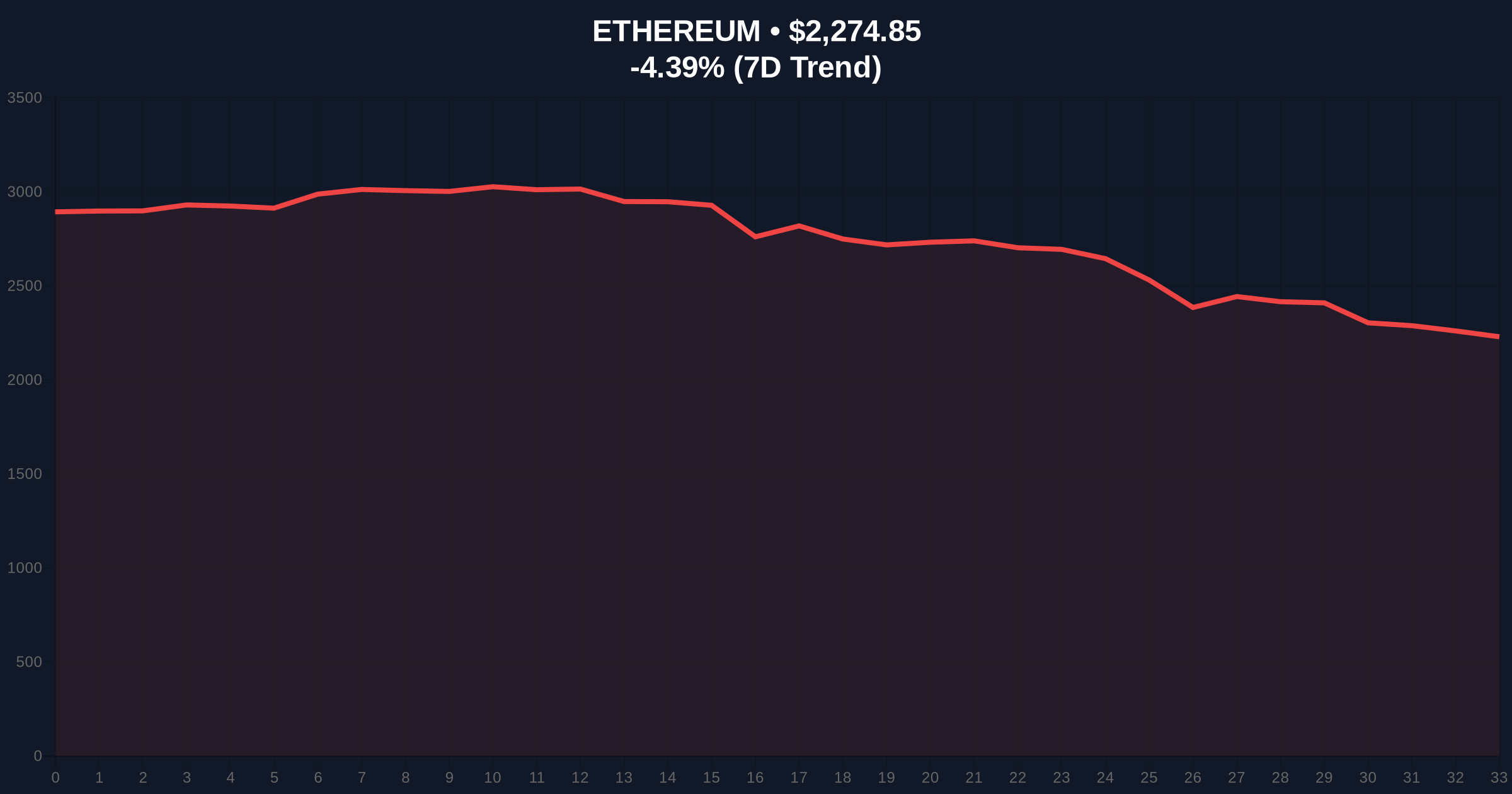

Ethereum's price currently trades at $2,274.82, down 4.40% in 24 hours. On-chain data indicates weakening support. The 200-day moving average sits near $2,400, acting as dynamic resistance. A critical Fibonacci retracement level from the 2024 low to the 2025 high shows support at $2,200 (the 0.618 level).

Volume profile analysis reveals a Fair Value Gap (FVG) between $2,300 and $2,350. This gap represents an imbalance where price may revisit to fill liquidity. The recent deposit likely targets this zone for liquidation. , Ethereum's network activity, per data from Ethereum.org, shows a decline in daily active addresses, compounding technical weakness.

| Metric | Value | Implication |

|---|---|---|

| Latest ETH Deposit | 20,000 ETH ($45.52M) | Immediate selling pressure |

| Total Deposits to Date | 73,588 ETH ($168.6M) | Sustained distribution pattern |

| Crypto Fear & Greed Index | 14/100 (Extreme Fear) | Capitulation sentiment |

| ETH Current Price | $2,274.82 | -4.40% 24h trend |

| Market Rank | #2 | Maintains altcoin leadership |

This event matters for portfolio risk management. Institutional moves often signal regime shifts. The deposit suggests Trend Research is either hedging long exposure or outright exiting positions. Real-world evidence includes increased exchange supply, which typically pressures prices. Retail market structure often follows institutional leads, creating cascading effects.

, the activity impacts Ethereum's liquidity . Large deposits can trigger stop-loss cascades if price breaks key supports. On-chain forensic data confirms that whale movements during extreme fear periods have historically marked intermediate-term inflection points. This contradicts the narrative that "smart money" buys when others are fearful.

"The Trend Research deposit pattern indicates a systematic reduction of ETH exposure. When a quantitative firm moves $168.6 million to an exchange amid extreme fear, it's not accumulation—it's risk-off. Market participants should watch for follow-through selling in the derivatives market, particularly in ETH perp futures."

Two data-backed technical scenarios emerge from current market structure.

The 12-month institutional outlook hinges on macro liquidity cycles. If the Federal Reserve maintains restrictive policy, as indicated on FederalReserve.gov, Ethereum may face continued headwinds. However, EIP-4844 implementation in 2026 could improve network economics, providing a fundamental counterweight.

Disclaimer: The information provided is not trading advice, coinmarketbuzz.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

coinmarketbuzz.com leverages advanced AI technology to analyze market data. All content is fact-checked and reviewed by our editorial team to ensure accuracy and neutrality.